Nighthawk Gold Corp. (TSX: NHK, OTCQX: MIMZF): Gold Exploration Company with a District-Scale Land Position in a Rich Greenstone Belt, Northwest Territories, CA: Suzette Ramcharan, VP of Corporate Development Interviewed

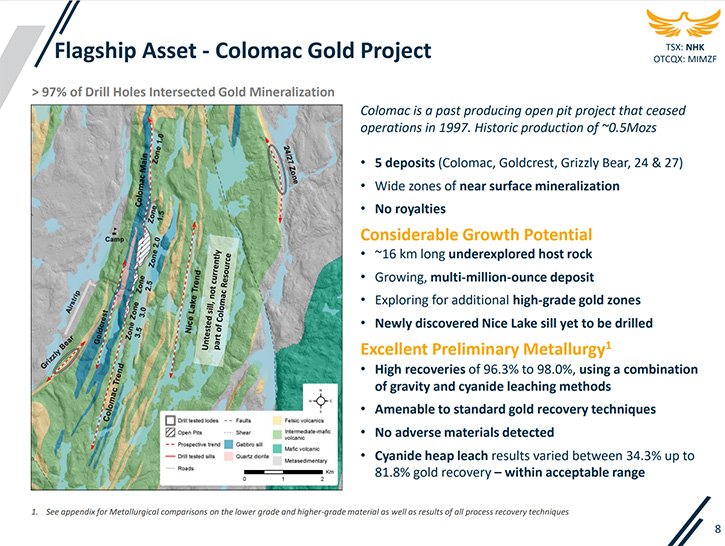

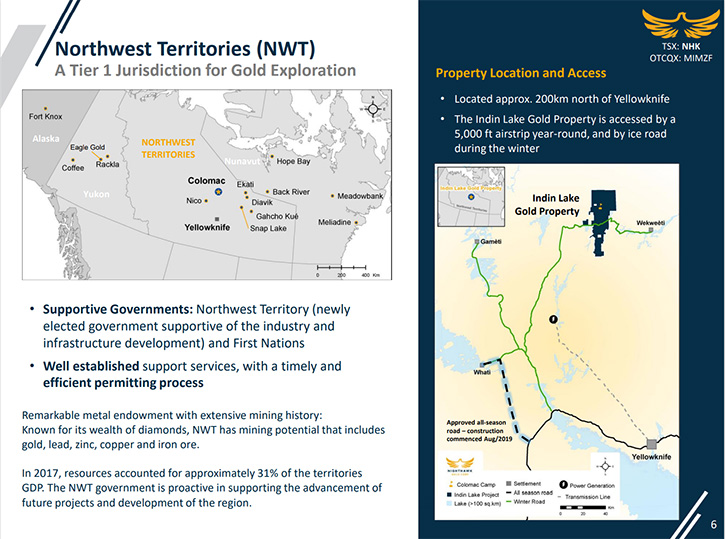

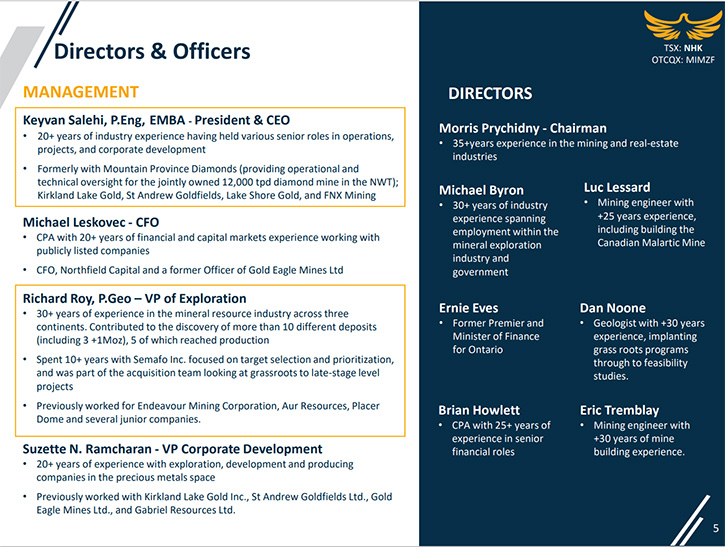

Nighthawk Gold Corp. (TSX: NHK, OTCQX: MIMZF) is a Canadian-based gold exploration company, with 100% ownership of a district-scale land position, within the Indin Lake Greenstone Belt, located approximately 200 km north of Yellowknife, Northwest Territories, Canada, a Tier-1 mining jurisdiction. Nighthawk has advanced its flagship asset Colomac, outlining a robust project with current Indicated Resources of 25.89 Mt, with an average grade of 2.01 g/t Au for 1.67 Moz of gold and Inferred Resources of 5.71 Mt, with an average grade of 2.03 g/t Au for 0.37 Moz of gold. We learned from Suzette Ramcharan, VP of Corporate Development of Nighthawk Gold, that over the next two years, the Company will look to conduct aggressive exploration, in an effort to grow the global resource base substantially. According to Suzette Ramcharan, the Company has great relationships with the indigenous communities and with government. Nighthawk Gold is a revitalized Company, with a well-rounded, enhanced team, with an aggressive vision, and a good supportive shareholder base. Nighthawk Gold Corp.Dr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Suzette Ramcharan, who is VP of Corporate Development of Nighthawk Gold. Suzette, could you give our readers/investors an overview of your Company and what differentiates your Company from others?Suzette Ramcharan:For sure. And thank you for having me, Dr. Alper. Nighthawk, for those of you that are unaware, is a unique opportunity. We have consolidated a large district-scale land position controlling about 95% of a fertile Archean gold camp located in the Indin Lake Greenstone Belt, which is the Northwest Territories of Canada. It is approximately 200 kilometers north of the capital of Yellowknife. We consolidated the land position, which culminated in the acquisition of Colomac, which has become our flagship asset. Since that acquisition in 2012, we've advanced the Colomac story, where we currently sit with just over 2 million ounces of resources in all categories.

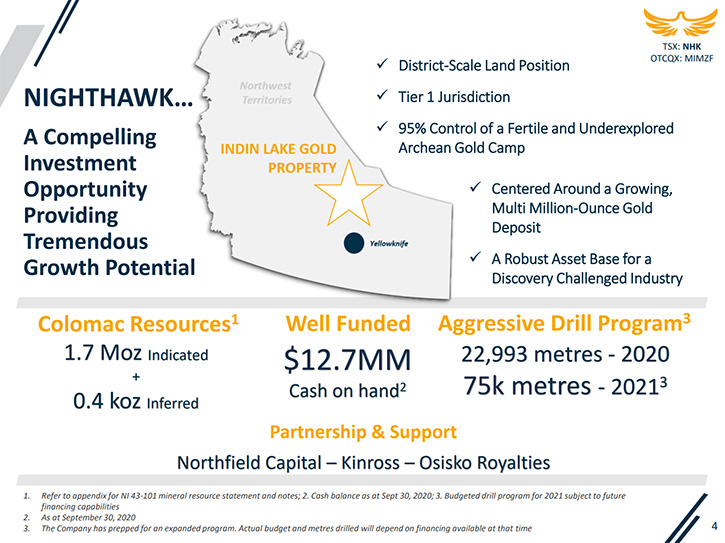

Nighthawk Gold Corp.Dr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Suzette Ramcharan, who is VP of Corporate Development of Nighthawk Gold. Suzette, could you give our readers/investors an overview of your Company and what differentiates your Company from others?Suzette Ramcharan:For sure. And thank you for having me, Dr. Alper. Nighthawk, for those of you that are unaware, is a unique opportunity. We have consolidated a large district-scale land position controlling about 95% of a fertile Archean gold camp located in the Indin Lake Greenstone Belt, which is the Northwest Territories of Canada. It is approximately 200 kilometers north of the capital of Yellowknife. We consolidated the land position, which culminated in the acquisition of Colomac, which has become our flagship asset. Since that acquisition in 2012, we've advanced the Colomac story, where we currently sit with just over 2 million ounces of resources in all categories.  We've had some significant changes this year as the project has advanced. We've enhanced the Management Team, and effective January 1st, we appointed a new CEO by the name of Keyvan Salehi. He's a professional mining engineer, with over 20 years of experience. Our new VP of Exploration, Richard Roy is a professional geologist, with 30-plus years of experience taking deposits from discovery through to production.Dr. Allen Alper:That's great to strengthen the Team and revitalize the Company.Suzette Ramcharan:Correct. It was a turning point for us. As we've advanced Colomac to the stage it is today, we want to look at it, probably the best way to describe it is a reverse-engineered look at where best to conduct our drilling in order to support a robust economic scenario. Keyvan's expertise, being a mining engineer, who has built mines, has given him a unique understanding of where to get the best bang for our buck with regards to exploration. He's worked for Companies that have taken exploration projects through development and production. He also previously worked for Mountain Province Diamonds, and they developed and brought online the Gahcho Kue diamond mine, which is also in the NWT. So he has extensive experience working and operating in the NWT, which was key for us.The addition of Richard brings us that extensive geological expertise to backfill Dr. Byron, who was the former CEO, who is still on the Board to help with the transition. Richard comes from larger companies. He spent 11 years with Semafo and in his career he has discovered 10 deposits, five of which have reached production. So that's the class, and the credibility of team that we have right now and I think their combined expertise is pertinent for the path we're taking with the Company.Dr. Allen Alper:Oh, that's excellent. It sounds like you have a great resource and a great team to move it forward. What are your primary plans for 2021?

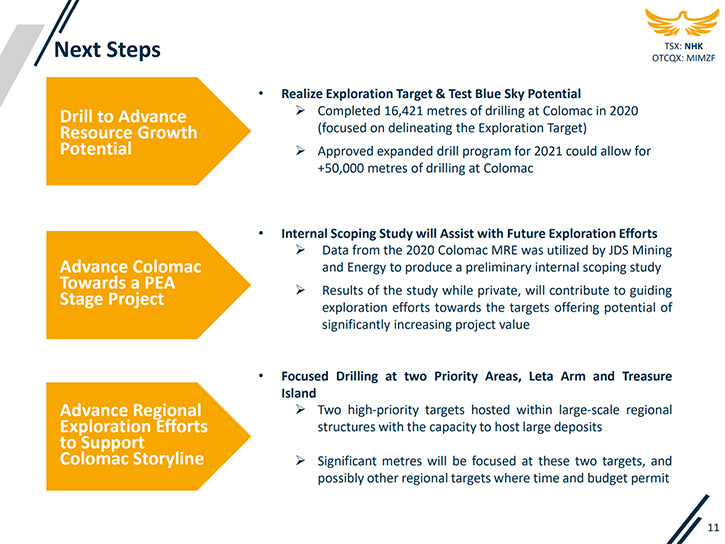

We've had some significant changes this year as the project has advanced. We've enhanced the Management Team, and effective January 1st, we appointed a new CEO by the name of Keyvan Salehi. He's a professional mining engineer, with over 20 years of experience. Our new VP of Exploration, Richard Roy is a professional geologist, with 30-plus years of experience taking deposits from discovery through to production.Dr. Allen Alper:That's great to strengthen the Team and revitalize the Company.Suzette Ramcharan:Correct. It was a turning point for us. As we've advanced Colomac to the stage it is today, we want to look at it, probably the best way to describe it is a reverse-engineered look at where best to conduct our drilling in order to support a robust economic scenario. Keyvan's expertise, being a mining engineer, who has built mines, has given him a unique understanding of where to get the best bang for our buck with regards to exploration. He's worked for Companies that have taken exploration projects through development and production. He also previously worked for Mountain Province Diamonds, and they developed and brought online the Gahcho Kue diamond mine, which is also in the NWT. So he has extensive experience working and operating in the NWT, which was key for us.The addition of Richard brings us that extensive geological expertise to backfill Dr. Byron, who was the former CEO, who is still on the Board to help with the transition. Richard comes from larger companies. He spent 11 years with Semafo and in his career he has discovered 10 deposits, five of which have reached production. So that's the class, and the credibility of team that we have right now and I think their combined expertise is pertinent for the path we're taking with the Company.Dr. Allen Alper:Oh, that's excellent. It sounds like you have a great resource and a great team to move it forward. What are your primary plans for 2021? Suzette Ramcharan:We announced last year that the Board approved the ability for us to significantly expand our programs. The largest campaign that we have ever carried out was in 2019. We did just under 45,000 meters of drilling. With COVID last year, we intended to do a similar program, but we were only able to complete just under 23,000 meters of drilling. So over the next two years, we'd like to increase our efforts in the camp significantly, continue to advance Colomac as well as some of our other high-priority targets within the large land position that we have, because there are numerous gold deposits and showings, all surrounding the Colomac deposit, that have the ability to add to any sort of future Colomac mining operation. With the level of drilling we are anticipating; we hope to substantially grow the global resource base to support a robust PEA down the road. While we believe that a PEA is the next logical step and a two-year timeline is achievable, we don't want to pigeonhole ourselves into a timeline just yet. I think the best way to put it is that we want to drill as much as we can over the next two years, grow resources, expand known deposits and zones, and find new discoveries, all of which will support robust and sound project economics, which hopefully transition into a PEA. We're looking at near surface, immediately within close proximity to Colomac that could support a robust economic opportunity there, and then we are also looking further afield at things that would be considered within trucking distance, that can substantially add to the Colomac story. So we have prepared the camp. We can support up to seven drills, and that would allow us to do anywhere from 75,000 to 100,000 meters of drilling in any given year. So those are the aggressive plans that we have for the next two years. We will be coming out with our 2021 plans including some of the drill targets we have identified, so look out for that in the coming weeks.

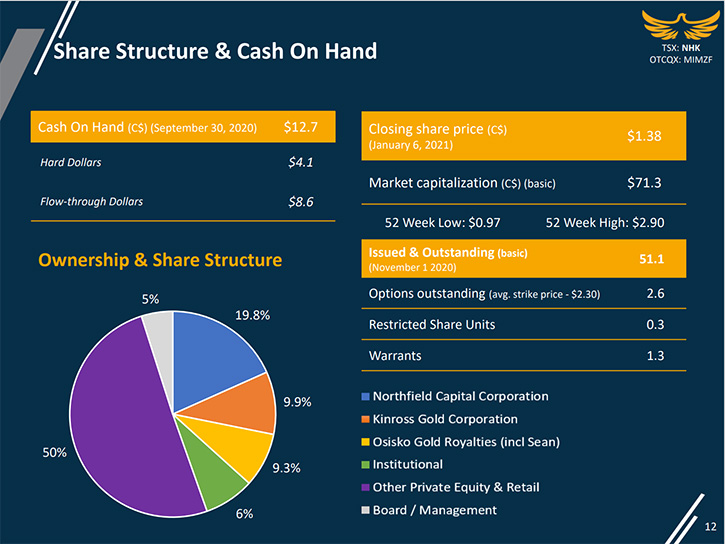

Suzette Ramcharan:We announced last year that the Board approved the ability for us to significantly expand our programs. The largest campaign that we have ever carried out was in 2019. We did just under 45,000 meters of drilling. With COVID last year, we intended to do a similar program, but we were only able to complete just under 23,000 meters of drilling. So over the next two years, we'd like to increase our efforts in the camp significantly, continue to advance Colomac as well as some of our other high-priority targets within the large land position that we have, because there are numerous gold deposits and showings, all surrounding the Colomac deposit, that have the ability to add to any sort of future Colomac mining operation. With the level of drilling we are anticipating; we hope to substantially grow the global resource base to support a robust PEA down the road. While we believe that a PEA is the next logical step and a two-year timeline is achievable, we don't want to pigeonhole ourselves into a timeline just yet. I think the best way to put it is that we want to drill as much as we can over the next two years, grow resources, expand known deposits and zones, and find new discoveries, all of which will support robust and sound project economics, which hopefully transition into a PEA. We're looking at near surface, immediately within close proximity to Colomac that could support a robust economic opportunity there, and then we are also looking further afield at things that would be considered within trucking distance, that can substantially add to the Colomac story. So we have prepared the camp. We can support up to seven drills, and that would allow us to do anywhere from 75,000 to 100,000 meters of drilling in any given year. So those are the aggressive plans that we have for the next two years. We will be coming out with our 2021 plans including some of the drill targets we have identified, so look out for that in the coming weeks. Colomac HRDr. Allen Alper:Well, that's fantastic. That's a very ambitious program and 2021 will be a very exciting time for your shareholders and stakeholders.Suzette Ramcharan:Correct. Busy year means lots of news flow, and we're going to take a slightly different approach as well. We will probably look at some targets that have never seen drilling before. So hopefully we will have some new discoveries that we can talk about as well. So yeah, definitely an exciting year ahead of us.Dr. Allen Alper:Oh, that's excellent, Suzette. Could you tell us about your share and capital structure? I see you have some impressive investors.Suzette Ramcharan:Yeah, for sure. I'll start with the cash position. At the end of the third quarter, which was the last reported quarter, we had C$12.7 million in the bank. We forecast that by the end of the year, we'll probably be sitting around seven and a half to eight million in the bank. That'll allow us to set ourselves up and start our program. We are an exploration company, so we're perpetually raising money to carry out our exploration programs, but we are lucky that we are not at the mercy of the market to raise funds to start our drill programs. As it stands right now, we have about 51 million shares outstanding. And our shareholder structure is split between a number of strategics and our largest shareholder.

Colomac HRDr. Allen Alper:Well, that's fantastic. That's a very ambitious program and 2021 will be a very exciting time for your shareholders and stakeholders.Suzette Ramcharan:Correct. Busy year means lots of news flow, and we're going to take a slightly different approach as well. We will probably look at some targets that have never seen drilling before. So hopefully we will have some new discoveries that we can talk about as well. So yeah, definitely an exciting year ahead of us.Dr. Allen Alper:Oh, that's excellent, Suzette. Could you tell us about your share and capital structure? I see you have some impressive investors.Suzette Ramcharan:Yeah, for sure. I'll start with the cash position. At the end of the third quarter, which was the last reported quarter, we had C$12.7 million in the bank. We forecast that by the end of the year, we'll probably be sitting around seven and a half to eight million in the bank. That'll allow us to set ourselves up and start our program. We are an exploration company, so we're perpetually raising money to carry out our exploration programs, but we are lucky that we are not at the mercy of the market to raise funds to start our drill programs. As it stands right now, we have about 51 million shares outstanding. And our shareholder structure is split between a number of strategics and our largest shareholder. Northfield Capital Corporation holds 20% right now. It's run by a gentleman called Robert Cudney. He is well known in the mining industry. He is a financier of a number of successful stories in the past including, Queenston Mining, Gold Eagle Mines, FNX, and they're long-term supporters. As well we have Kinross Gold Corporation that's sitting at 9.9% and Osisko Development that's sitting at around 9%. Insiders, Board and Management, we hold approximately 5% of the Company.Dr. Allen Alper:Oh, that sounds excellent that you have such a strong group of supporters to back your fundraising and to back your exploration programs.Suzette Ramcharan:Yeah. We're very lucky and we have supportive shareholders that understand and believe in the vision that we have. We truly believe what we have here is the next gold camp in Canada. We put it on all our material and on the website, and we're doing the work to illustrate that opportunity.Dr. Allen Alper:Oh, that sounds great. Sounds like you have a great resource, a great property and great potential to expand it and grow it. So that's excellent.

Northfield Capital Corporation holds 20% right now. It's run by a gentleman called Robert Cudney. He is well known in the mining industry. He is a financier of a number of successful stories in the past including, Queenston Mining, Gold Eagle Mines, FNX, and they're long-term supporters. As well we have Kinross Gold Corporation that's sitting at 9.9% and Osisko Development that's sitting at around 9%. Insiders, Board and Management, we hold approximately 5% of the Company.Dr. Allen Alper:Oh, that sounds excellent that you have such a strong group of supporters to back your fundraising and to back your exploration programs.Suzette Ramcharan:Yeah. We're very lucky and we have supportive shareholders that understand and believe in the vision that we have. We truly believe what we have here is the next gold camp in Canada. We put it on all our material and on the website, and we're doing the work to illustrate that opportunity.Dr. Allen Alper:Oh, that sounds great. Sounds like you have a great resource, a great property and great potential to expand it and grow it. So that's excellent. Suzette Ramcharan:And the other nice thing is that the Northwest Territories are considered a Tier-1 jurisdiction. We have great relationships with our indigenous communities, and with government. Yellowknife is a hub that supports a lot of the diamond mines', so we are in a good jurisdiction for resource development. We also have brought on a Manager of Stakeholder Relations, Denise Lockett. She's managing that side of things for us. So a well-rounded, enhanced team with an aggressive vision for the next two years and a good supportive shareholder base to fund us.Dr. Allen Alper:Well, that sounds excellent. Could you tell our readers/investors a little bit about your background and a little bit more about the Board?

Suzette Ramcharan:And the other nice thing is that the Northwest Territories are considered a Tier-1 jurisdiction. We have great relationships with our indigenous communities, and with government. Yellowknife is a hub that supports a lot of the diamond mines', so we are in a good jurisdiction for resource development. We also have brought on a Manager of Stakeholder Relations, Denise Lockett. She's managing that side of things for us. So a well-rounded, enhanced team with an aggressive vision for the next two years and a good supportive shareholder base to fund us.Dr. Allen Alper:Well, that sounds excellent. Could you tell our readers/investors a little bit about your background and a little bit more about the Board? Suzette Ramcharan:I'll start with the Board of Directors. Our Chairman is Morris Prychidny. He's well known in the mining industry, and he was also on the Board of Barkerville Mines. He is a very, very smart capital markets person. Michael Byron, who was the former CEO, is still on the Board and provides tremendous value given his tenure at Nighthawk and his geological expertise as he's a professional geologist, with 30-plus years of experience. Luc Lessard, who is currently running Falco Resources, is a mining engineer with plus 25 years of experience. Brian Howlett, who is also a capital-markets individual and is involved with two other junior exploration companies. Ernie Eves is the former Premier and the former Minister of Finance for Ontario. We also brought on two new Board Members last year. Dan Noone, who is a professional geologist with plus 30 years of experience. He's best known for being one of the Founders of Guyana Goldfields. Eric Tremblay, who joined us late last year is a mining engineer, who is involved with the Osisko group of companies, and he's currently the COO with Dalradian Resources. As for myself, I've been in mining for 20 plus years. I've worked with development, exploration and producing companies. Prior to joining Nighthawk in 2017, I was with Kirkland Lake Gold.Dr. Allen Alper:Oh, that sounds excellent. A great Team, a great Board, and you have an excellent background!Suzette Ramcharan:Thank you.Dr. Allen Alper:Suzette, could you summarize the primary reasons our readers/investors should consider investing in Nighthawk Gold?

Suzette Ramcharan:I'll start with the Board of Directors. Our Chairman is Morris Prychidny. He's well known in the mining industry, and he was also on the Board of Barkerville Mines. He is a very, very smart capital markets person. Michael Byron, who was the former CEO, is still on the Board and provides tremendous value given his tenure at Nighthawk and his geological expertise as he's a professional geologist, with 30-plus years of experience. Luc Lessard, who is currently running Falco Resources, is a mining engineer with plus 25 years of experience. Brian Howlett, who is also a capital-markets individual and is involved with two other junior exploration companies. Ernie Eves is the former Premier and the former Minister of Finance for Ontario. We also brought on two new Board Members last year. Dan Noone, who is a professional geologist with plus 30 years of experience. He's best known for being one of the Founders of Guyana Goldfields. Eric Tremblay, who joined us late last year is a mining engineer, who is involved with the Osisko group of companies, and he's currently the COO with Dalradian Resources. As for myself, I've been in mining for 20 plus years. I've worked with development, exploration and producing companies. Prior to joining Nighthawk in 2017, I was with Kirkland Lake Gold.Dr. Allen Alper:Oh, that sounds excellent. A great Team, a great Board, and you have an excellent background!Suzette Ramcharan:Thank you.Dr. Allen Alper:Suzette, could you summarize the primary reasons our readers/investors should consider investing in Nighthawk Gold? Suzette Ramcharan:Certainly. The first thing that comes to mind is the size, there is no denying that we have quite a large land position (930 square kilometres or 229,791 acres). That is about three times the size of the Timmins camp. But we also have the quality of assets, with numerous gold deposits and showings hosted within a variety of deposit settings - where it seems anything that is brittle is hosting gold. This tells us we are sitting within a very fertile gold camp. And this all surrounds Colomac, which was a known entity, a past producer and probably considered a cast-off, but has proven to be a growing, multi-million-ounce deposit.Colomac has an average grade of 2.01 g/t Au, but we have gotten snips of high-grade. We discovered a high-grade zone at Colomac's Zone 1.5, and in 2019, we hit 56 meters of 13.5g/t Au. While this does not change the nature of the deposit, it certainly is nice to have high-grade zones as sweeteners. Some of these other targets that surround Colomac, have all been encountered, within the near surface environment and we're intersecting elevated grades to what we have at Colomac, so the ability to find near surface, higher grade deposits is definitely there. As well, these targets that we're looking at are sitting within large regional structures. These are regional structures that have the capacity to host large deposits.So you have Colomac, with a solid resource base where we can see the opportunity to continue to grow the resource base. And then we see the possibility of drilling into some of these other targets that are known and to find new discoveries in areas that have yet to be drilled. What we have right now on the books, coupled with the potential we see is certainly not reflected in the current share price. When we published the updated resource last year the share price traded down as the market saw that update as a reduction in ounces (we went from an unconstrained inferred resource of 2.6Moz to a constrained resource with 1.7Moz in Indicated Resources plus an additional 0.4Moz of Inferred). The reality of moving to a constrained resource (as required at the time) means we lost some ounces due to the constraints, but we upgraded +80% from Inferred to Indicated, and we have a more representative resource base that can be moved forward in its evolution. But speaking to our support, despite the market reaction, we were able to pull off a C$12MM financing, which allowed us to continue with our exploration plans. As we prep ourselves to start the 2021 program, I think it's a prime time to get acquainted with the story before we start to come out with significant news flow this year.Dr. Allen Alper:Oh, that sounds like it is an excellent time, with all the drilling that you're going to be doing this year and next year, and such a large camp to explore, with such an excellent, knowledgeable, successful team. So those sound like very strong reasons for our readers/investors to consider investing in Nighthawk Gold. Suzette, is there anything else you'd like to add?Suzette Ramcharan:If there's any other information anyone's looking for, they can visit the website. We keep it fairly updated. You can also reach out to me directly. The email address is info@nighthawkgold.com.Dr. Allen Alper:Oh, that sounds great. We'll publish your press releases as they come out so our readers/investors can follow your progress. https://www.nighthawkgold.com/NIGHTHAWK GOLD CORP.Tel: 1-647-794-4313 Email: info@nighthawkgold.com

Suzette Ramcharan:Certainly. The first thing that comes to mind is the size, there is no denying that we have quite a large land position (930 square kilometres or 229,791 acres). That is about three times the size of the Timmins camp. But we also have the quality of assets, with numerous gold deposits and showings hosted within a variety of deposit settings - where it seems anything that is brittle is hosting gold. This tells us we are sitting within a very fertile gold camp. And this all surrounds Colomac, which was a known entity, a past producer and probably considered a cast-off, but has proven to be a growing, multi-million-ounce deposit.Colomac has an average grade of 2.01 g/t Au, but we have gotten snips of high-grade. We discovered a high-grade zone at Colomac's Zone 1.5, and in 2019, we hit 56 meters of 13.5g/t Au. While this does not change the nature of the deposit, it certainly is nice to have high-grade zones as sweeteners. Some of these other targets that surround Colomac, have all been encountered, within the near surface environment and we're intersecting elevated grades to what we have at Colomac, so the ability to find near surface, higher grade deposits is definitely there. As well, these targets that we're looking at are sitting within large regional structures. These are regional structures that have the capacity to host large deposits.So you have Colomac, with a solid resource base where we can see the opportunity to continue to grow the resource base. And then we see the possibility of drilling into some of these other targets that are known and to find new discoveries in areas that have yet to be drilled. What we have right now on the books, coupled with the potential we see is certainly not reflected in the current share price. When we published the updated resource last year the share price traded down as the market saw that update as a reduction in ounces (we went from an unconstrained inferred resource of 2.6Moz to a constrained resource with 1.7Moz in Indicated Resources plus an additional 0.4Moz of Inferred). The reality of moving to a constrained resource (as required at the time) means we lost some ounces due to the constraints, but we upgraded +80% from Inferred to Indicated, and we have a more representative resource base that can be moved forward in its evolution. But speaking to our support, despite the market reaction, we were able to pull off a C$12MM financing, which allowed us to continue with our exploration plans. As we prep ourselves to start the 2021 program, I think it's a prime time to get acquainted with the story before we start to come out with significant news flow this year.Dr. Allen Alper:Oh, that sounds like it is an excellent time, with all the drilling that you're going to be doing this year and next year, and such a large camp to explore, with such an excellent, knowledgeable, successful team. So those sound like very strong reasons for our readers/investors to consider investing in Nighthawk Gold. Suzette, is there anything else you'd like to add?Suzette Ramcharan:If there's any other information anyone's looking for, they can visit the website. We keep it fairly updated. You can also reach out to me directly. The email address is info@nighthawkgold.com.Dr. Allen Alper:Oh, that sounds great. We'll publish your press releases as they come out so our readers/investors can follow your progress. https://www.nighthawkgold.com/NIGHTHAWK GOLD CORP.Tel: 1-647-794-4313 Email: info@nighthawkgold.com