Old Man Winter Will Stimulate Natural Gas and Heating Oil Demand / Commodities / Natural Gas

Happy new year, everyone! We hope that2022 will be a prosperous one for all our readers. However, will it besuccessful for oil?

EnergyMarket Updates

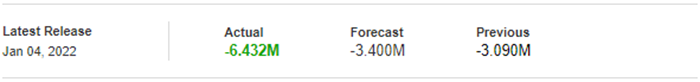

Yesterday, crude oil prices ended higher,after a volatile session as US inventories fell by 6.4 million barrels – morethan twice the previous week – which is another positive sign for demand.

US inventories levels of crude oil,gasoline, and distillates stocks are again forecasted to fall by about 3million more than expected last week. That would be another significant declineon the back of greater demand, according to estimated figures released by theAmerican Petroleum Institute (API) yesterday.

(Source: Investing.com)

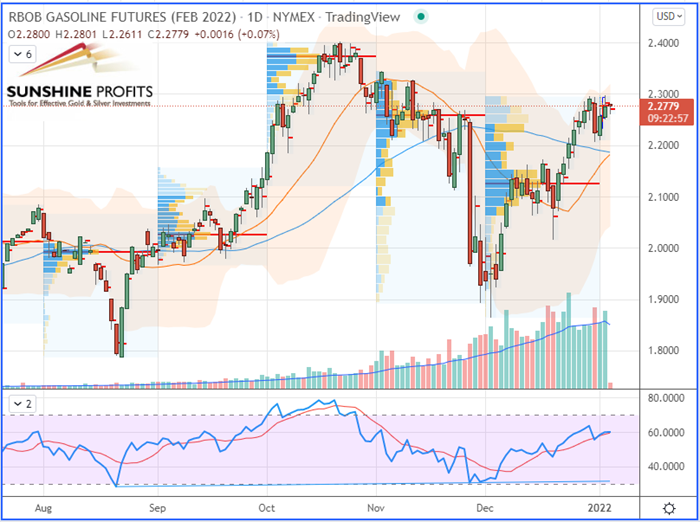

Crude oil prices stabilized near their6-week highs following the OPEC+ group meeting, which maintained a limitedincrease in production of 400k barrels/day (no surprise). It is therefore amatter of maintaining an increase in production for the seventh consecutivemonth.

This also shows that the organization wasconfident and believed in the resistance of global oil demand despite therecent restrictions implemented by several governments scared by Omicron, eventhough those travel restrictions may likely delay the resumption of aviationdemand.

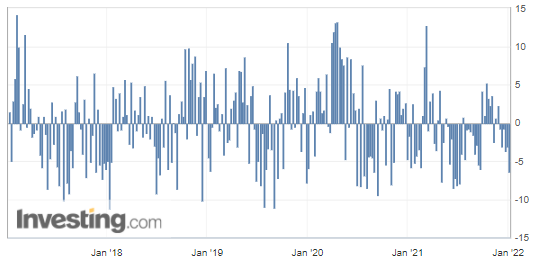

RBOB Gasoline (RBG22) Futures (Februarycontract, daily chart)

WTI Crude Oil (CLG22) Futures (Februarycontract, daily chart)

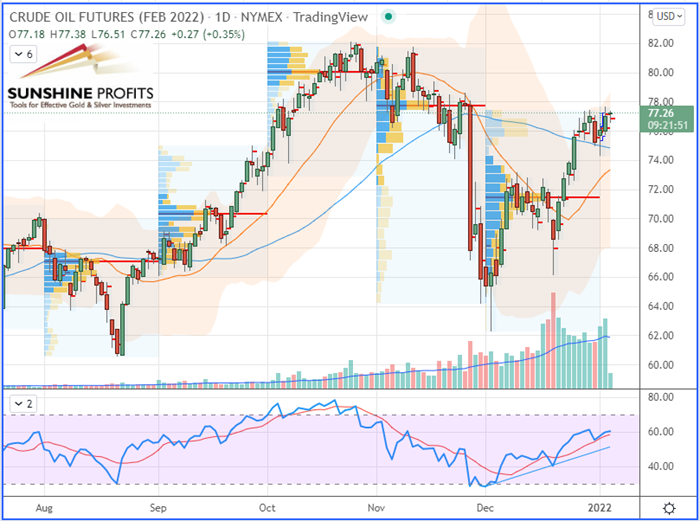

Regarding natural gas, the Henry Hub (USbenchmark) is slowly climbing as temperatures are dropping in many regions,while the European benchmark, the Dutch Title Transfer Facility (TTF), rallied3.5% as European gas prices remain extremely volatile due to reduced exportsfrom Russia (notably via the Yamal pipeline) but also via Ukraine.

The upward momentum is also linked toweather forecasts, such as colder temperatures and frost encountering theEuropean continent in the coming days and weeks, which may obviously have astimulating effect on gas demand.

Henry Hub Natural Gas (NGG22) Futures(February contract, daily chart)

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.