One Big, Potential Catalyst for Gold in 2018 / Commodities / Gold and Silver Stocks 2018

The rebound in the precious metals sectorcontinues. Friday, Gold pushed to another new high, near $1340/oz. Gold stocksled by the HUI Gold Bugs Index and GDX also made a new high with juniors andSilver right behind. The greatest traders say the move comes first and then thereason later. When it comes to Gold we are always analyzing the reason behindthe moves so we can distinguish between reactions and reflex moves and thosemoves that are part of a real bull market. The market may be starting to sniff outa potential big catalyst for Gold that could drive its breakout in 2018.

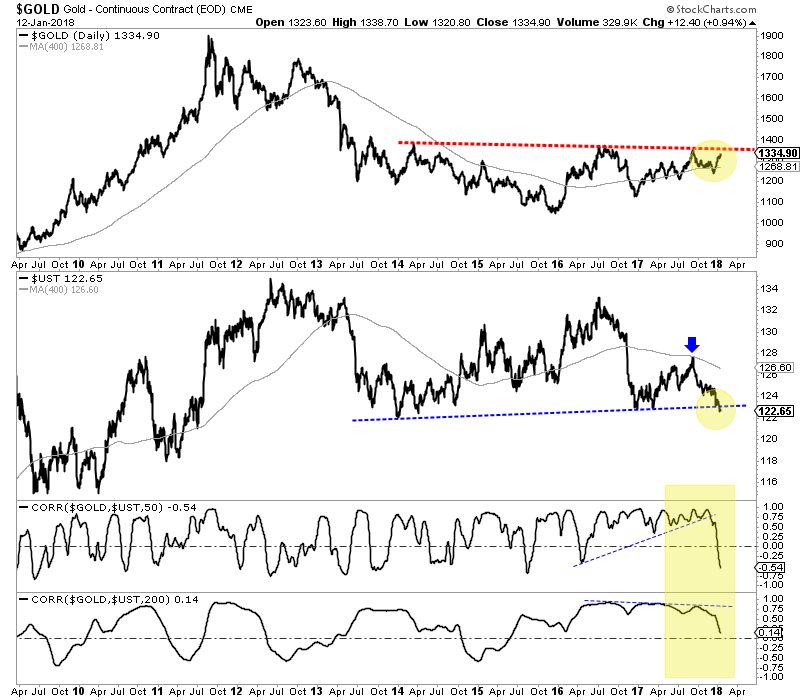

With respect to Gold and Bonds an importantchange has taken place in recent months. The two asset classes had beenpositively correlated. When rates declined, Gold moved higher. When ratesrebounded, Gold struggled. That is what happens when inflation is low and nottrending. However, now we see long-term Bonds (specifically the 10-year Bond)moving towards a breakdown while Gold is not far from a breakout. Look at therolling 50-day and 200-day correlations at the bottom of the chart.

As we’ve written in the past, higher long-termyields are bullish when they rise faster than short-term yields. That is asteepening of the yield curve and indication of inflation.

At present, higher long-term rates could helpbid Gold in a few different ways. First, for those who are seeking income theyenhance the appeal of bonds relative to stocks. Second and more importantly,higher long-term rates will hurt what is an over-indebted economy andgovernment at somepoint. Debt payments rise. Credit growth can slow. Thethreshold of that remains to be seen. Perhaps it could be 3.00% on the 10-yearyield.

It is counterintuitive but upward pressure onlong-term rates can be very bullish for Gold (in the present environment) as itnecessitates the need for lower or stable long-term rates (amid an inflationaryenvironment). It all comes back to debt. At somepoint rising rates negativelyimpact the economy and the government’s balance sheet. If that creates the needfor central bank intervention and monetization while inflation is running thenthat is what can push Gold to $2000-$3000/oz in the next several years.

The looming, potential breakdown in long-term Bondscould be a major catalyst for the breakout in precious metals. Don’t wait toolong, as gold stocks remain historically and incredibly cheap. Select junior miners and explorers have the chance to be 5-10 baggers if Goldbreaks resistance and trends towards its 2011 high. We seek the juniors thatare trading at reasonable values but have fundamental and technical catalyststhat will drive increased buying.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.