Nothing To Commend Gold But Fear

Gold is still without support from its main allies, silver and oil.

Mining stocks also remain in a malaise, which isn't helping the metal.

A dollar index reversal would divert safe-haven demand into gold.

Gold investors are biting their nails right now over gold's inability to rally in the face of widespread fears. Normally the yellow metal would be in full-blown bullish mode with as much uncertainty as there is now over U.S.-China trade and Brexit. Yet gold prices have been uncharacteristically subdued despite these worries in the last few weeks. In today's report I'll make the case that while a near-term gold rally can't be ruled out, until demand for gold's "sister" and "cousin" commodities revives, any gold rallies from here are likely to be short-lived.

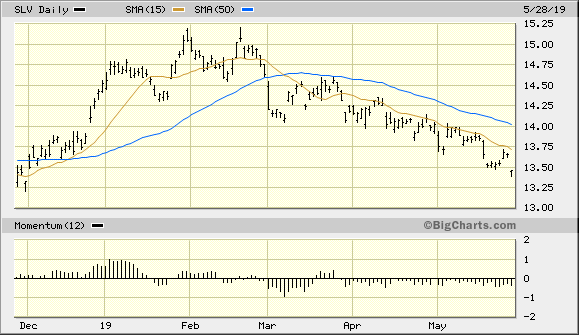

As recently as February, gold enjoyed the support of several of its nearest allies, including crude oil, silver and copper. Now, however, gold has been reduced to relying solely on the "fear factor" to keep its dwindling rally hopes alive. Among the commodities which have typically confirmed gold's near-term strength, silver is arguably the most important. And right now the white metal has been on a conspicuous downward slide.

Shown here is the 6-month daily graph of the iShares Silver Trust (SLV), a useful proxy for the silver price. At no time in the last three months has SLV managed to get above its psychologically significant 50-day moving average (blue line). What's more, the silver ETF has been unable to even overcome its downward-sloping 15-day MA since March. That's truly a sign that silver has been under the complete control of the sellers. It's worth pointing out that in the past, a weak silver price trend has often served as a precursor to gold price weakness.

Source: BigCharts

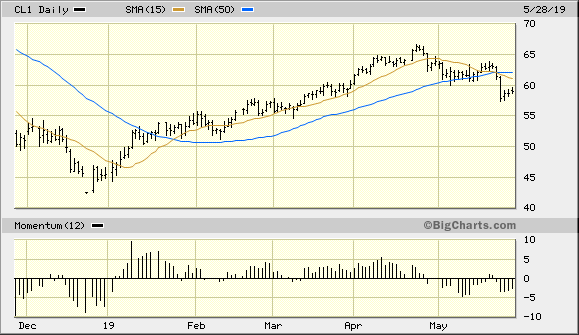

Then there is the crude oil price to consider. While oil has no direct bearing on the yellow metal, the short-to-intermediate-term performance of the crude oil price is an important reflection of the underlying demand for inflation-sensitive commodities in general. Historically, whenever the oil price is unusually strong, gold benefits from the knock-on effect of fund managers increasing their exposure to the commodities market. This is especially true when oil's strength is largely due to a weakening U.S. dollar. However, in recent weeks the performance of the oil price has been disappointing in the face of a strong dollar. Below is the cash crude oil price graph for illustration purposes.

Source: BigCharts

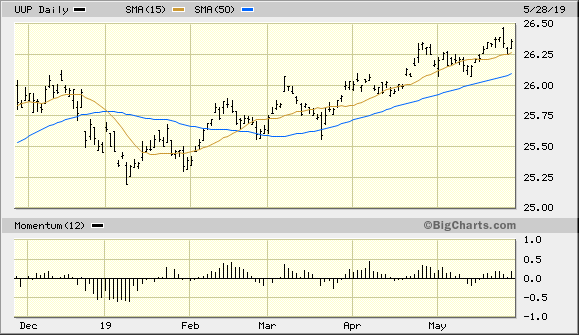

Speaking of the dollar, the greenback has steadfastly maintained its rising trajectory since January. The Invesco DB U.S. Dollar Index Bullish Fund (UUP) illustrates the dollar's relentless strength in the face of a weakening global trade outlook. As investors increasingly worry over the health of China's export-driven economy and the potential for an all-out trade war, the dollar has benefited from the resulting flight to safety. Investors in Asian countries especially have liquidated investments and have parked their cash in the U.S. dollar in the belief that the U.S. offers the most stability and the best returns on capital in an otherwise volatile global financial market. This belief has clearly helped buoy the greenback, and it should also continue supporting the dollar in the months to come.

Source: BigCharts

As I've emphasized in recent reports, a strong dollar is the biggest obstacle to a sustainable gold rally right now. I argue that a sizable move in the dollar index, in which the 50-day moving average is decisively violated on a weekly closing basis, would change gold's near-term fortunes for the better. Indeed, a weaker dollar would boost gold's currency component and allow the metal to commence a rally. Fear is ubiquitous enough among the world's investors to where a notable setback in the dollar index would likely turn their attention to the nearest major safe have asset, namely gold. But as long as the dollar is trending higher, the greenback enjoys an advantage over gold in terms of attracting flight capital.

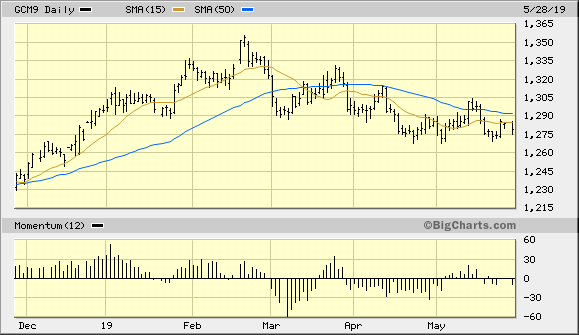

The next chart exhibit displays the performance of the June gold futures price since last December. As the chart shows, gold has been unable to close above its 50-day moving average on a weekly basis since March. That's an unusually long stretch of relative weakness (compared to other safe-haven assets) for gold. Right now, in fact, virtually every other safety asset is outperforming gold. This includes the dollar, U.S. Treasury bonds, and U.S. utility stocks. On a short-term basis, even the Japanese Yen currency is outperforming gold. This underscores the unattractiveness of the yellow metal in the light of a strong U.S. dollar.

Source: BigCharts

Earlier this month, gold showed promise in trying to reverse its multi-month relative weakness position versus the S&P 500 Index (SPX). Yet despite an initial rally in the gold:SPX ratio (below), the ratio has since stalled out as gold remains in a weak position compared with equities. Ideally, gold's relative strength versus the S&P should make a series of higher highs and higher lows in order to confirm that the climate is ripe for buying gold. When gold outperforms stocks, it tends to attract the notice of institutional investors and thereby increase demand for the metal.

Source: StockCharts

Source: StockCharts

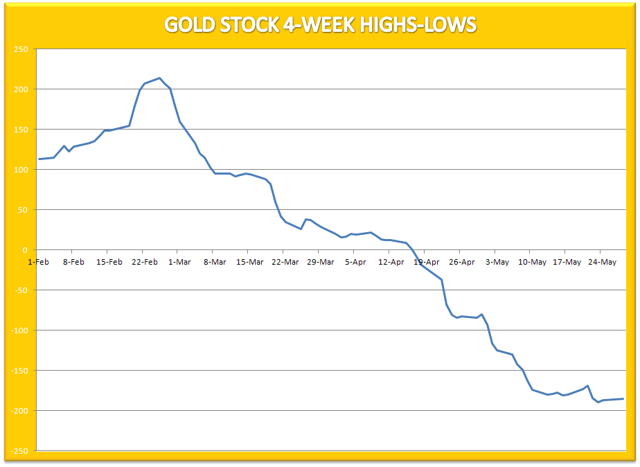

It should also be noted that the demand for gold mining stocks remains muted as of the last week of May. Rising gold stock prices are a strong indication that smart investors anticipate strength ahead for the physical metal. Since investors like the leverage that gold stocks afford, it stands to reason that strength in the gold price should always be accompanied by strength in the PHLX Gold/Silver Index (XAU), which is the benchmark for U.S.-listed precious metals mining stocks. Right now the XAU hangs precariously above its lowest level since December 2018.

Meanwhile, the internal profile for the 50 most actively traded gold stocks remains weak. Shown here is the 4-week rate of change (momentum) of the new highs and new lows in the 50 most actively traded gold stocks. As you can see here, the trend of this indicator remains down. I use the new highs and lows to gauge the overall demand for equities, and with the demand for gold stocks evidently in decline, the path of least resistance for gold stocks in the near term is still down. Until this indicator reverses its decline, investors should avoid new commitments to the gold stocks for now.

Source: NYSE

In summary, gold has little to commend itself to potential buyers right now. The only major factor in its favor in the immediate term is fear, namely the uncertainty arising over the U.S.-China trade war and various geopolitical concerns. Even this fear has barely budged gold prices in the last few weeks as investors have favored other safe-haven assets over the metal. What is needed to reverse gold's malaise is a sharp pullback in the U.S. dollar index along with a corresponding strengthening of the inflation-sensitive commodities, including most notably silver and oil. Until that happens, I recommend that investors favor cash over gold and hold off on making new commitments in the yellow metal.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts