Options Bulls Hold Out Hope for TSLA Stock

The analyst predicted an 8% drop in sales for Tesla's third-quarter

The analyst predicted an 8% drop in sales for Tesla's third-quarter

The shares of Tesla, Inc. (NASDAQ:TSLA) are down at midday, following a note from Cowen regarding the company's upcoming third-quarter deliveries report this week. Specifically, the analyst foresees a slight drop from TSLA's second-quarter numbers, predicting a sequential decline of 11% in Model 3 deliveries, with U.S. sales down 8% for the quarter. Cowen noted that even in the case of a delivery beat, investors reactions could be muted as they anticipate profitability potential, while a miss will likely mean even more downward pressure for the stock.

Caution over TSLA stock is nothing new for the brokerage bunch, with the majority in coverage calling it a "hold" or worse, and a consensus 12-month price target that sits at a slim 4.7% premium to current levels.

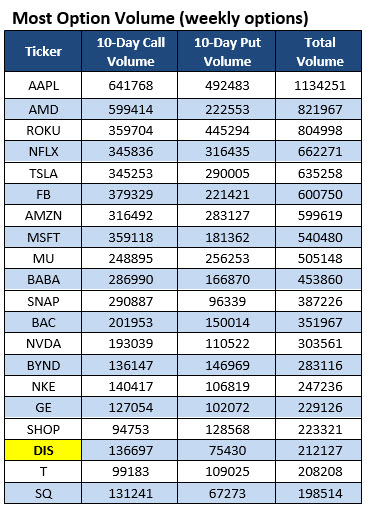

Despite this pessimistic analyst sentiment, traders are still showing a preference for calls over puts today, echoing a recent trend. The stock just showed up on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest weekly options volume during the past 10 days, with names highlighted in yellow new to the list. In the last two weeks, roughly 345,253 weekly calls have changed hands on TSLA, compared to about 290,005 weekly puts.

In fact, data from the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows that a notable portion of this activity was of the buy-to-open kind. That's because TSLA's 10-day call/put volume ratio of 1.34 sits in the 98th percentile of its annual range.

While calls may be more popular overall, the October 70 put saw a huge surge in open interest during the past two weeks, though it is unclear whether these contracts are being bought or sold. On the other end of the spectrum, the December 275 call also saw a notable increase in open interest.

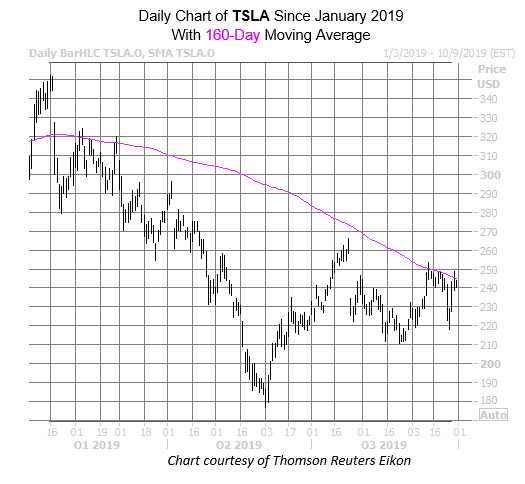

Taking a broader look TSLA recently managed a bounce off the $220 region, but overhead pressure at the 160-day moving average kept a tight lid on the shares. TSLA has a 27.7% deficit for the year, last seen down 1.7% at $238.08.