Not-So-Awful News Concerning Gold

Gold got whacked Thursday as it so often does i.e., at the apex of a rally that may have encouraged a bullish thought or two in the minds of some investors.

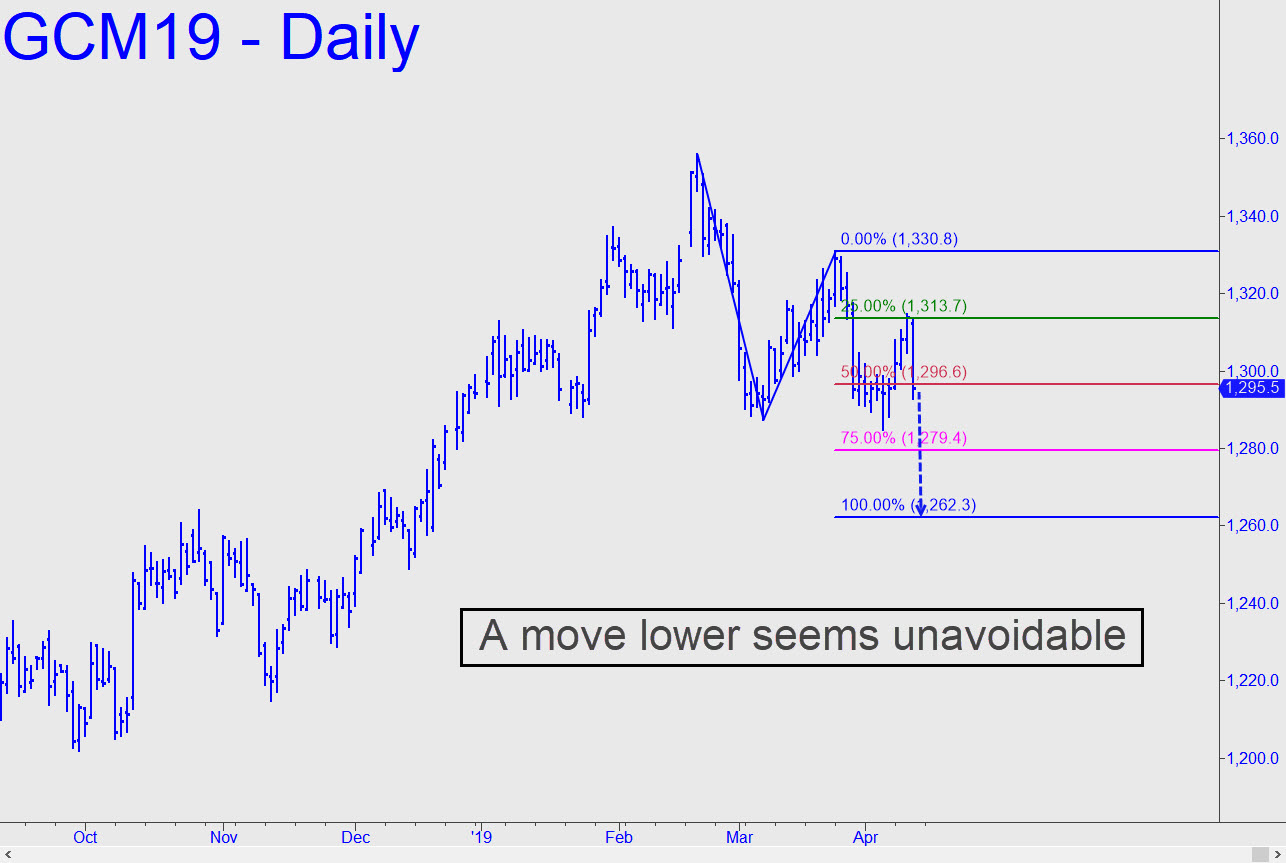

Alas, the worst selloff we've seen in well, it's actually been only two weeks socked the June contract with an $18 loss. In the accompanying chart, some might discern a head-and-shoulders kinda thing going on in the ups and downs of 2019. If you're believer in these patterns and I am not, since they are everywhere one wants to see them they imply that a downdraft is coming that could take the futures down to as low as 1220. If it's any consolation, that would not be much of a victory for bears (aka the Bad Guys), since it would amount to a decline of less than 6%. For the time being, however, I'll suggest sticking with the 1262.70 target that has obtained for the last two weeks. It is my minimum downside objective and worth bottom-fishing. There's a chance bulls could find some gumption at 1279.40, the pattern's 'secondary Hidden Pivot support.

Click here for a free two-week trial subscription that will give you access to all paid features and services of Rick's Picks, including daily, actionable trading recommendations and a ringside seat in a 24/7 chat room that draws veteran traders from around the world.