No Jobs but More Inflation

Ron Struthers of Struthers Resource Stock Report takes a look at the current jobs report and shares one gold stock he thinks is worth keeping an eye on in light of surging gold.

Ron Struthers of Struthers Resource Stock Report takes a look at the current jobs report and shares one gold stock he thinks is worth keeping an eye on in light of surging gold.

The big news to most about the market on Friday was the disaster jobs number. It should be no surprise to readers of this newsletter as I have been pointing out the economic weakness everywhere and it looked to only get worse.

Unfortunately, being right is not always popular!

Well, now it is becoming obvious to the less trained eye. U.S. job growth weakened sharply in August while the unemployment rate increased to nearly a four-year high of 4.3%. Non-farm payrolls increased by only 22,000 jobs last month after rising by an upwardly revised 79,000 in July, the Labor Department's Bureau of Labor Statistics said. Economists polled by Reuters had forecast payrolls would rise by 75,000 positions after a previously reported gain of 73,000 in July.

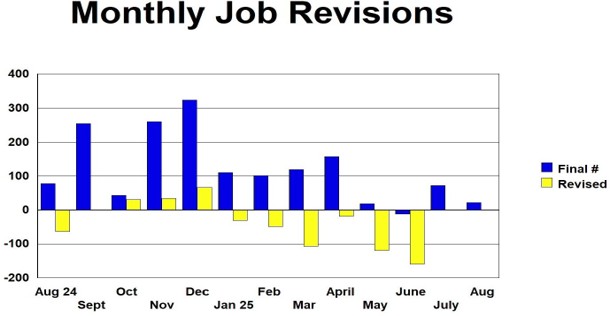

Revisions also showed payrolls declined by -13,000 jobs in June, the first drop since December 2020, rather than rising by 14,000, as had been reported last month. This chart shows final job numbers after revisions. The BLS does not provide much detail on the revisions, but they have been large lately.

I wonder how July and August will be revised?

I often commented that Trump's plans would be disruptive and cause short-term pain. The short-term pain is becoming obvious, and the jury is still out on whether Trump's economic plans will work at all.

Perhaps there will only be more pain.

Interest rates dropped, and gold made new highs on the job numbers. The market is now expecting rate cuts, and the jump in gold is really saying these rate cuts are too soon.

Let's dig deeper . . .

Certainly, the weak job numbers help pave the way for a rate cut. Perhaps the Fed realizes a rate cut is needed, so some job revisions appeared to give them an excuse. As I have always said, the Government and the Fed are masters of the economic data.

The last inflation print in both Canada and the U.S. was low last month, thanks to a plunge in gasoline prices. The CPI for August, to be reported on Thursday, will have the same benefit. Here is a 2-year chart of gasoline prices, and it is easy to see the year-over-year drop for July and August.

However, what is also obvious, this benefit to the CPI numbers will end with September's data that will be reported in October. The Fed meets September 16-17 so they will be able to lower rates before a bad inflation report in October. That said, this October inflation report could be part of the scary October market scenario.

Just because the Fed cuts the bank rate, it does not mean rates for business and consumers will come down. U.S. fiscal health, Federal Reserve independence, and geopolitical instability are questioning the stability of long-term Treasuries, historically seen as the safest asset. As a result, many central banks are returning to gold. This year, gold prices have soared to new highs, while long-dated bond yields have reached levels not seen in years. Gold has recently surpassed the euro to become the second-largest global reserve asset after the U.S. dollar and, for the first time since 1996, gold represents a bigger share of central banks' reserves than Treasuries.

And from current levels, if just 1% of privately owned Treasuries were shifted into gold, the US$ gold price could rise to US$5,000/oz, according to a new report from Goldman Sachs. The chance of interest rate cuts, and the risk of the Fed losing independence, could also be drivers for the gold price in 2026, according to Goldman.

Even if rates come down for consumers, their spending cannot increase amid the current cost-of-living crisis. Remember, the actual inflation rate consumers face is two times or more the reported rate. The majority of Americans are living on a paycheck-to-paycheck basis and no longer have confidence in the American dream. America's consumer-driven economy will not do well when consumers have no disposable income.

I previously commented when rates were about 7.5% that the best that could happen with rates is a drop of 1 to 1.5%. As you can see in this chart, the rate on the 30-year mortgage is down a bit more than 0.5% from 7.5%.

The Bond Market Is Belatedly Calling An End To The Money Printing Gimmick

Inflation-sensitive 30-year long bond market yields are now aggressively moving higher for France and the UK, with the U.S. 30-year yield poised to break higher.

After years of being duped, the bond market senses even higher approaching inflation and is selling off. The running price of gold and silver signals that physical demand is overwhelming years of repressive control by the government and the Fed.

And more poor economic numbers last week. Total construction spending fell 0.1% in July, amounting to a 2.8% year-over-year decline. Factory orders in the United States were down by 1.3% in July compared to the previous month, landing at $603.6 billion, a new report by the Census Bureau said last Wednesday.

Data out last Tuesday from the Institute for Supply Management showed the ISM's manufacturing PMI came in at 48.7 last month, an increase from the reading of 48 seen in July but below estimates for a reading of 48.9, according to Bloomberg data. This marked the sixth straight month of contraction in the U.S. manufacturing sector, according to the ISM's reading.

I don't know how much longer markets can hold together in face of economic decline. Perhaps they are hoping on lower interest rates?

However, as I noted, they are going to get a rude awakening there. It still amazes me that most North American retail investors are still ignoring gold.

It does not help that the U.S. mainstream outlets, such as CNBC and Fox Business, either ignore gold or frame it only in comparison to Bitcoin. One analyst noted that during gold's record-breaking surge, CNBC's social media feed mentioned the metal only once and even then, in the context of Bitcoin.

This neglect is perhaps common habit. U.S. financial culture and government policies are built on sustaining confidence in the fiat system. Downplaying gold serves to reinforce the dollar's role, even as its purchasing power erodes. That said, I think the jig is up.

And I will end with a quick update on one of our junior gold explorers about to break out.

Goliath

Recent Price -$2.40

Entry Price - $1.22

Opinion - Hold, Buy

Recently, Goliath Resources Ltd. (GOT:TSX.V; GOTRF:OTCQB; B4IF:FSE) announced additional assay results from its 2025 drill program, where drill hole GD-25- 328 intersected 18.58 g/t Au over 5.00 meters, including 23.22 g/t Au over 4.00 meters, including 30.95 g/t Au or 1.00 oz/t over 3 meters at Surebet Discovery on its 100% controlled Golddigger Property, Golden Triangle, British Columbia.

100% of the drill holes completed to date on Surebet have intersected substantial quartz-sulphide mineralization as well as 90% of the 2025 drill holes contain visible gold to the naked eye ("VG-NE") that clearly demonstrates the exceptional discovery potential remaining on the property.

Drilling has been completed for 82 holes (55,000 meters) during the 2025 drill season, with 33 holes remaining (5,000 meters) for a total of 115 planned drill holes.

Drill hole GD-25-355 intersected 72 g/t Au over 12.20 meters, including 12.92 g/t Au over 5.20 meters,Drill hole GD-25-345 intersected two separate mineralized intervals within the Bonanza Zone at the sediment-volcanic contact. The first 5.09 g/t Au over 9.00 meters, including 9.04 g/t Au over 5.05 meters, including 14.88 g/t Au over 3.00 meters from a quartz-sulphide breccia intervals that transition into a broad quartz-sulphide vein containing moderate amounts of pyrrhotite, galena and sphalerite part of The second interval assayed 4.22 g/t Au over 6.03 meters including 8.50 g/t Au over 2.97 metersDrill hole GD-25-317 intersected 56 g/t Au over 5.15 meters, including 10.22 g/t Au over 3.3 meters from the Golden Gate Zone.Drill hole GD-25-321 intersected 59 g/t Au over 8.00 meters, including 6.53 g/t Au over 5.00 meters, including 7.42 g/t over 4.00 meters from the Bonanza Zone.Drill hole GD-25-362 intersected 73 g/t Au over 5.94 meters, including 5.67 g/t Au over 4.94 meters, including 6.80 g/t Au over 4.1 meters from the Surebet Zone.Drill hole GD-25-313 intersected 88 g/t Au over 7.5 meters, including 10.68 g/t Au over 3.40 meters from the Bonanza Zone. The intercept is approximately true width, and these assays reflect gold only (AuEq value in the interval will be adjusted accordingly once Ag, Cu, Pb, and Zn are received)This is going to be a nice high-grade deposit. Throughout history, the market has valued gold in the ground for these junior explorers at around $50 to $100 per ounce. Larger or high-grade deposits could be valued higher. However, we are in a new era of much higher gold prices that are going to stay for some time and no doubt go much higher still.

At some point, these gold explorers will get re-rated up to $200 or $300 per ounce in the ground, maybe even higher.

Goliath has not announced any resource numbers yet, but the stock looks poised to break out to new highs. It is trying to clear near-term resistance around $2.50.

We are up about 100% on the stock, but if you don't own any, I think it still has legs to go way higher. You can join these shareholders.

Goliath's key strategic shareholders include Crescat Capital, a Global Commodity Group (Singapore), McEwen Mining Inc. (NYSE: MUX), Waratah Capital Advisors, Mr. Rob McEwen, Mr. Eric Sprott and Mr. Larry Childress.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Goliath Resources is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.Ron Struthers: I, or members of my immediate household or family, own securities of: Goliath Resources. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.