Options Bears Blast Johnson & Johnson After Baby Powder Recall

The FDA found traces of asbestos in the company's baby powder product

The FDA found traces of asbestos in the company's baby powder product

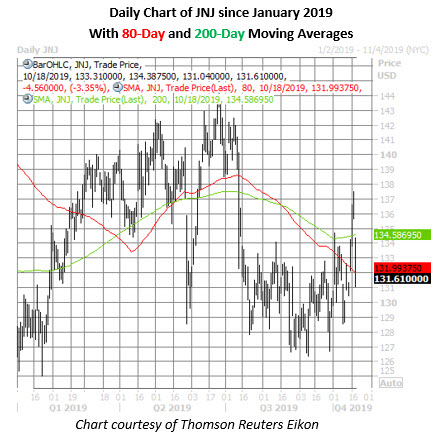

Johnson & Johnson (NYSE:JNJ) is the worst stock on the Dow this morning -- down 3.4% at $131.61, after the consumer products giant recalled a single lot of Baby Powder in the U.S. after the Food and Drug Administration (FDA) found traces of asbestos in a tested sample. This is the latest in a string of talc-related headaches for JNJ, with the shares suffering their worst day in years last December when reports suggested the company knew about asbestos in its baby powder products.

Today's drop has the stock paring most of its post-earnings gains, and has speculative players flooding into JNJ's options pits. Already today, more than 40,000 options have changed hands, six times what's typically seen, and volume pacing in the 99th annual percentile.

Most of the action has occurred on the put side, with day traders likely buying to open the October 132 puts -- targeting more downside through front-month expiration at tonight's close. Longer-term bears may be purchasing new positions at the December 130 put for a volume-weighted average price of $3.22. If this is the case, breakeven for the put buyers at December options expiration is $126.78 (strike less premium paid).

Today's put-skewed session marks a change of pace for JNJ options traders. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day call/put volume ratio of 1.47 registers in the 72nd annual percentile, meaning puts have been bought to open over calls at an accelerated clip.

Looking closer at the charts, JNJ had been chopping higher after finding a floor near $127 in late August and September. In fact, the shares topped out at an intraday high of $137.49 yesterday, their loftiest perch since a mid-July bear gap. Today's drop puts the stock back below its 80-day and 200-day moving averages, though its year-to-date breakeven mark near $129 could emerge as support.