Nike Stock Hit With Bear Note as Earnings Loom

Nike is expected to reveal its fiscal third-quarter report after the close tomorrow

Nike is expected to reveal its fiscal third-quarter report after the close tomorrow

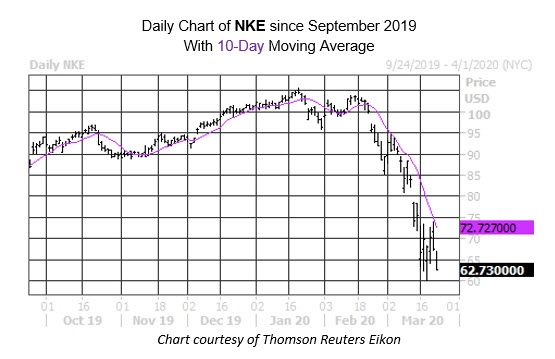

When we last checked in with Nike Inc (NYSE:NKE), the blue chip retailer was just beginning to feel the pinch of coronavirus-induced headwinds. Seven weeks later, Nike stock is nursing a nasty 37.3% loss year-to-date. What's more, the swoosh logo steps into the earnings confessional for its fiscal third-quarter report after-the-close tomorrow, March 24. Ahead of the event, options traders are bracing for a larger-than-normal post-earnings move.

Looking at Nike's earnings history, the stock saw negative returns during three of the last eight sessions, including a 1.2% dip in December and a 6.6% drop last March. This time around the options pits are pricing in a 15.8% next-day swing, regardless of direction, almost four times bigger than the 4% post-earnings move averaged during the past two years.

At last check, Nike stock was trading down 6.5% at $62.73 after Needham cut its price target to $80 from $105. The shares have faced stiff pressure from their 10-day moving average the last two months, although 18 out of 25 analysts in coverage still rate NKE a "buy" or better.

The options pits are quite put-heavy. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), NKE sports a 50-day put/call volume ratio of 2.29. This ratio sits four percentage points from an annual high, suggesting long puts have been picked up at a slightly quicker-than-usual clip. Today, the most popular front-month contract is the weekly 3/27 65-strike put, where new positions are being opened.