Nickel 28 Capital Corp. (TSXV: NKL): World-Class Nickel-Cobalt Mine in Production, Upside Through Royalty Portfolio; Interview with Anthony Milewski, Chairman and Justin Cochrane, President & CEO

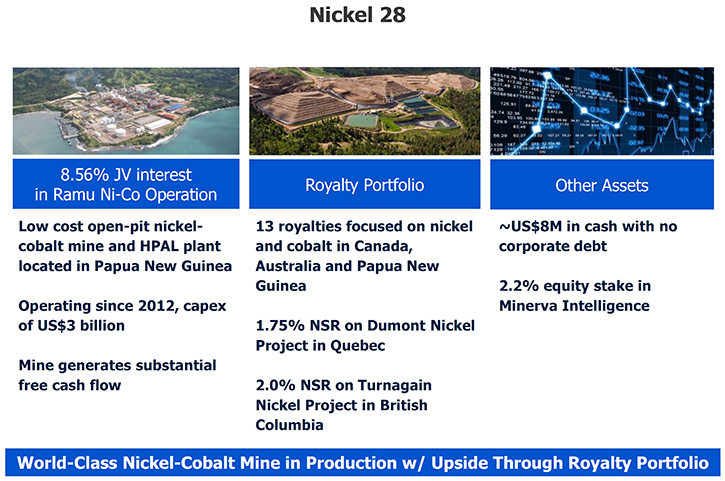

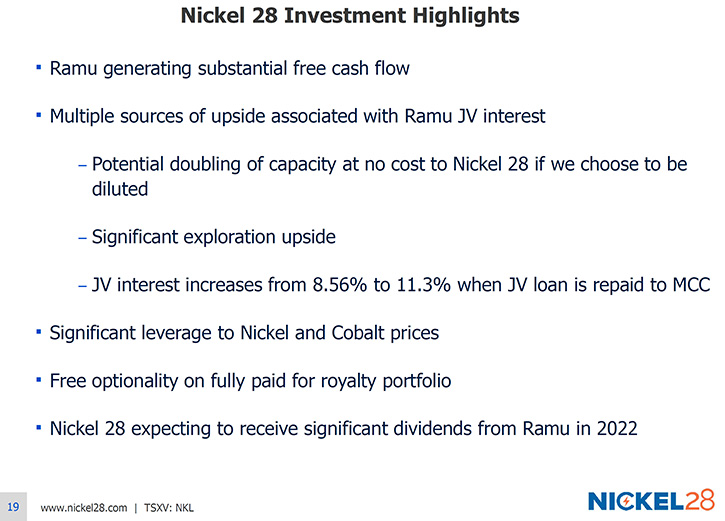

Nickel 28 Capital Corp. (TSXV: NKL), formerly Conic Metals Corp., is one of Canada's only pure-play nickel and cobalt producers, with an 8.56% joint-venture interest in the producing, long-life and world-class Ramu Nickel-Cobalt Operation, located in Papua New Guinea. It is one of the leading nickel producers globally. In addition, Nickel 28 manages a portfolio of 13 nickel, cobalt and scandium royalties, on development and exploration projects in Canada, Australia and Papua New Guinea. Nickel and cobalt are critical elements of electric vehicles and energy storage systems. We learned from Anthony Milewski, who is Chairman of the Board, and from Justin Cochrane, who is President and CEO of Nickel 28 that they have a 1.75% NSR on the construction-ready Dumont Nickel Project, in Quebec and a 2.0% NSR on the Turnagain Nickel Project, in British Columbia that is targeting a Bankable Feasibility Study by end of 2023. Both projects are expected to go into production this cycle. We learned from Mr. Cochrane, that one of the important milestones this year is expected to be the start of 35% of Nickel 28's attributable cash flow from the Ramu project, once the Company pays off the first tranche of their debt. The Ramu Nickel-Cobalt projectDr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Anthony Milewski, who is Chairman of the Board. We'll be joined by Justin Cochrane, who is President and CEO of Nickel 28. Anthony, could you give our readers /investors an overview of your Company, what differentiates you from others, and also some of your primary important developments in the Company since our last interview, in the past year?Anthony Milewski:Sure. Thank you for interviewing me for Metals News, Allen. I'm happy to update you. Nickel 28 is uniquely positioned on the TSX Venture Exchange, a producing nickel mining company. Almost without peer, it's a pure play nickel mining company. The producing asset is called Ramu Nickel. Ramu Nickel is one of the leading nickel producers globally. It's a nickel-cobalt producer, and we own approximately 9% of that mine and have since inception. The key Driver of the business, the asset value and performance going forward is Ramu Nickel.We also have a portfolio of nickel, cobalt and scandium royalties. In particular, we have two special royalties, one of them on Dumont and another on Turnagain. Those are unique royalties because they are in first-world jurisdictions, mining jurisdictions like Canada, and they are on projects, which are possibly going to be built this cycle. If you look at the nickel industry globally, one of the problems has been historically the technology HPAL (high pressure acid leach), has had tremendous cost overruns. So we are looking into this cycle with the supply and demand as they are, and we can see a pretty dramatic need for more supply to come in. I don't believe there's appetite to build new HPAL projects. So it is likely that projects to be built in the future will be nickel sulfide projects, such as Dumont and Turnagain.

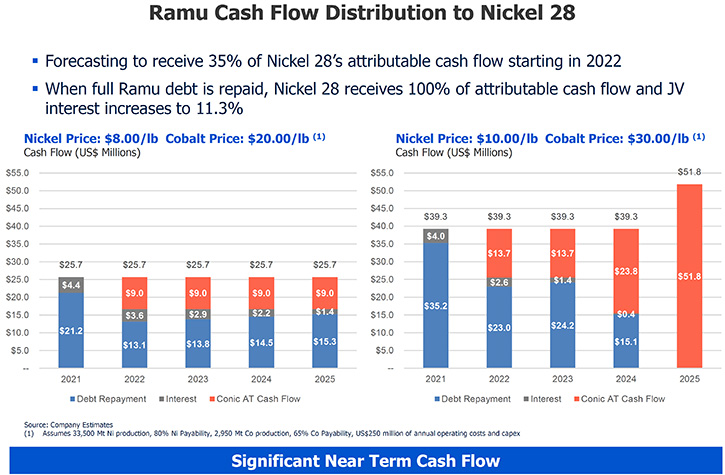

The Ramu Nickel-Cobalt projectDr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Anthony Milewski, who is Chairman of the Board. We'll be joined by Justin Cochrane, who is President and CEO of Nickel 28. Anthony, could you give our readers /investors an overview of your Company, what differentiates you from others, and also some of your primary important developments in the Company since our last interview, in the past year?Anthony Milewski:Sure. Thank you for interviewing me for Metals News, Allen. I'm happy to update you. Nickel 28 is uniquely positioned on the TSX Venture Exchange, a producing nickel mining company. Almost without peer, it's a pure play nickel mining company. The producing asset is called Ramu Nickel. Ramu Nickel is one of the leading nickel producers globally. It's a nickel-cobalt producer, and we own approximately 9% of that mine and have since inception. The key Driver of the business, the asset value and performance going forward is Ramu Nickel.We also have a portfolio of nickel, cobalt and scandium royalties. In particular, we have two special royalties, one of them on Dumont and another on Turnagain. Those are unique royalties because they are in first-world jurisdictions, mining jurisdictions like Canada, and they are on projects, which are possibly going to be built this cycle. If you look at the nickel industry globally, one of the problems has been historically the technology HPAL (high pressure acid leach), has had tremendous cost overruns. So we are looking into this cycle with the supply and demand as they are, and we can see a pretty dramatic need for more supply to come in. I don't believe there's appetite to build new HPAL projects. So it is likely that projects to be built in the future will be nickel sulfide projects, such as Dumont and Turnagain. Dr. Allen Alper:That sounds excellent. Could you tell our readers/investors your primary plans for 2021?Anthony Milewski:Justin, can answer that question. Talking about the milestones for this year and paying down debt. Justin Cochrane:We have two material milestones, or maybe even three that we'll be focused on this year. The first one is the repayment of the first tranche of joint-venture debt that we have with MCC, who are operators of the Ramu Mine in Papua New Guinea. We believe that that first tranche of debt will be repaid somewhere around the fall of this year. Dr. Allen Alper:Oh, that's excellent.Justin Cochrane:If nickel prices remain high, it could be a little bit earlier than that, but we're targeting around the fall of this year. Importantly, what that means is once that first tranche of debt is repaid, we start getting 35% of our attributable cash flow from Ramu. And at today's commodity prices, that would be about $9 million US, on an annual basis. So it's an absolute transformative event for us, when we start getting that free cash flow from Ramu. A number of our investors have been waiting for that moment. So that's number one.

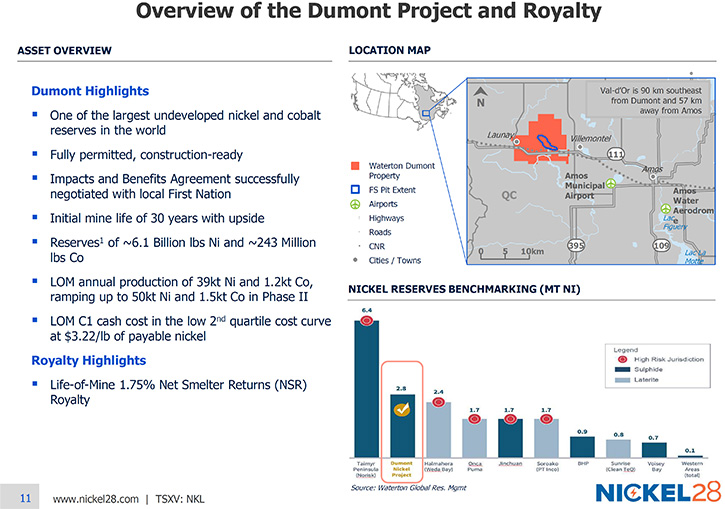

Dr. Allen Alper:That sounds excellent. Could you tell our readers/investors your primary plans for 2021?Anthony Milewski:Justin, can answer that question. Talking about the milestones for this year and paying down debt. Justin Cochrane:We have two material milestones, or maybe even three that we'll be focused on this year. The first one is the repayment of the first tranche of joint-venture debt that we have with MCC, who are operators of the Ramu Mine in Papua New Guinea. We believe that that first tranche of debt will be repaid somewhere around the fall of this year. Dr. Allen Alper:Oh, that's excellent.Justin Cochrane:If nickel prices remain high, it could be a little bit earlier than that, but we're targeting around the fall of this year. Importantly, what that means is once that first tranche of debt is repaid, we start getting 35% of our attributable cash flow from Ramu. And at today's commodity prices, that would be about $9 million US, on an annual basis. So it's an absolute transformative event for us, when we start getting that free cash flow from Ramu. A number of our investors have been waiting for that moment. So that's number one. The second big potentially transformative event, this year, is some progress on our Dumont Royalty. Our second largest asset arguably would be our 1.75% NSR on the Dumont Project in Quebec. We believe that's a project that, certainly at today's nickel price, should be developed. It's fully permitted and construction ready. It's had two different feasibility studies conducted on it. There's some optimization work that's going on today, but our hope is that Waterton Private Equity, who owns Dumont, will look to find a partner and to develop Dumont, hopefully this year. I think that would have a material impact on our share price, if any partnership were announced.

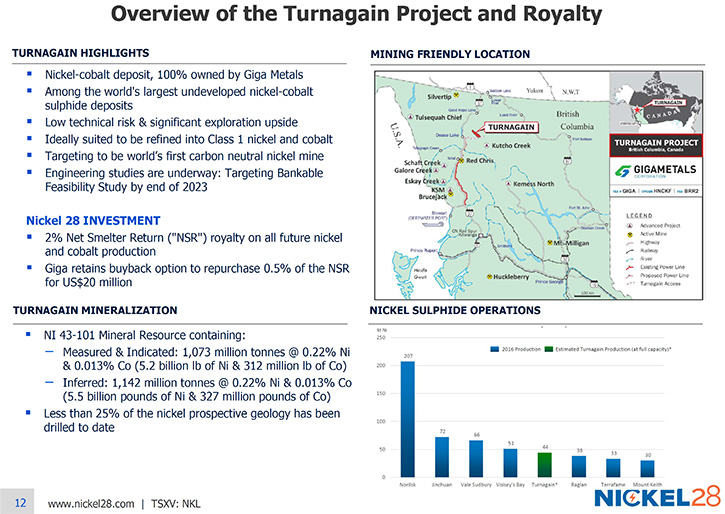

The second big potentially transformative event, this year, is some progress on our Dumont Royalty. Our second largest asset arguably would be our 1.75% NSR on the Dumont Project in Quebec. We believe that's a project that, certainly at today's nickel price, should be developed. It's fully permitted and construction ready. It's had two different feasibility studies conducted on it. There's some optimization work that's going on today, but our hope is that Waterton Private Equity, who owns Dumont, will look to find a partner and to develop Dumont, hopefully this year. I think that would have a material impact on our share price, if any partnership were announced. Dr. Allen Alper:That sounds excellent!Justin Cochrane:And the third thing would be our third largest asset, which is a 2.0% NSR on a project called Turnagain in British Columbia. Turnagain is actively looking for a partner to come in at the project level and help them advance that project towards detailed engineering, feasibility and permitting. Their hope is to do that this year.

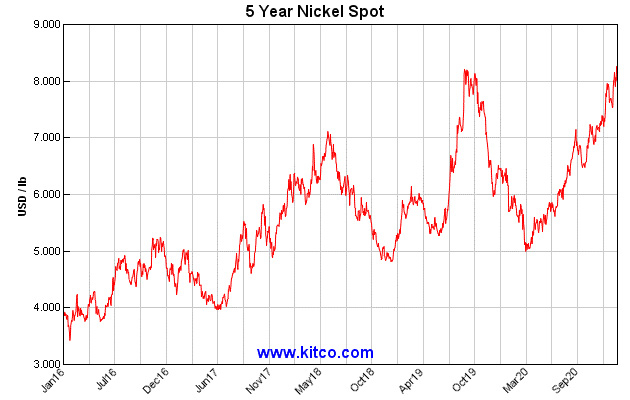

Dr. Allen Alper:That sounds excellent!Justin Cochrane:And the third thing would be our third largest asset, which is a 2.0% NSR on a project called Turnagain in British Columbia. Turnagain is actively looking for a partner to come in at the project level and help them advance that project towards detailed engineering, feasibility and permitting. Their hope is to do that this year. Justin Cochrane:But that's Giga Metals' project. So if Giga Metals is successful finding a partner there, as they've been very public about looking to find a partner, then that would have a tremendous impact for us.Dr. Allen Alper:That sounds excellent. Could you tell our readers/investors what's happening in the nickel and cobalt market and what the outlook is?Anthony Milewski:Yeah, sure. As recently as yesterday, you saw nickel approaching five-year highs. I don't think they are quite there yet, but over $8. That demand is driven by a few different things. Remember today nickel is primarily industrial in nature, like stainless steel and that type of thing. With the Chinese market coming back with strong demand, in addition to incremental demand from the EV and battery storage segments, you've seen a lot of upward price pressure on nickel over the past six months, since lows last year, in March and April. We anticipate that, notwithstanding some sort of a big global economic recession, pressure is only going to increase as the Biden administration comes in, later this month, with a green deal and a wave of green initiatives globally, driving technology that utilizes and relies heavily on nickel. So we're exceptionally bullish on nickel in the coming years.I think that's driven by strong industrial demand, but also an energy transition that's underway globally.

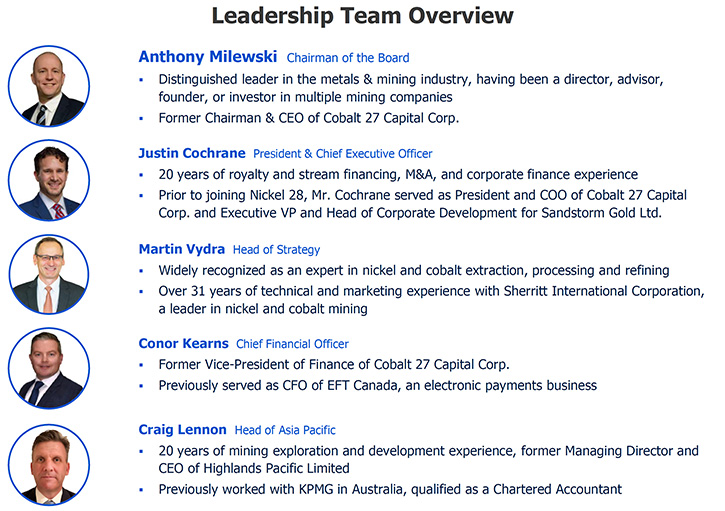

Justin Cochrane:But that's Giga Metals' project. So if Giga Metals is successful finding a partner there, as they've been very public about looking to find a partner, then that would have a tremendous impact for us.Dr. Allen Alper:That sounds excellent. Could you tell our readers/investors what's happening in the nickel and cobalt market and what the outlook is?Anthony Milewski:Yeah, sure. As recently as yesterday, you saw nickel approaching five-year highs. I don't think they are quite there yet, but over $8. That demand is driven by a few different things. Remember today nickel is primarily industrial in nature, like stainless steel and that type of thing. With the Chinese market coming back with strong demand, in addition to incremental demand from the EV and battery storage segments, you've seen a lot of upward price pressure on nickel over the past six months, since lows last year, in March and April. We anticipate that, notwithstanding some sort of a big global economic recession, pressure is only going to increase as the Biden administration comes in, later this month, with a green deal and a wave of green initiatives globally, driving technology that utilizes and relies heavily on nickel. So we're exceptionally bullish on nickel in the coming years.I think that's driven by strong industrial demand, but also an energy transition that's underway globally. Cobalt has the same fundamentals. With cobalt, you have increasingly a transition towards chemistries which aren't quite as cobalt rich. So I think you're going to see cobalt come down a bit in price, but I think that's probably where it will stay for a while. But many of the same dynamics that drive nickel also drive cobalt. I think the one question for cobalt is the aerospace industry, which is sort of on its knees at the moment, with everything that's happened with global travel. An open question for cobalt, in the short term is: How is the price impacted, talking about the metal now, with everything going on in the aerospace industry?Dr. Allen Alper:Well, that sounds like a good summary for our readers/investors. Anthony and Justin, could you give our readers/investors more information on your backgrounds and your team? Anthony Milewski:Our team is made up of Justin, Martin, Conor, Craig and myself, along with our Chinese President, Mark Fang. Our team is really a mosaic approach. Each individual is a piece of the mosaic and together you can see the picture. In Martin you have a highly qualified specialist in nickel processing and nickel projects globally. In China, you have Mark, who has spent his career in finance and helps us with various aspects of marketing the material and reaching out to our partners in China. Conor is our CFO and he manages our reporting obligations. Craig is based in Australia and his team in Australia manages our Ramu mine relationships, reporting and joint-venture obligations as well as our government relationships in PNG. Justin, of course, is the CEO, who leads the team and direction of the enterprise and is an expert in royalty and stream financing transaction. Myself, I'm the Chairman and have spent my career in the mining and energy investment space.

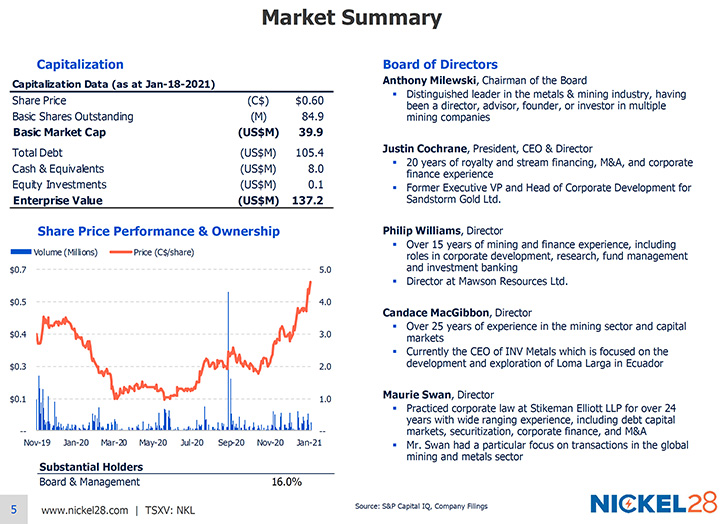

Cobalt has the same fundamentals. With cobalt, you have increasingly a transition towards chemistries which aren't quite as cobalt rich. So I think you're going to see cobalt come down a bit in price, but I think that's probably where it will stay for a while. But many of the same dynamics that drive nickel also drive cobalt. I think the one question for cobalt is the aerospace industry, which is sort of on its knees at the moment, with everything that's happened with global travel. An open question for cobalt, in the short term is: How is the price impacted, talking about the metal now, with everything going on in the aerospace industry?Dr. Allen Alper:Well, that sounds like a good summary for our readers/investors. Anthony and Justin, could you give our readers/investors more information on your backgrounds and your team? Anthony Milewski:Our team is made up of Justin, Martin, Conor, Craig and myself, along with our Chinese President, Mark Fang. Our team is really a mosaic approach. Each individual is a piece of the mosaic and together you can see the picture. In Martin you have a highly qualified specialist in nickel processing and nickel projects globally. In China, you have Mark, who has spent his career in finance and helps us with various aspects of marketing the material and reaching out to our partners in China. Conor is our CFO and he manages our reporting obligations. Craig is based in Australia and his team in Australia manages our Ramu mine relationships, reporting and joint-venture obligations as well as our government relationships in PNG. Justin, of course, is the CEO, who leads the team and direction of the enterprise and is an expert in royalty and stream financing transaction. Myself, I'm the Chairman and have spent my career in the mining and energy investment space. Dr. Allen Alper:That sounds like a very strong, accomplished, knowledgeable team. Could you tell our readers/investors about your share and capital structure?Justin Cochrane:Absolutely. Nickel 28 today trades roughly around 50 cents a share. We have 84.9 million shares outstanding. So that's a market cap of $42 million. Importantly, Management and the Board are big shareholders. Collectively we own 16.0% of the Company and have been buyers of the stock throughout 2020. Importantly, on the basis of a market cap of $42 million, our invested capital into this Company is in the neighborhood of $130 million. We firmly believe that our share price is significantly undervalued. We have been buyers of the stock and now own over 16% of the Company.

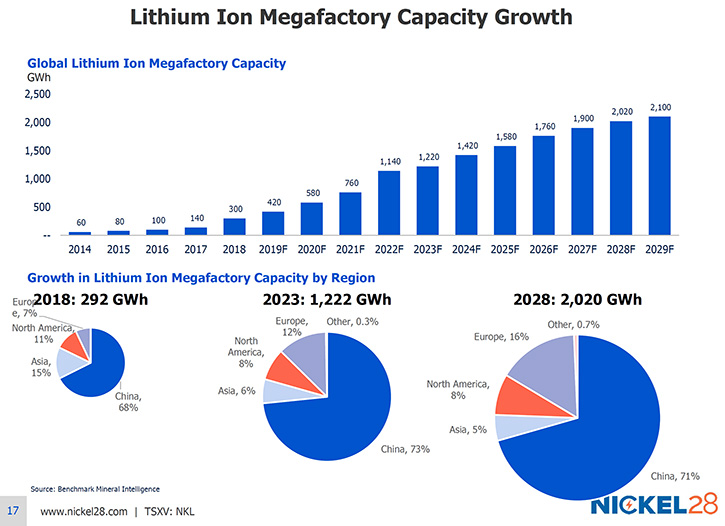

Dr. Allen Alper:That sounds like a very strong, accomplished, knowledgeable team. Could you tell our readers/investors about your share and capital structure?Justin Cochrane:Absolutely. Nickel 28 today trades roughly around 50 cents a share. We have 84.9 million shares outstanding. So that's a market cap of $42 million. Importantly, Management and the Board are big shareholders. Collectively we own 16.0% of the Company and have been buyers of the stock throughout 2020. Importantly, on the basis of a market cap of $42 million, our invested capital into this Company is in the neighborhood of $130 million. We firmly believe that our share price is significantly undervalued. We have been buyers of the stock and now own over 16% of the Company. Dr. Allen Alper:Oh, that sounds great! It shows readers/investors that Management is committed to the Company and has confidence in the Company. So that's very good. Justin Cochrane:Absolutely.Dr. Allen Alper:Could you tell us a little bit about the lithium ion, mega factory capacity growth?Justin Cochrane:Yes, absolutely. When we started our business and Anthony and I partnered together back in 2017, if you looked globally, there were only about 140 gigawatt hours of lithium ion battery capacity. Today, that number is closer to 600 gigawatt hours. That's about a four times growth in three years for global battery capacity.But then if you look at the plans that GM and Ford and very importantly, Tesla have announced and in particular, the battery supply chain, particularly in China, when you look out to later this decade, there's an expectation of over two terawatt hours of battery capacity. And that is committed capacity, that's announced capacity today that will be built over the next seven or eight years. It's another three or four times leap in global battery capacity. And this battery capacity is all predicated on the expectation of a nickel-manganese-cobalt-based battery. There'll be a few other battery chemistries, but primarily it'll be that NMC battery. And the expectation is that at least 80% of the cathode in that battery is going to be nickel.

Dr. Allen Alper:Oh, that sounds great! It shows readers/investors that Management is committed to the Company and has confidence in the Company. So that's very good. Justin Cochrane:Absolutely.Dr. Allen Alper:Could you tell us a little bit about the lithium ion, mega factory capacity growth?Justin Cochrane:Yes, absolutely. When we started our business and Anthony and I partnered together back in 2017, if you looked globally, there were only about 140 gigawatt hours of lithium ion battery capacity. Today, that number is closer to 600 gigawatt hours. That's about a four times growth in three years for global battery capacity.But then if you look at the plans that GM and Ford and very importantly, Tesla have announced and in particular, the battery supply chain, particularly in China, when you look out to later this decade, there's an expectation of over two terawatt hours of battery capacity. And that is committed capacity, that's announced capacity today that will be built over the next seven or eight years. It's another three or four times leap in global battery capacity. And this battery capacity is all predicated on the expectation of a nickel-manganese-cobalt-based battery. There'll be a few other battery chemistries, but primarily it'll be that NMC battery. And the expectation is that at least 80% of the cathode in that battery is going to be nickel. Dr. Allen Alper:That's an excellent summary. Could you tell us the primary reasons our readers /investors should consider investing in Nickel 28?Justin Cochrane:Nickel 28 is probably the only investible, pure play nickel-cobalt producer on the TSX Venture Exchange. We have an interest in, arguably, the best or one of the best performing nickel-cobalt assets in the world, in our Ramu mine in Papua New Guinea. That mine has now operated above its name plate capacity for four years in a row, and has costs around $2 a pound of nickel. So with nickel above $8, it's generating tremendous free cash flow and has been a tremendous investment for the Company. So that's one.But I think that the most important reason is, as we talked about, those transformative events for the Company, in the course of 2021, where we see ourselves starting to generate free cash flow from Ramu. Our intention is to use that cash flow to buy back stock and pay a dividend and return capital to shareholders. We firmly believe that the share price is significantly undervalued, not only based on our cost base for the assets in our portfolio, but a scarcity value, with the type of assets that we have in our portfolio and the transformative events that we're expecting over the course of this year.

Dr. Allen Alper:That's an excellent summary. Could you tell us the primary reasons our readers /investors should consider investing in Nickel 28?Justin Cochrane:Nickel 28 is probably the only investible, pure play nickel-cobalt producer on the TSX Venture Exchange. We have an interest in, arguably, the best or one of the best performing nickel-cobalt assets in the world, in our Ramu mine in Papua New Guinea. That mine has now operated above its name plate capacity for four years in a row, and has costs around $2 a pound of nickel. So with nickel above $8, it's generating tremendous free cash flow and has been a tremendous investment for the Company. So that's one.But I think that the most important reason is, as we talked about, those transformative events for the Company, in the course of 2021, where we see ourselves starting to generate free cash flow from Ramu. Our intention is to use that cash flow to buy back stock and pay a dividend and return capital to shareholders. We firmly believe that the share price is significantly undervalued, not only based on our cost base for the assets in our portfolio, but a scarcity value, with the type of assets that we have in our portfolio and the transformative events that we're expecting over the course of this year. Dr. Allen Alper:Oh, those sound like very compelling reasons for our readers/investors to consider investing in Nickel 28. Justin Cochrane:We're focused, Dr. Alper, on the assets in our portfolio, which we fundamentally believe are extraordinarily undervalued. And being very shareholder friendly, we're big shareholders ourselves, our interests are completely aligned with those of our shareholders. We're going to be shareholder friendly, return capital to shareholders, focus on earning that free cash flow from Ramu, and hopefully realizing some real value out of our royalty portfolio this year.Dr. Allen Alper:Sounds excellent, Anthony and Justin. We'll publish your press releases as they come out so our readers/investors can follow your progress.https://www.nickel28.com/Justin CochraneTel: 647.846.7765Email: info@nickel28.com

Dr. Allen Alper:Oh, those sound like very compelling reasons for our readers/investors to consider investing in Nickel 28. Justin Cochrane:We're focused, Dr. Alper, on the assets in our portfolio, which we fundamentally believe are extraordinarily undervalued. And being very shareholder friendly, we're big shareholders ourselves, our interests are completely aligned with those of our shareholders. We're going to be shareholder friendly, return capital to shareholders, focus on earning that free cash flow from Ramu, and hopefully realizing some real value out of our royalty portfolio this year.Dr. Allen Alper:Sounds excellent, Anthony and Justin. We'll publish your press releases as they come out so our readers/investors can follow your progress.https://www.nickel28.com/Justin CochraneTel: 647.846.7765Email: info@nickel28.com