Nickel price jumps on Manila mining crackdown

On Monday, nickel exchanged hands for $10,755 a tonne in London, the highest since mid-August last year and a 24% advance in 2016. Measured from its 2016 trough of $7,725 a tonne struck in February, the price of the metal mainly used in steelmaking is up 39%.

Nevertheless, it's still nowhere near where it was in early in 2014 when Indonesia's ban on ore exports led many to believe the volatile metal is entering a bull market.

Mining companies in the Philippines already face the most burdensome tax regime in Southeast Asia, with 40% of revenues transferred to the government

Source: Capital Economics

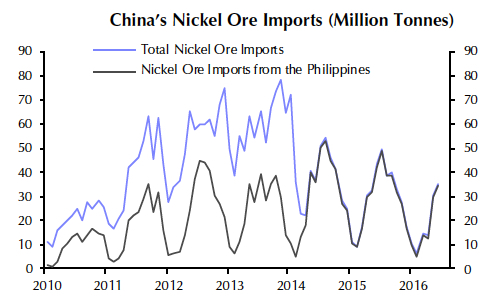

Back then, nickel miners in the Philippines stepped into the breach, more than making up for the dearth of supply from Indonesia. Massive stockpiles built up by Chinese pig nickel makers, ample stocks held in LME and Shanghai warehouses also pushed prices lower.

Indonesia's ore ban remains in place until at least next year and mining companies in the world's fourth most populous country now face further regulatory uncertainty from the planned transfer of licensing powers from local to provincial authorities and a renewed environmental crackdown.

Apart from continuing problems in Indonesia, the Chinese pig nickel industry is now wholly dependent on Philippine miners (see chart) and recent development in the Asian nation could set up another big run-up in the price.

Rodrigo Duterte, sworn in as the Philippines president at the end of June, has ratcheted up the rhetoric against mining companies operating in the country.

Reuters quotes Duterte as saying the country could forego the $850m in government revenues from the mining industry which represents just 1% of GDP:

"We will survive as a nation without you," Duterte told a media briefing, referring to the country's miners. "Either you follow strictly government standards or you close down."

According to PGI Intelligence, a London-based research company, investment in mining in the Philippines dropped to a three-year low of just $924m last year.

The Philippines natural resources ministry is conducting an audit of all mining operations within the country and have already shut down six mines since Duterte came into office, three of them nickel mines. The ministry is also calling for an outright ban on all open pit mining and a 2012 moratorium on new mining licences also remains in place.

The proposed changes to the licences, which are supported by the new Duterte administration, would increase the government's share of mining revenues. Mining companies in the Philippines already face the most burdensome tax regime in Southeast Asia, with an average of 40 percent of revenues transferred to the government, via a 30 percent corporate income tax and several mining-specific taxes.