Option Bear Bets on More Downside for Oversold WWE

WWE shares have been crushed in the second half of 2019

WWE shares have been crushed in the second half of 2019

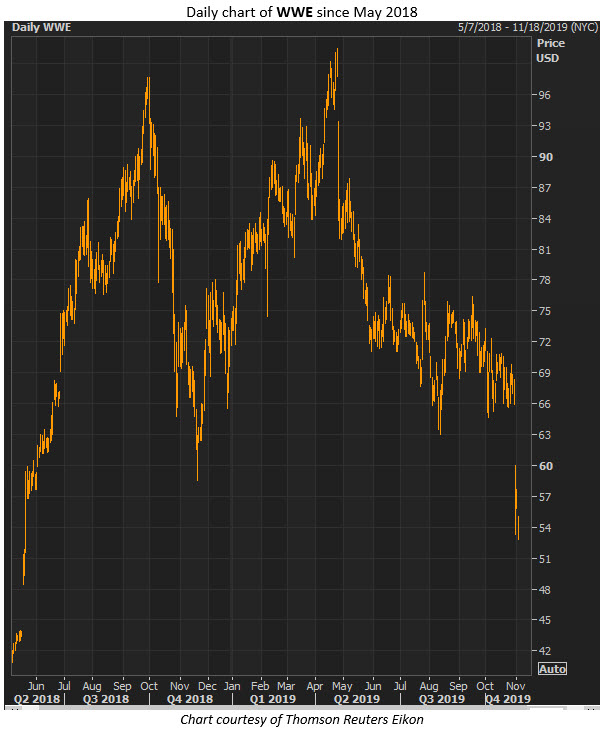

World Wrestling Entertainment, Inc. (NYSE:WWE) stock has been selling off since its peak above $100 back in April, including last week's bear gap from the $66 regionto below $57, and today the shares are adding to these woes. The stock is trading down 3% at $54.27, after Wells Fargo cut its price target to $80 from $94 and said the company has lost some credibility among investors. In response to the losses, options trading has picked up on WWE.

Put volume was last seen running at six times the expected pace, driven by new positions opening at the January 2020 50-strike put. These contracts crossed concurrently with closing activity at the November 65 put, suggesting one bear is rolling down his or her position to bet on more downside for the shares.

Still, near-term options traders were very call-skewed coming into today, based on WWE's Schaeffer's put/call open interest ratio (SOIR) of 0.29. This reading ranks in the 9th annual percentile, showing such a focus on calls is rare. Of note, there are roughly 4,900 positions open at the December 60 call.

The stock was already in oversold territory, based on its 14-day Relative Strength Index (RSI) of 26, and just today hit a new annual low of $52.83. Traders should monitor how WWE performs around the $50 region, since this was the site of a massive bull gap last year.