Options Bears Rush NTAP Ahead of Earnings

NetApp will report its fiscal second-quarter earnings after the close today

NetApp will report its fiscal second-quarter earnings after the close today

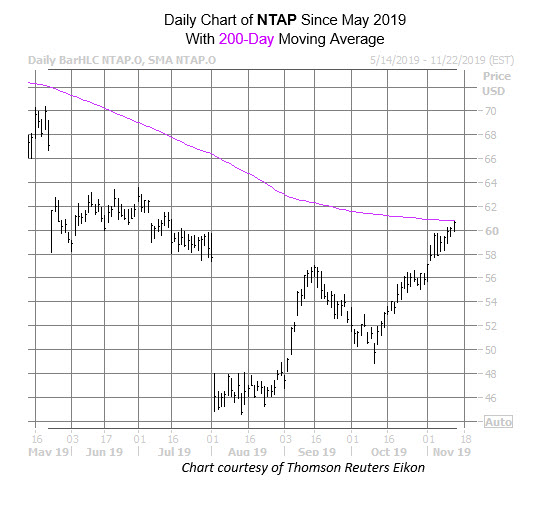

The shares of cloud software concern NetApp Inc. (NASDAQ:NTAP) are eyeing their fourth consecutive win today, inching up 0.9% to trade at $60.68 ahead of the firm's fiscal second-quarter earnings report, due out after the close tonight. Since staging a bounce off its one-month lows near the $49 region in mid-October, NTAP has climbed steadily higher to the tune of five straight weekly wins. Today, the equity is trading just above its year-to-date breakeven level, while squaring off with its 200-day moving average

Despite this recent upside, options bears are coming out in droves today. So far, more than 11,000 puts have exchanged hands -- three times what's typically seen at this point -- compared to 2,516 calls, which still doubles the intraday average. It looks as if most of today's activity is occurring at the November series, which expires at the close this Friday, with positions being opened at the 58- and 52.50- puts.

This bearish sentiment is more of the same for NTAP, though. In the last 10 days, 3.39 puts have been bought for every call on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio sits higher than 90% of all other readings from the past year, too, suggesting a healthier-than-usual appetite for puts of late.

Analyst sentiment has veered toward pessimism as well. Of the 18 in coverage, only three call NTAP a "buy," while 13 say "hold." What's more, the consensus 12-month price target of $54.37 is a 10.3% discount to current levels, which could inspire some post-earnings bull notes, should tonight's report go favorably.

Looking back at NTAP's last eight earnings reports, the stock tends to end lower the next day, with a massive 11.7% dip happening this time last year. It's November 2017 post-earnings return, however, was 15.9%. This time around, the options market is pricing in a 12.8% next-day swing, almost double the stocks 6.9%move averaged during the past two years.