One Gold Producer Poised For Outperformance In A Gold Bull Market

Detour Gold (DRGDF) should produce outsized returns in a rising gold price environment.

The company's high "gold beta" provides gold price leverage.

At today's gold price and FX rates, Detour Gold is poised for 20%+ returns.

Investment Thesis:

A handful of GDX producers have returns that are exceptionally sensitive to the gold price. We prioritize one company, Detour Gold (OTCPK:DRGDF), that should outperform the broader gold market in a rising gold price environment. We follow up with a deep dive into the company's fundamentals.

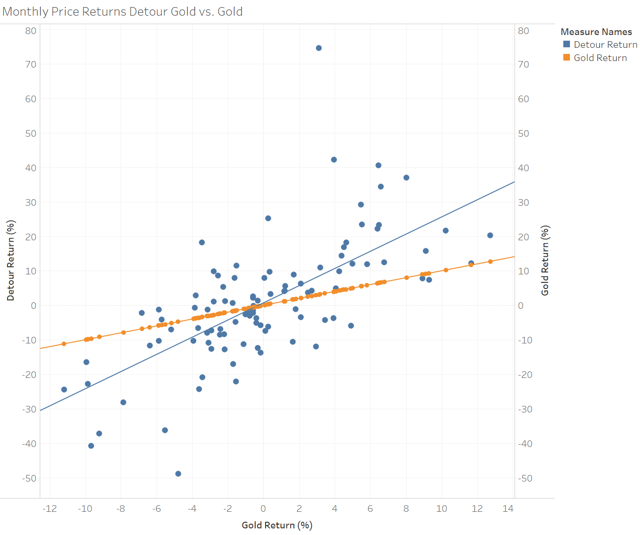

Gold Beta:

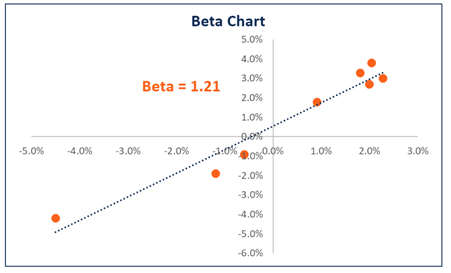

Most people in the finance industry have heard of the term "beta." Beta is a foundational aspect of the capital asset pricing model. Generally, beta reflects the historic relationship between a stock's return and the investible market. As an example of its application, if a company's beta is 1.2 we'd expect it to return 12% when the S&P500 returns 10%. This is a simplified example but reflects the way this tool is used in the finance industry.

So why should we care about beta when thinking about gold mining investments and how does this relate to our thesis? Well, the concept of beta can extend beyond its traditional use. We can use the concept to model a "gold beta." Gold beta, unlike its traditional counterpart, relates gold miner returns to changes in the gold price. Obviously, this information is backward-looking, but it is generally used as a proxy for future outcomes.

If we believe that gold prices will continue their YTD bullish trend, then we should maximize our returns by allocating our capital to stocks with the highest "gold beta."

The Data and the Results:

We use 102 monthly return data points for GDX producers and compare this information to the monthly return for gold to calculate the gold beta.

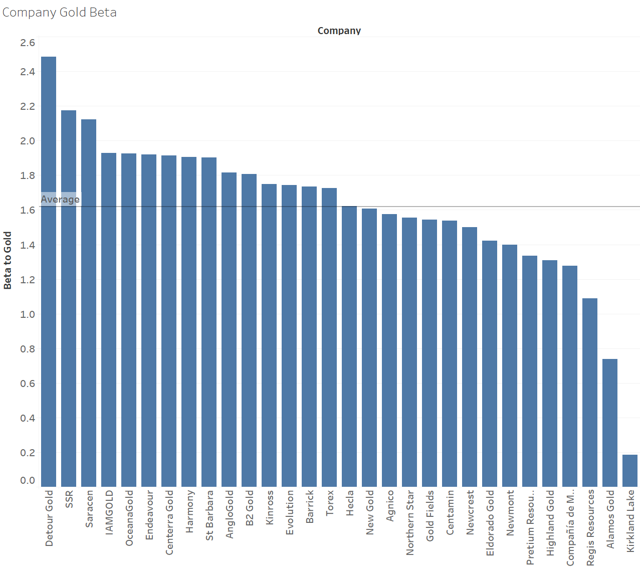

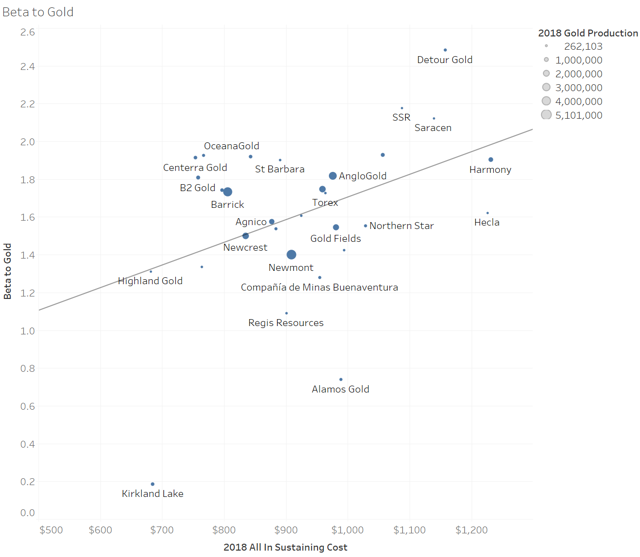

The chart shows 3 companies that have significantly higher gold betas than the GDX average (Detour Gold (OTCPK:DRGDF), Silver Standard Mining (SSRM), and IAMGOLD (IAG); I've ignored the Australian producer Saracen). In trying to understand what influences gold beta, we've regressed beta against company average production costs for 2018. The intuition here is that higher cost producers should have stock prices that are more sensitive to the gold price.

The chart shows 3 companies that have significantly higher gold betas than the GDX average (Detour Gold (OTCPK:DRGDF), Silver Standard Mining (SSRM), and IAMGOLD (IAG); I've ignored the Australian producer Saracen). In trying to understand what influences gold beta, we've regressed beta against company average production costs for 2018. The intuition here is that higher cost producers should have stock prices that are more sensitive to the gold price.

Note that our hypothesis is validated by the data. At the extremes, the lowest cost gold miner, Kirkland Lake (KL), has a stock price that has the lowest beta to gold. At the other extreme, Detour Gold, a high-cost producer, has the most leverage to the gold price.

Note that our hypothesis is validated by the data. At the extremes, the lowest cost gold miner, Kirkland Lake (KL), has a stock price that has the lowest beta to gold. At the other extreme, Detour Gold, a high-cost producer, has the most leverage to the gold price.

Tying This Back to the Investment Thesis:

So why does this matter? Well, our thesis aims to identify stocks that are sensitive to the gold price. This data points us in the right direction of companies to focus fundamental research on. The arrows point towards Detour Gold.

A Fundamental Assessment of Our Top Pick:

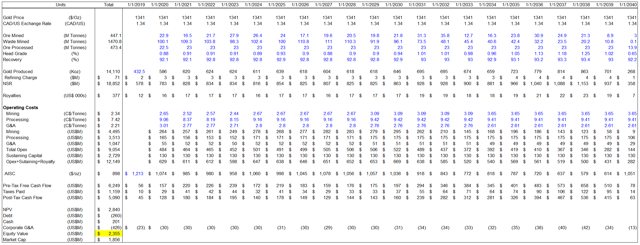

In a previous article, I completed a brief summary that dove into the positive impacts associated with a higher gold price / weaker Canadian dollar on Detour Gold's valuation. I've expanded this assessment and completed a bottoms-up assessment of the company. The table below shows a cash flow projection from 2019 through 2040; the length of the Detour Lake Life-of-Mine plan.

On that note, I've made a handful of assumptions in the process of creating this fundament assessment. Gold production is taken directly from the 2018 technical report which can be found on sedar. Operating costs, royalties, and operating parameters are also from the technical report. I've assumed a 19% effective tax rate as this reflects the difference between pre and post-tax NPV that was described in the 2018 report. Corporate G&A is based on 2018 actuals and scales based on yearly gold production. This assessment produced an equity valuation of $2.35B. This assessment corroborates my stance that Detour Gold could see a 20-30% price increase based on fundamental value.

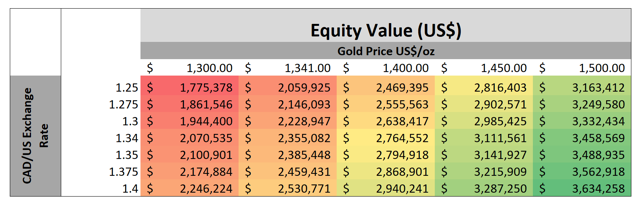

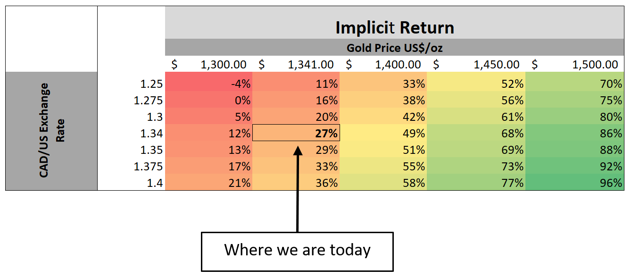

Detour Gold's company value as a function of gold price and CAD/US exchange rate is as follows:

As a reminder, Detour's current market capitalization is $1.865B. The return matrix shows the return potential as follows:

So based on a $1,341 gold price, and 1.34:1 CAD/US exchange rate, Detour is valued at $2.355B; a 27% upside from today's prices. Now you could make the case that Detour should trade a discount to this value and you'd probably be right. There are, however, other factors to consider in Detour's valuation. The first is the value of their other assets that are not considered as part of this analysis.

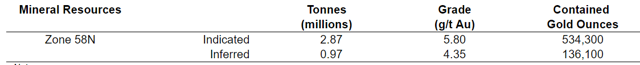

Just south of the Detour Lake pit is an underground resource of 700K oz. This ore source could provide incremental feed for the mill and could represent a low-capex option for increasing production.

In addition, the Detour Lake pit contains an additional 3M oz of measured and indicated resource that is not included in this assessment.

Company-Specific Risks:

While I believe this opportunity is particularly interesting. Detour has some idiosyncratic risks that need to be considered as part of any investment.

Detour is a single asset company that has experienced issues achieving targets in the past so these estimates should be viewed with that in mind. This assessment also assumes that gold prices will remain at their elevated levels, the mine plan will be executed as per plan, and that the Canadian dollar remains weak. Readers should also be cognizant of the fact that this is mining. Pit walls can fail, people can get hurt, and mines can get shut down for a plethora of reasons.

Conclusion:

Our assessment highlighted Detour Gold (OTCPK:DRGDF) as having a high "gold beta." In a rising gold price environment, this factor can be viewed as a large positive for the company. We performed a fundamental, bottoms-up, assessment of Detour Gold and see a 20%+ upside from current price levels.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow Resource Skeptic and get email alerts