North American insiders signal that stocks face heavy resistance

There appears to be a consensus among insiders that stocks are likely to face significant resistance at current levels. On Monday, we suggested that insiders were signalling that 1,160 would be a tough nut the crack for the INK Canadian Insider Index. We see the same dynamic playing out in US markets.

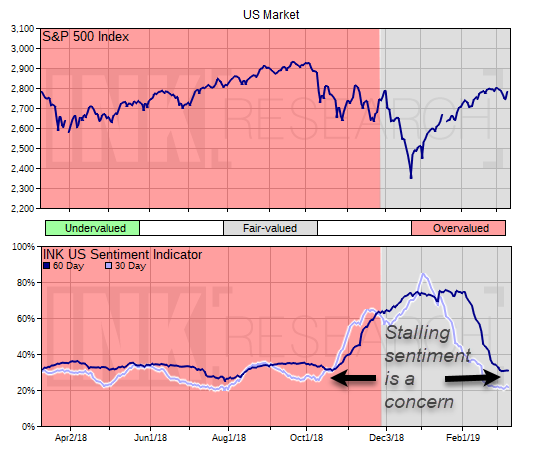

Stalling insider sentiment suggests stocks may have a hard time advancing

Like our Canadian-focused INK Indicator, our US Indicator is also levelling off. Such bottoming behaviour often takes place near significant resistance points. As a result, we expect 2,800 on the S&P 500 will be hard to crack in the short-term. If we are wrong, and stocks move higher in the days ahead, it would likely signal a return to a big-stock momentum-investing playbook. That said, we would not bet on that outcome.

Unless one believes we are headed back to the glory days of Alphabet (Mixed: GOOGL) and other technology-empowered monopoly darlings such as Amazon (Mixed; AMZN) and Facebook (Mostly Sunny; FB) leading the market, it is hard to envision stocks scooting higher without the participation of economically-sensitive stocks. If sectors that have their fortunes directly tied to economic growth such as Energy, Basic Materials, and Industrials now stall, it will cast doubt on the durability of US economic growth, raising the risks of a recession. While we are not forecasting a recession, it may only take heightened risks of one occurring this year for stocks to pause until the outlook becomes a bit clearer.

The Industrials sector is our biggest concern right now with both our 30-day and 60-day indicators below 20%, meaning there are more than 5 stocks with key insider selling for every one with buying over those respective periods. Such depressed levels are often associated with broad sector weakness.

Moreover, until US bank stocks regain some momentum, we will have a hard time believing that investors will have confidence that a sustainable economic recovery lies ahead. Over the past month, the SPDR KBW Bank ETF (KBE) is off -0.9%, trailing the broad market SPDR S&P Trust 500 ETF (SPY) up 1.6%. Our Banks Indicator has also levelled off which concerns us that the group has stalled, at least until medium and long-term bond yields can move off their recent lows. If both bond yields and banks can head up over the next few weeks, we will have more confidence that 2,800 can be cleared.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.

This post is drawn from the March 13th US Market INK report.