Old Nova Scotia tin mine could resume production in a few years

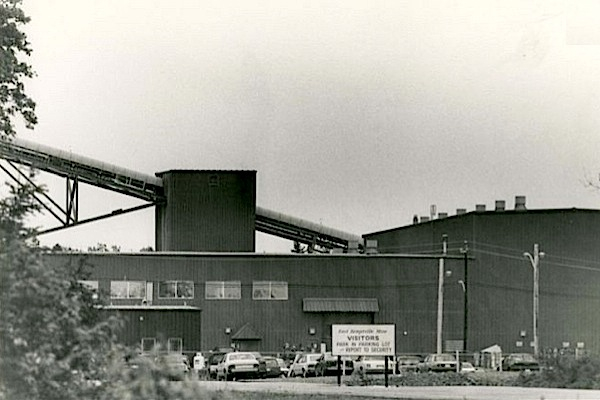

The Rio Algom mine closed in 1992. The pit - 1.5 kilometres long, 0.5 km wide and 60 metres deep - was then flooded, with runoff directed to a tailings pond for treatment. (Image by Fred A. Hatfield | Flickr Commons)

Canada's Avalon Rare Metals (TSX:AVL), until now mostly known for its incursion in the rare earths market, says it's quite advanced on a $1.3 million work program in South-western Nova Scotia aimed to reopen a historic tin-indium mine.

The Toronto-based miner was granted a special licence by the province in March of this year for the East Kemptville Mine formerly owned by Rio Algom, and located about 45 kilometres northeast of Yarmouth.

In a market update this week, Avalon said drilling on the former mine has been progressing steadily and that results have been in line with expectations. It added that the site access agreement for Avalon has been extended until Nov. 30 to complete the 2015 work program.

Next major step will be the publication of the Preliminary Economic Assessment, expected by the end of the month.

Meanwhile, discussions continue towards transitioning full title of the property to the company and the parties have said they hope to conclude an agreement by year-end.

The Rio Algom tin mine in East Kemptville operated in the area from the mid-1980s to 1992, employing 200 people from Yarmouth and Shelburne counties. At the time, it was North America's only open-pit tin mine, but it had to close after prices for the metal dropped to levels reaching well below US$3 per pound.

And while the metal used in electronics and packaging is now trading at more than double the price that caused the mine closure, it is down more than 20% so far this year, which makes it the worst performing industrial metal on the London Metal Exchange.

Analysts are, as expected, not very optimistic about the short-term outlook for it. Steve Hardcastle, head of client services for industrial commodities at Sucden Financial Ltd. in London, is one of them. In June, he told Bloomberg that tin prices were set for the biggest first-half decline in 25 years because of abundant supplies and weak demand.

"The long-term future for tin is not brilliant, and it's been reflected in the price," Hardcastle said. "The big unknown 18 months ago was Myanmar, which is now filling the gap."

Project geologist Derek Thomas and geology student Jason Willson study ore from the East Kemptville tin-indium project. (Image courtesy of Avalon Rare Metals )

But there is potential. Unlike the major base metals, little new tin production capacity has come on-stream over the past 10 years during the commodities super-cycle. Tin inventories remain low and many industry analysts believe tin prices will rise in the absence of significant new supply.

In addition, some tin supplies originating in Central Africa are now designated as conflict minerals, which preclude their use by consumers in the U.S. and European Union under legislation restricting the use of minerals produced to finance armed conflict. So new supplies from non-conflict areas, such as Canada, should be welcomed by the electronics sector.

If everything goes as planned, Avalon expects to have the mine running again in about three to four years.

Other than the East Kemptville project, Avalon Rare Metals has projects underway in Separation Rapids near Kenora, Ontario and Nechalacho, Thor Lake, in the North West Territories.