Northisle Copper and Gold Inc. (TSX-V: NCX): District-Scale, One of the Most Promising Copper and Gold Porphyry Deposits in Canada, Robust PEA, Low-Cost and Long Mine Life, Sam Lee, President and CEO Interviewed

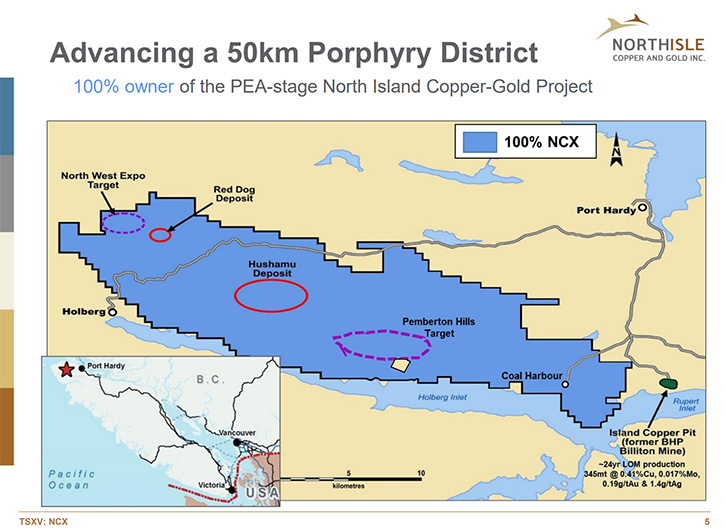

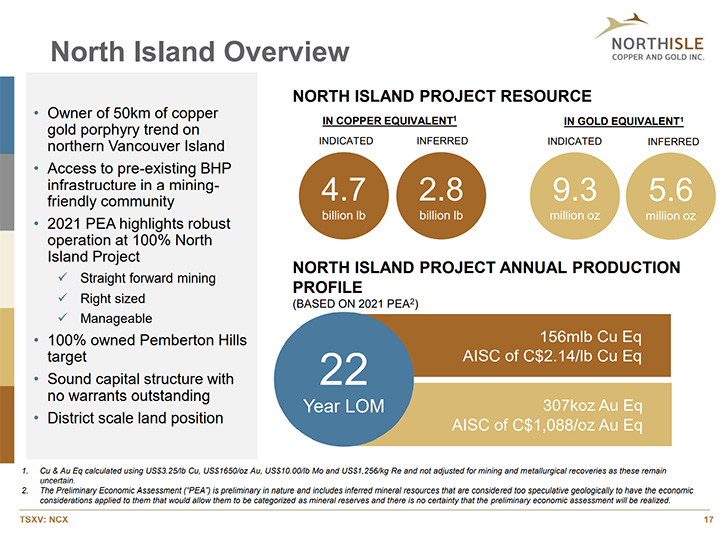

Northisle Copper and Gold Inc. (TSX-V: NCX) owns the district-scale North Island Project, located near Port Hardy, British Columbia. The North Island Project is one of the most promising copper and gold porphyry deposits in Canada, with the robust PEA boasting low cost and long mine life. The Company is aggressively advancing its exploration and development program in 2021. We learned from Sam Lee, President and CEO of Northisle Copper and Gold, that they are advancing into the pre-feasibility stage. Near-term plans include negotiating with BHP and First Nations for the use of historical infrastructure including the historical Island Copper pit and a foreshore lease, and also aggressive exploration drilling at the North Island Project, including the prospective Pemberton Hills target. We learned from Mr. Lee that Northisle's mission is to become Canada's leading sustainable resource company for the future, being one of the only mine development companies in the world which has put such an intense focus on the sustainability of their operations at an early stage. Northisle Copper and Gold Inc.Dr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sam Lee, President and CEO of Northisle Copper and Gold Inc. Sam, could you give our readers/investors an overview of your Company and also what differentiates it from others and the highlights of 2020?Sam Lee:Sure. Thanks Al. I'll start with our mission. I joined in October, 2020, with a mission to build the leading sustainable resource company for the future. In this context, the North Island project, which is based in British Columbia, represents one of the most attractive copper and gold projects in Canada, not only because of its compelling economics, but its proximity to existing infrastructure and cheap and clean power. High quality projects like this are very hard to come by.It's very rare. That's the reason we believe Northisle is among the best in the industry. I think I described to you last time that we have the core nucleus at the leadership level, but more importantly, it's really our desire to deliver on this mission. That's why we think this is one of the most attractive undeveloped copper and gold porphyry developments in Canada.

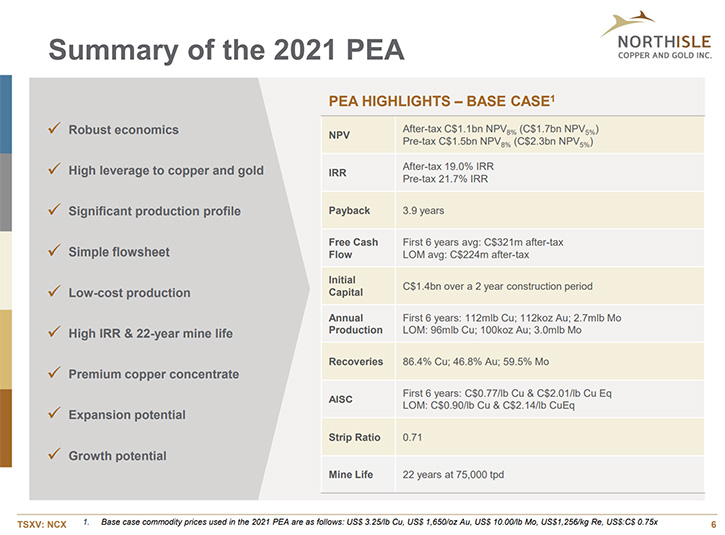

Northisle Copper and Gold Inc.Dr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Sam Lee, President and CEO of Northisle Copper and Gold Inc. Sam, could you give our readers/investors an overview of your Company and also what differentiates it from others and the highlights of 2020?Sam Lee:Sure. Thanks Al. I'll start with our mission. I joined in October, 2020, with a mission to build the leading sustainable resource company for the future. In this context, the North Island project, which is based in British Columbia, represents one of the most attractive copper and gold projects in Canada, not only because of its compelling economics, but its proximity to existing infrastructure and cheap and clean power. High quality projects like this are very hard to come by.It's very rare. That's the reason we believe Northisle is among the best in the industry. I think I described to you last time that we have the core nucleus at the leadership level, but more importantly, it's really our desire to deliver on this mission. That's why we think this is one of the most attractive undeveloped copper and gold porphyry developments in Canada. Dr. Allen Alper:That sounds great. Could you elaborate on the resource and what you've found to date?Sam Lee:Sure. Our flagship asset is the North Island project. We just recently updated our PEA on this project. The project now boasts an after tax NPV(8%) of $1.1 billion Canadian and an after tax IRR of 19% over a very long 22 year life of mine. It produces more than 150 million pounds of copper equivalent production. It has a first quartile, all in sustaining cost of 77 cents Canadian per pound of copper during the first six years, which is net of byproducts.

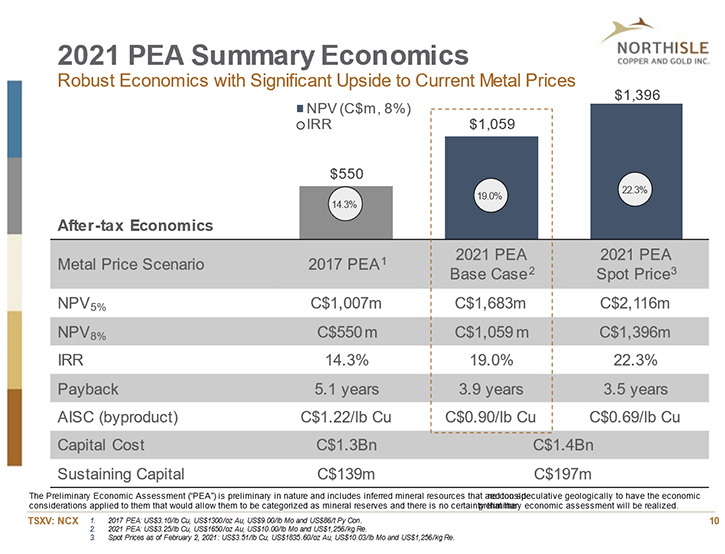

Dr. Allen Alper:That sounds great. Could you elaborate on the resource and what you've found to date?Sam Lee:Sure. Our flagship asset is the North Island project. We just recently updated our PEA on this project. The project now boasts an after tax NPV(8%) of $1.1 billion Canadian and an after tax IRR of 19% over a very long 22 year life of mine. It produces more than 150 million pounds of copper equivalent production. It has a first quartile, all in sustaining cost of 77 cents Canadian per pound of copper during the first six years, which is net of byproducts. This is a tremendous improvement from the last time we spoke, where the project had approximately $550 million Canadian NPV and approximately 14% after-tax IRR. This obviously was informed by the improved metallurgical recoveries that we saw through our program and increased copper and gold prices, which were obviously offset by anticipated increases in operating and capital costs. Informing these production numbers, there are nearly 100,000 ounces of gold production and approximately 100 million pounds of copper production for that 22-year mine life. The way I characterize this project is not too big and not too small, very meaningful on both the copper and gold production scale. This project is situated in a place that has access to cheap and clean power and where the communities have historically supported mining. We are absolutely laser focused on ensuring that this project is developed with sustainability at the core of who we are.

This is a tremendous improvement from the last time we spoke, where the project had approximately $550 million Canadian NPV and approximately 14% after-tax IRR. This obviously was informed by the improved metallurgical recoveries that we saw through our program and increased copper and gold prices, which were obviously offset by anticipated increases in operating and capital costs. Informing these production numbers, there are nearly 100,000 ounces of gold production and approximately 100 million pounds of copper production for that 22-year mine life. The way I characterize this project is not too big and not too small, very meaningful on both the copper and gold production scale. This project is situated in a place that has access to cheap and clean power and where the communities have historically supported mining. We are absolutely laser focused on ensuring that this project is developed with sustainability at the core of who we are. It is worth noting that this is a project that is highly levered to commodity pricing assumptions and the numbers below reflect our base case scenario assuming prices of $3.25 per pound of copper and $1,650 per ounce of gold.Increasing those assumptions to $3.51 copper and $1,835 gold the after-tax NPV and IRR increase to $1.4 billion and 22.3%, respectively.Copper prices are nearing $4.20 right now! As a mentioned last time we spoke, I believe we are on the verge of a commodity super cycle, led by copper and gold.

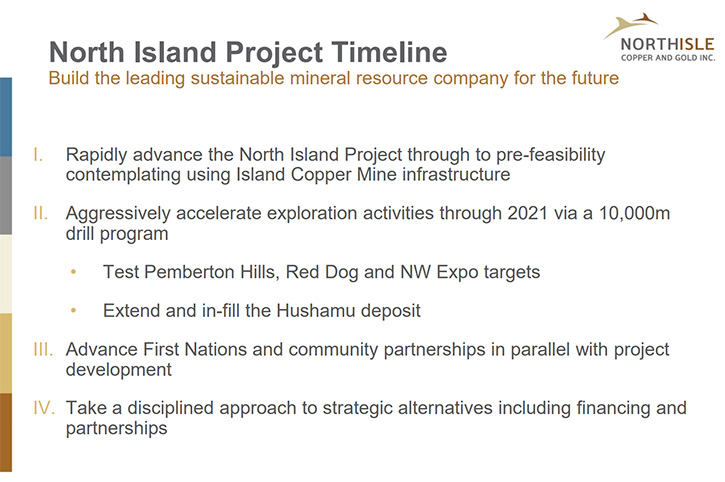

It is worth noting that this is a project that is highly levered to commodity pricing assumptions and the numbers below reflect our base case scenario assuming prices of $3.25 per pound of copper and $1,650 per ounce of gold.Increasing those assumptions to $3.51 copper and $1,835 gold the after-tax NPV and IRR increase to $1.4 billion and 22.3%, respectively.Copper prices are nearing $4.20 right now! As a mentioned last time we spoke, I believe we are on the verge of a commodity super cycle, led by copper and gold.  Dr. Allen Alper:Oh, that sounds great. Could you tell our readers/investors your primary goals for 2021?Sam Lee:Sure. The project is now advancing into the pre-feasibility stage. Before we initiate on that study, we need to accurately define what the scope of that study looks like. Predominantly, what are some of the trade-offs that we need to perform around disposing of our tailings? There is an existing historical pit, owned by BHP, 25 kilometers away, in addition to infrastructure and a foreshore lease that we would contemplate using. Given that it's an existing industrial zone, using this existing infrastructure would significantly reduce the impact of our operations on the land relative to a greenfield site.Over the nextsix months, we will be advancing those discussions, with the relevant parties, including each First Nations group, BHP, and the government to see what can be done around reusing the existing infrastructure. The second pillar for us is our exploration strategy. Not only do we have the opportunity to improve the resource available for our existing North Island project, but we recently regained 100% of our Pemberton Hills project. We intend to commence drilling on this target immediately, which is a highly prospective area for a large, buried, copper-gold porphyry system under a three and a half by one and a half kilometer highly altered lithocap.This structure suggests the potential for a very large reservoir-style deposit.

Dr. Allen Alper:Oh, that sounds great. Could you tell our readers/investors your primary goals for 2021?Sam Lee:Sure. The project is now advancing into the pre-feasibility stage. Before we initiate on that study, we need to accurately define what the scope of that study looks like. Predominantly, what are some of the trade-offs that we need to perform around disposing of our tailings? There is an existing historical pit, owned by BHP, 25 kilometers away, in addition to infrastructure and a foreshore lease that we would contemplate using. Given that it's an existing industrial zone, using this existing infrastructure would significantly reduce the impact of our operations on the land relative to a greenfield site.Over the nextsix months, we will be advancing those discussions, with the relevant parties, including each First Nations group, BHP, and the government to see what can be done around reusing the existing infrastructure. The second pillar for us is our exploration strategy. Not only do we have the opportunity to improve the resource available for our existing North Island project, but we recently regained 100% of our Pemberton Hills project. We intend to commence drilling on this target immediately, which is a highly prospective area for a large, buried, copper-gold porphyry system under a three and a half by one and a half kilometer highly altered lithocap.This structure suggests the potential for a very large reservoir-style deposit. Dr. Allen Alper:That's excellent, Sam. Could you tell our readers/investors about your strong leadership team, your background and your board?Sam Lee:Absolutely.One of my most important jobs is to match our resources with our vision. Our key Team Members span the competencies around financing, discovering, building and expanding mines worldwide. Our founder, Dale Corman is also our largest shareholder and responsible for bringing the Penasquito deposit from discovery through to feasibility, after which he sold it to Glamis, now Newmont Goldcorp, for $1.2 billion. With my significant fundraising experience, spanning over 20 years, we can help our VP Exploration Jack McClintock do what he does best, which is to find copper-gold porphyry deposits. Jack is the person responsible for discovering the Spence deposit, which now lies within BHP. He is probably one of a handful of people in the world that truly understands these types of systems. Kevin O'Kane, who is on our Board, brings development and operating credibility to the team, through his 40 years at BHP and SSR. He actually lived in Port Hardy for 12 years, while he rose to Chief Mining Engineer for the adjacent Island Copper Mine that was owned by BHP. He has already been instrumental in adding to our operating and development credibility with our key stakeholders.

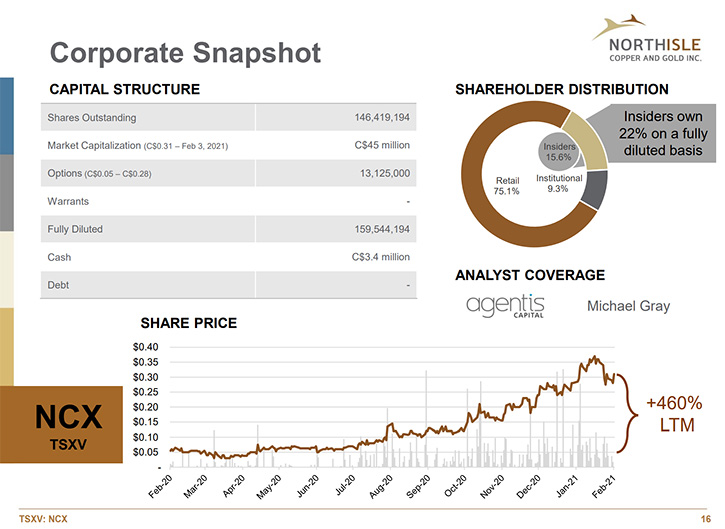

Dr. Allen Alper:That's excellent, Sam. Could you tell our readers/investors about your strong leadership team, your background and your board?Sam Lee:Absolutely.One of my most important jobs is to match our resources with our vision. Our key Team Members span the competencies around financing, discovering, building and expanding mines worldwide. Our founder, Dale Corman is also our largest shareholder and responsible for bringing the Penasquito deposit from discovery through to feasibility, after which he sold it to Glamis, now Newmont Goldcorp, for $1.2 billion. With my significant fundraising experience, spanning over 20 years, we can help our VP Exploration Jack McClintock do what he does best, which is to find copper-gold porphyry deposits. Jack is the person responsible for discovering the Spence deposit, which now lies within BHP. He is probably one of a handful of people in the world that truly understands these types of systems. Kevin O'Kane, who is on our Board, brings development and operating credibility to the team, through his 40 years at BHP and SSR. He actually lived in Port Hardy for 12 years, while he rose to Chief Mining Engineer for the adjacent Island Copper Mine that was owned by BHP. He has already been instrumental in adding to our operating and development credibility with our key stakeholders. Dr. Allen Alper:Well, you have a very strong and very well-balanced team of mine finders, developers and financiers. So that's excellent!Sam Lee:Thank you.Dr. Allen Alper:Could you tell reader/investors a little bit about your share and capital structure?Sam Lee:You bet. It's very clean. We have no warrants. We have no debts. We have approximately 146 million shares outstanding. We have approximately $3 million of cash in the bank and recently announced an oversubscribed and upsized equity offering of approximately $7 million.Following the completion of this financing we will have raised over $10 million in a short few months and expect to be sufficiently capitalized for our exploration and development program. Our shareholders are very committed and long-term in nature. I could count on one hand the top 50% of our shareholder register, which is comprised of world-leading institutions, and individuals and insiders, who all support the Company's vision of becoming the leading sustainable mineral resource company for the future. So all in all, we're in a great position to capture the potential that our strategy has laid out, over the next few months. And we're really looking forward to accelerating our programs through 2021.

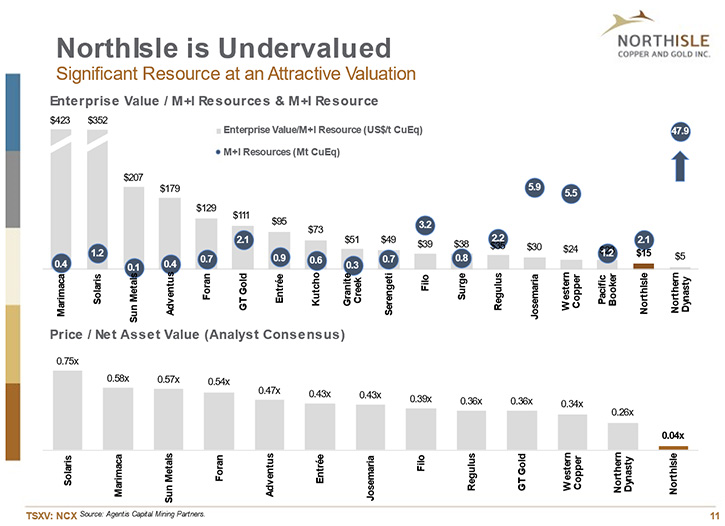

Dr. Allen Alper:Well, you have a very strong and very well-balanced team of mine finders, developers and financiers. So that's excellent!Sam Lee:Thank you.Dr. Allen Alper:Could you tell reader/investors a little bit about your share and capital structure?Sam Lee:You bet. It's very clean. We have no warrants. We have no debts. We have approximately 146 million shares outstanding. We have approximately $3 million of cash in the bank and recently announced an oversubscribed and upsized equity offering of approximately $7 million.Following the completion of this financing we will have raised over $10 million in a short few months and expect to be sufficiently capitalized for our exploration and development program. Our shareholders are very committed and long-term in nature. I could count on one hand the top 50% of our shareholder register, which is comprised of world-leading institutions, and individuals and insiders, who all support the Company's vision of becoming the leading sustainable mineral resource company for the future. So all in all, we're in a great position to capture the potential that our strategy has laid out, over the next few months. And we're really looking forward to accelerating our programs through 2021. Dr. Allen Alper:Well, that's great, having the support of shareholders and companies that have a long position in your Company and are willing to support you as you move along and develop the project.Sam Lee:Indeed. Thank you.Dr. Allen Alper:Sam, could you tell our readers/investors the primary reasons they should consider investing in Northisle Copper and Gold?Sam Lee:You bet. The timing is now, Al. In my opinion, all of the exciting things I have spoken about have not been accurately reflected in our valuation. There aretwo primary methodologies used to value a company of our nature. That's price to net asset value (P/NAV) and EV/Resource ($/Ounce). On both metrics we are significantly undervalued, which gives me great confidence in my decision to join the Company in October and buy in at $0.12, $0.13, $0.24, and the most recent offering at $0.26. Several other members of our team have been buying shares as well.

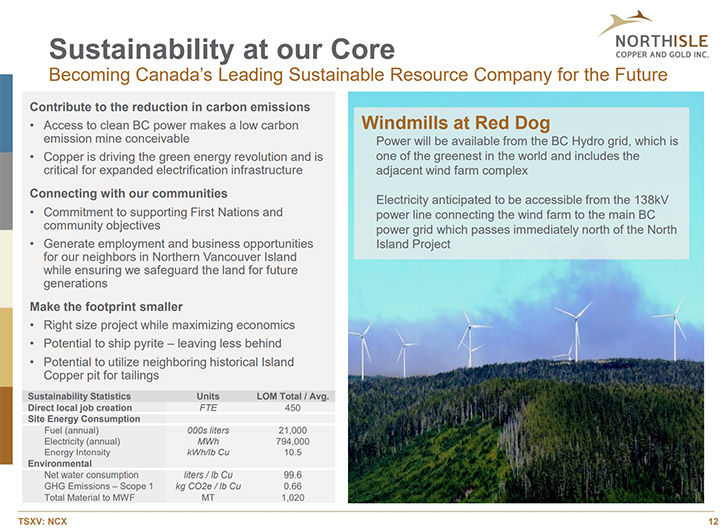

Dr. Allen Alper:Well, that's great, having the support of shareholders and companies that have a long position in your Company and are willing to support you as you move along and develop the project.Sam Lee:Indeed. Thank you.Dr. Allen Alper:Sam, could you tell our readers/investors the primary reasons they should consider investing in Northisle Copper and Gold?Sam Lee:You bet. The timing is now, Al. In my opinion, all of the exciting things I have spoken about have not been accurately reflected in our valuation. There aretwo primary methodologies used to value a company of our nature. That's price to net asset value (P/NAV) and EV/Resource ($/Ounce). On both metrics we are significantly undervalued, which gives me great confidence in my decision to join the Company in October and buy in at $0.12, $0.13, $0.24, and the most recent offering at $0.26. Several other members of our team have been buying shares as well.  The other takeaway I would leave you with is that with our meaningful resource and potential production profile, with moderate capital intensity, we have multiple strategic options ranging from developing the project ourselves to attracting the attention of a project partner. This project is not too big and not too small, the size is just right.I do think that this option value is critical, as we embark on the path to what I believe is the next copper super-cycle. The other really important thing to understand about us is that sustainability is at our core. Our mission, as I mentioned before, is being Canada's leading sustainable resource company for the future. I believe that we might be one of the only mine development companies in the world who has put such an intense focus on the sustainability of our operations at an early stage. That to me is a very important element. If your belief is authentic, then the chances of success is much higher.We have put some metrics in our press release around some high-level benchmarking on sustainability. It's obviously not where we are going to end up with our project. It provides us with a starting place for us to consider how to reduce the impact of the development of this project further. We do have an opportunity in BC to consider the development of a truly low carbon impact mine. In addition, the copper obviously is critical for the wave of electrification that will need to happen in order to support the rollout of worldwide electric vehicle fleets that are clearly well advanced now.

The other takeaway I would leave you with is that with our meaningful resource and potential production profile, with moderate capital intensity, we have multiple strategic options ranging from developing the project ourselves to attracting the attention of a project partner. This project is not too big and not too small, the size is just right.I do think that this option value is critical, as we embark on the path to what I believe is the next copper super-cycle. The other really important thing to understand about us is that sustainability is at our core. Our mission, as I mentioned before, is being Canada's leading sustainable resource company for the future. I believe that we might be one of the only mine development companies in the world who has put such an intense focus on the sustainability of our operations at an early stage. That to me is a very important element. If your belief is authentic, then the chances of success is much higher.We have put some metrics in our press release around some high-level benchmarking on sustainability. It's obviously not where we are going to end up with our project. It provides us with a starting place for us to consider how to reduce the impact of the development of this project further. We do have an opportunity in BC to consider the development of a truly low carbon impact mine. In addition, the copper obviously is critical for the wave of electrification that will need to happen in order to support the rollout of worldwide electric vehicle fleets that are clearly well advanced now. In addition, we want to connect with our communities, by ensuring that we will work to support First Nations, local community and stakeholder objectives. Our project, as currently conceived, could employ over 450 people on a direct basis and would have a significant further impact on an indirect basis. Finally, we have several options to reduce our impact further. This includes considering the historical Island Copper Pit Lake for tailing storage, reusing the existing foreshore site and considering the sale of a pyrite concentrate, should the market conditions support this. We're very happy about our intentions around making this one of the most sustainable mines in Canada, if not the world.I'm also very enthusiastic about our exploration program. In 2021, we will focus on two main concepts. In the near term we're commencing an exploration drilling program at Pemberton Hills, of which we recently regained 100%. Pemberton is this target that effectively spans over three and a half by one and a half kilometers of intensely altered lithocap. The program is focused on using the great foundational work completed over the past several years to drill what we believe has the potential to be a very significant copper-gold porphyry system. The second part of our exploration program revolves around improving and increasing confidence in the resources for the North Island Project. We're targeting prospective areas at Red Dog, Northwest Expo, and Hushamu, in close proximity to the existing resources, which have the potential to expand our North Island Project resources significantly.Dr. Allen Alper:Well, those are very compelling reasons for our readers/investors to consider investing in Northisle Copper and Gold. It sounds like you have a great team, great projects, in a great location, and management has a great understanding of stakeholders and community, of protecting the environment and increasing sustainability.Sam Lee:I appreciate that, Allen. Thank you very much for picking that up. It is a very important component of our story and we're all very excited to see what the future brings and the number of attractive catalysts in 2021 for Northisle.Dr. Allen Alper:Well, it sounds like 2021 will be extremely exciting time for you and will be a time that you'll be publishing a lot of news releases on the results you're receiving, as you drill and explore.Sam Lee:I absolutely agree with that statement. Thanks.Dr. Allen Alper:Sam. Is there anything else you'd like to add?Sam Lee:No, I think we've covered the main points, thank you very much.Dr. Allen Alper:We'll publish your press releases as they come out so our readers/investors can follow your progress. https://www.northisle.ca/Nicholas Van Dyk, CFAVice President, Corporate Development and Investor RelationsTel: (778) 655-9582Email: info@northisle.ca

In addition, we want to connect with our communities, by ensuring that we will work to support First Nations, local community and stakeholder objectives. Our project, as currently conceived, could employ over 450 people on a direct basis and would have a significant further impact on an indirect basis. Finally, we have several options to reduce our impact further. This includes considering the historical Island Copper Pit Lake for tailing storage, reusing the existing foreshore site and considering the sale of a pyrite concentrate, should the market conditions support this. We're very happy about our intentions around making this one of the most sustainable mines in Canada, if not the world.I'm also very enthusiastic about our exploration program. In 2021, we will focus on two main concepts. In the near term we're commencing an exploration drilling program at Pemberton Hills, of which we recently regained 100%. Pemberton is this target that effectively spans over three and a half by one and a half kilometers of intensely altered lithocap. The program is focused on using the great foundational work completed over the past several years to drill what we believe has the potential to be a very significant copper-gold porphyry system. The second part of our exploration program revolves around improving and increasing confidence in the resources for the North Island Project. We're targeting prospective areas at Red Dog, Northwest Expo, and Hushamu, in close proximity to the existing resources, which have the potential to expand our North Island Project resources significantly.Dr. Allen Alper:Well, those are very compelling reasons for our readers/investors to consider investing in Northisle Copper and Gold. It sounds like you have a great team, great projects, in a great location, and management has a great understanding of stakeholders and community, of protecting the environment and increasing sustainability.Sam Lee:I appreciate that, Allen. Thank you very much for picking that up. It is a very important component of our story and we're all very excited to see what the future brings and the number of attractive catalysts in 2021 for Northisle.Dr. Allen Alper:Well, it sounds like 2021 will be extremely exciting time for you and will be a time that you'll be publishing a lot of news releases on the results you're receiving, as you drill and explore.Sam Lee:I absolutely agree with that statement. Thanks.Dr. Allen Alper:Sam. Is there anything else you'd like to add?Sam Lee:No, I think we've covered the main points, thank you very much.Dr. Allen Alper:We'll publish your press releases as they come out so our readers/investors can follow your progress. https://www.northisle.ca/Nicholas Van Dyk, CFAVice President, Corporate Development and Investor RelationsTel: (778) 655-9582Email: info@northisle.ca