Options Volume Runs High on Controversial Coffee Chain

Overall options volume is pacing in the 99th annual percentile today

Overall options volume is pacing in the 99th annual percentile today

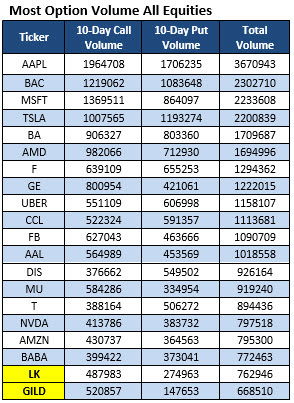

The20 stocks listed in the table below have attracted the highest weekly options volume during the past 10 trading days, with data courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. Stocks highlighted in yellow are new to the list. One name that sticks out is Luckin Coffee Inc (NASDAQ:LK), with the recent volatile stock market climate sending the stock's options volume popping. Below, we'll take a closer look at the options activity surrounding LK.

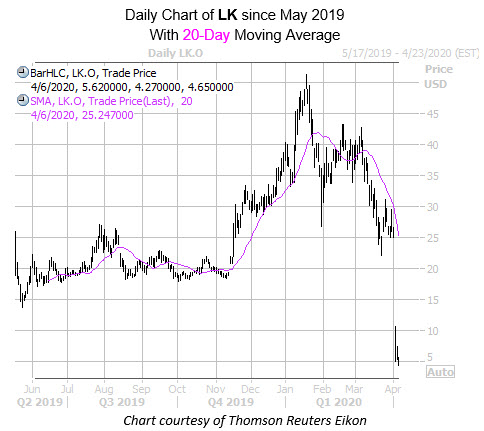

Luckin Coffee stock has had a rough go on the charts, today headed toward its fourth-straight daily loss, down 17.7% at $4.43 at last check, and earlier touching a record low of $4.27. Overhead pressure at the 20-day moving average attributed to some of the equity's recent losses, but taking the cake for the catalyst behind LK's April 2 bear gap are allegations against the company regarding several avenues of employee misconduct.

To make matters worse for the Chinese coffee chain, Chairman Charles Zhengyao Lu and Chief Executive Jenny Zhiya Qian both handed over their company shares to lenders following a $518 million margin loan default. Year-to-date, the security is down 88.9%. Looking toward the options pits, however, traders have yet to throw in the towel.

Per White's data, over the past 10 days, 487,983 calls and 274,963 puts have crossed the tape. This afternoon, most popular looks to be the weekly 4/9 5-strike call, with the the same strike in the April monthly series closely behind. Meanwhile, overall options volume is pacing in the 99th annual percentile.

Lastly, short interest dropped nearly 3% during the most recent reporting period, but most notably, now accounts for a whopping 95.1% of the stock's total available float. In simpler terms, at Luckin Coffee stock's average pace of daily trading, it would take short sellers just under four days to buy back their bearish bets.