One More Bounce for the Gold Price / Commodities / Gold and Silver 2018

You know by now that I think gold is above all acommodity, and in a bubble that was more extreme than stocks… a bubble that’s beenbursting since September 2011, but…

You know by now that I think gold is above all acommodity, and in a bubble that was more extreme than stocks… a bubble that’s beenbursting since September 2011, but…

Gold and bitcoin are two examples ofbubbles bursting that are NOT following my bubble model as well as most. Both,thus far, are basing out at higher levels than I expected.

I still see gold moving substantiallylower – to at least the $700 per ounce mark that it crashed into in 2008 – whenthe next global crash sets in. At worst it could crash towards its bubbleorigin in mid-2005, around $400. At that point it would be the best buy since2000-2005, with the 30-year Commodity Cycle to follow into 2038-2040.

I’ve already warned that gold was due tofall further when it broke a key trend line back in early June… and it fellover $100 since.

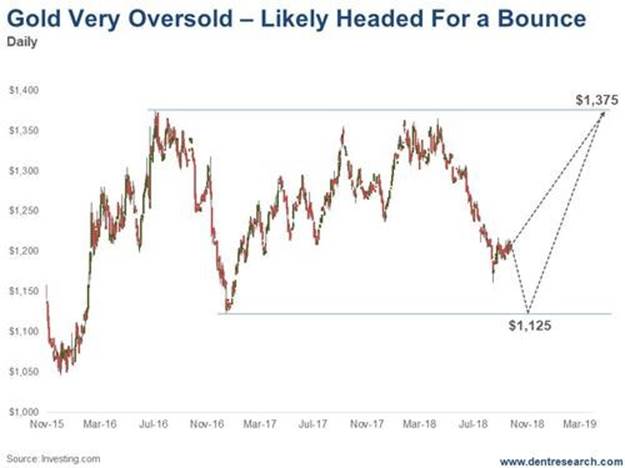

But now it’s getting extremelyoversold, asLee Lowell noted in TheRich Investor last Thursday.Gold is due for a significant bounce again, but likely after one more move downto stronger support around $1,125. That’s why Lee showed two ways to play thisbounce in the next several months using options.

So, here’s the two most likely scenarioswe’ll see in gold ahead…

Most likely, gold willhead down one more time. That would likely be stimulated by a rise in thedollar again, which has retreated from 107 down to 103 near support while stillclearly in a more bullish trend.

Gold’s strongest support would be at the December 2016 lowaround $1,125. At that point it would be severely oversold. Then we could see abounce back to recent highs of $1,375, and possibly a bit higher to $1,400 orso. That would complete its bear market rally back from $1,150 in December2015. (A while back I warned we would see this rally, despite being bearish ongold.)

This will give investors interested in gold one more chance toprofit by buying near term. Orplaying options, as Lee suggests.

It will give long-term holders of the precious metal one morechance to sell or lighten their gold portfolio before the larger bear markettrend towards $700 or lower resumes.

If gold does head back to around $1,125, prepare for amulti-month move up.

If it instead heads back above $1,230, then you can ride thegold train on its way up for a few months or so.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2018 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.