Options Traders See Another Big Earnings Swing For SFIX

SFIX will report earnings after the close on Tuesday, Oct. 1

SFIX will report earnings after the close on Tuesday, Oct. 1

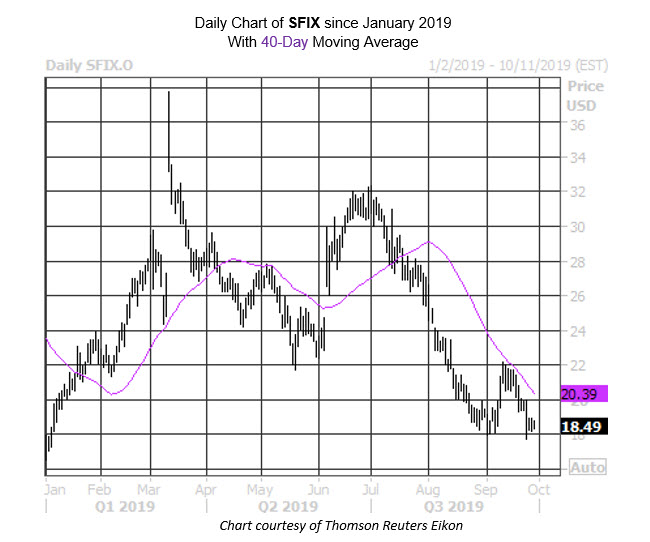

As earnings season starts to pick up again, online stylist Stitch Fix Inc (NASDAQ:SFIX) will be one of the first companies to step up to the plate, set for its fiscal fourth-quarter report after the close this Tuesday, Oct. 1. Ahead of the event, SFIX is struggling today -- down 1.7% to trade at $18.49 at last check -- after a fresh bear note.

More specifically, Stifel trimmed its price target to $28 from $35, the lowest on Wall Street. Analyst Scott Devitt cut profit estimates for the upcoming report, predicting that the U.K. launch will drag margins down. Devitt also noted "more uncertain" apparel and consumer spending trends as an overhang.

Looking at Stitch Fix's earnings history though, the security has closed higher the day after earnings three times over the past seven quarters, including a 14.7% pop in June and a 25.2% surge in March. This time around, the options market is pricing in a one-day, post-earnings swing of 26.3%, regardless of direction, compared to an average post-earnings move of 19.4% over the past two years.

Short sellers have been piling on in droves. Short interest increased by 36.5% in the two most recent reporting period to a record high 19.01 million shares. This accounts for a whopping 40% of SFIX's total available float, and 6.9 times the average daily trading volume.

On the charts, Stitch Fix stock was rejected by their 40-day moving average last month. Despite a 56% deficit year-over-year, SFIX is clinging to its year-to-date breakeven point, thanks in part to those two huge earnings-induced bull gaps referenced earlier.