Niche Gold Stocks Are the Best Way to Invest in Gold Now / Commodities / Gold and Silver Stocks 2019

Foryour sake, I hope you already have some gold in your portfolio.

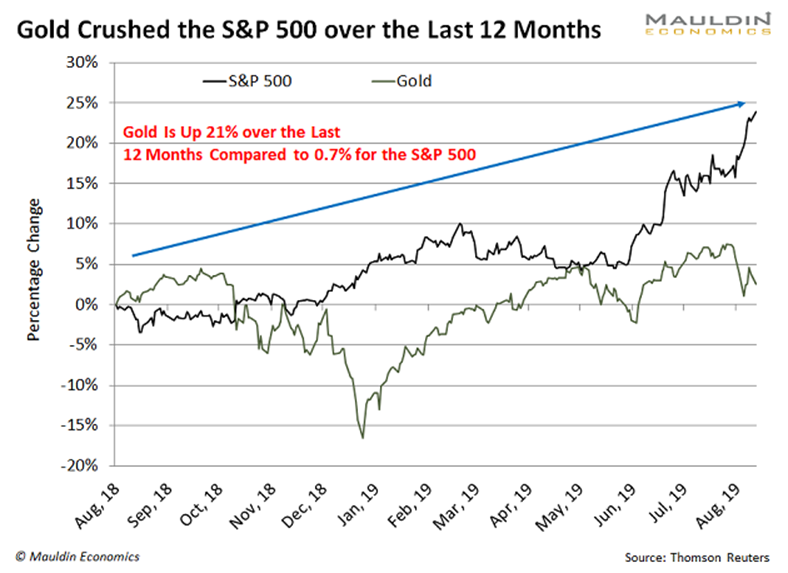

Gold is on an amazing run. It’s up over 21% since lastAugust.

Meanwhile,the S&P 500 is up a mere 0.7%, as you can see in the chart below.

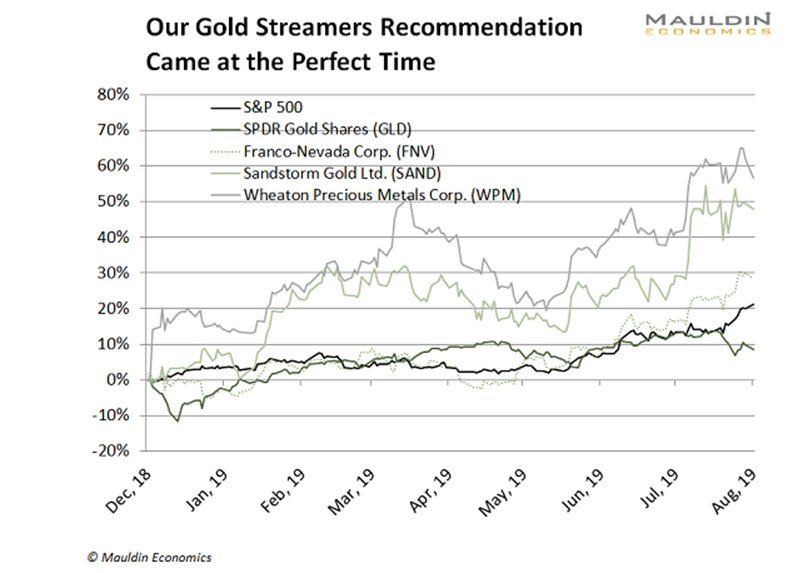

Whilegold has done very well in general, I’ve found one niche group ofgold stocks thatis hands down the winner in this run.

I’lltell you about it in a moment. Before that, let’s look at why gold isperforming so well.

When Stocks Zig Gold Zags

Whenstock market risk goes up—like it has in the past 12 months—investors flock tosafe investments likegold. That’s one of the reasons gold is doing so well.

Thesame thing happened shortly before the global financial crisis. Gold rose awhopping 83% between January 2005 and October 2007 when the stock marketpeaked. That’s more than triple the S&P 500’s 26% return during thatperiod.

I’msure you remember what happened next…

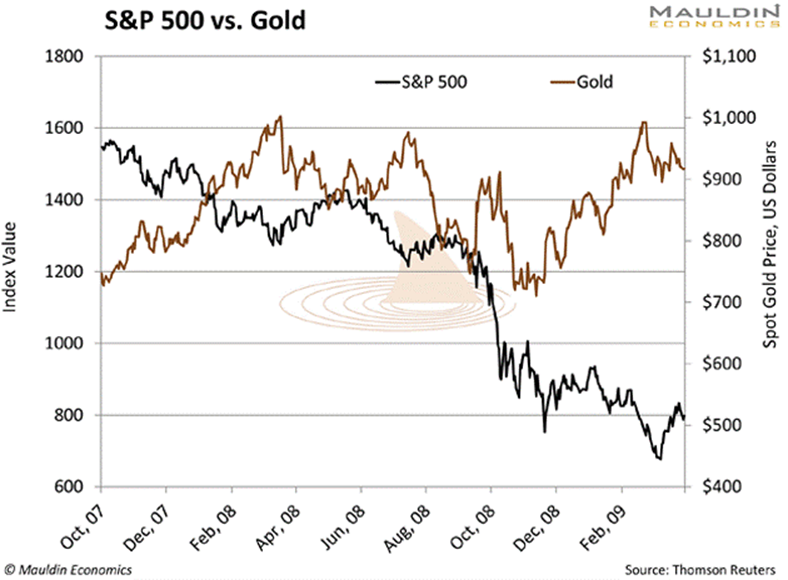

TheS&P 500 plunged over 55% from October 2007 to March 2009. Investors wereterrified. And a lot of them flooded into gold.

Infact, gold gained over 25% during the global financial crisis:

The same scenario played outwhen the dot-com bubble burst. The S&P 500 lost over46% from August 2000 to May 2003 as investors fled the first generation ofinternet-based companies. Meanwhile, gold gained over 43% during that period.

Today,we’re on the cusp of a similar situation.

TheS&P 500 has increased nearly 200% over the last 10 years. That makes thisthe longest bull market in US history.

Ofcourse, nothing goes up forever. My research indicates that stocks will peak inmid-2020. Butwe don’t need to pinpoint the exact date here.

Theimportant thing to know is that eventually, stocks will fall. And when thathappens, gold will surge. So it’s good to own some goldright now.

Butit’s even better to own a special type of gold stock that will surge even higher…

Gold Mining’s “Silent Partner”

Goldroyalty companies are the best gold-related investment to own right now.

Here’show the royalty business model works…

Buildingand operating a gold mine is very expensive. Sometimes a miner is sitting on apromising deposit but doesn’t have enough money to get the gold out of theground. This is fairly common.

That’swhere royalty companies come in.

Aroyalty company makes an up-front payment to a mining company. In return, itreceives a fixed percentage of the mine’s production, typically for as long asthe mine is active.

Withthe royalty model, the gold miner does all of the heavy lifting, like diggingup and selling the gold. The royalty company doesn’t do any of that. It simplyprovides cash to miners to help them run their businesses.

Then,when the miner sells the gold it digs up, the royalty company receives aroyalty payment.

Here’sthe best part: When gold prices rise, the royalty payments rise as well. Whenthat happens, the royalty company makes more money—and so do its shareholders.

Meanwhile,if the mine produces more gold, or the life of the mine is extended, theroyalty company benefits, too. This is all without investing any additional money.

Evenbetter, besides the unlimited upside, royalty companies also have very limiteddownside.

Theroyalty company isn’t on the hook for any of the variable risks and costs thatcome with running a mine.

Miningis full of challenges that miners can’t always predict or control. Things likeenvironmental activism, political risks, union pushback, and new safetyregulations. But royalty companies don’t cover any of the costs associated withthat stuff.

Inshort, royalty companies get the best of both worlds. They make a lot of moneywhen a miner does well. But there’s a cap on how much they can lose when aminer runs into roadblocks.

Royalty Companies Are Having a FantasticYear

Youalready know that gold is having a great year.

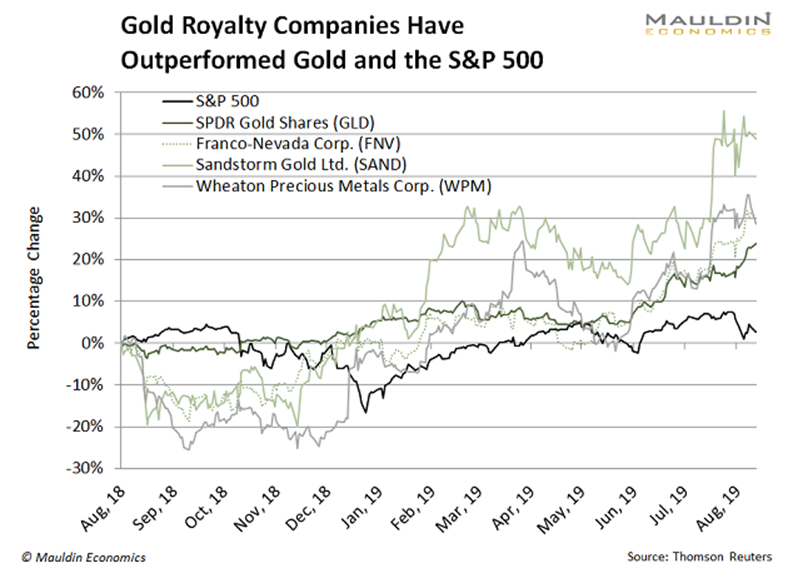

Butgold royalty companies are doing even better. Since last August, my top threeroyalty companies, Franco-NevadaCorp. (FNV), Sandstorm Gold Ltd. (SAND), Wheaton Precious Metals Corp. (WPM),are up an average of 36.5%.

Youcan see this in the chart below.

Thesethree companies also have an average dividend of 1.3%—modest, but still safeand reliable income.

The Top Gold Royalty Stocks to Own Now

I’mlooking for the safest and most reliable dividend-payingstocks.And right now, my top gold royalty companies I just mentioned are stilloffering compelling value.

Letme give you a quick rundown on each…

Thefirst company is Franco-NevadaCorp. (FNV).

Franco-Nevadais the largest gold royalty company. The Canadian-based firm was also the firstroyalty company, and it has a solid track record.

Thesecond company is SandstormGold Ltd. (SAND).

SandstormGold is another Canadian royalty company. Its huge portfolio includes 185royalties. This protects the company from any negative fallout if anything goeswrong with one of its miners.

Butthe best of the bunch is WheatonPrecious Metals Corp. (WPM).

Wheatonis unique. It has a large portfolio of both gold and silver royalties. Thisgives investors more exposure to the broader precious metals market.

That’simpressive. But royalty companies are still a good bet today.

With trade wars brewing, the global economy slowing, andthe stock market near all-time highs, it’s time to add gold and gold stocks toyour portfolio.

Goldroyalty companies should be at the top of that list.

The Sin Stock Anomaly: Collect Big, SafeProfits with These 3 Hated Stocks

Mybrand-new special report tells you everything about profiting from “sin stocks”(gambling, tobacco, and alcohol). These stocks are much safer and do twice aswell as other stocks simply because most investors try to avoid them. Claim your freecopy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.