Oreninc Index - Monday, June 5, 2017

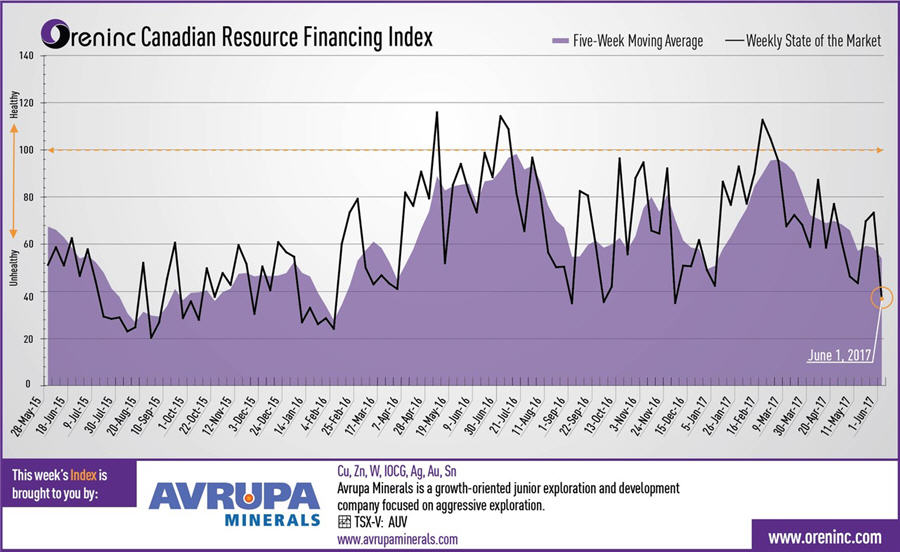

Last week index score: 73.35

This week: 37.34

Prospero Silver (TSXV: PSL) provided an update on planned drilling of the Matorral, Petate and Pachuca SE projects in Mexico.

Zinc One Resources (TSXV: Z) completed the acquisition of Forrester Metals.

The Oreninc Index plummeted in the week ending June 1st, 2017 to 37.34 from 73.35 in what was another volatile week for gold.

Total raises announced fell to C$60.0 million, a 21-week low, which included one brokered financing for a total of C$3.5 million, also a 21-week low within which there were no bought-deal financings. The average offer size fell to C$2.1 million, a 12-week low, whilst the total number of financings announced fell to 29, a three-week low.

As per last week, gold finished the week strongly to close at US$1,281 as the US dollar fell after president Donald Trump said that he would remove the country from the Paris climate agreement, to the world's opprobrium. Trump said the Paris agreement and its voluntary targets was too harsh on US business and would result in job losses, despite the fact that more people in the US are employed in the solar industry than coal mining, and overriding the pleas from business leaders such as Tesla's Elon Musk and Apple's Tim Cook, who stated that climate change is very real. In response, the European Union said it would bypass the US federal government and continue to work with US companies and US state governments on implementing the agreement.

Gold is seeing hedge fund managers move back into the space with long positions in US futures up by the most in recent weeks.

Although the gold price had a positive week, the van Eck managed GDXJ fell and is now up just 1.05% so far in 2017. The imminent rebalance of the GDXJ on June 16th is being a sea anchor on many stocks. The inventory of the SPDR GLD ETF held ground and closed at 847.5 tonnes, the same as the previous week.

In other commodities, silver continued its steady growth to close at US$17.55 whilst copper showed the faintest growth to close the week at US$2.57. Despite OPEC recently agreeing to sustain production cuts, oil gave back the gains that decision caused and WTI crude fell to close at US$47.74 per barrel.

The Dow Jones Industrial Average had another strong week and closed up at a new record high of 21,206. Canada's S&P/TSX Composite Index showed less stellar growth to close the week up at 15,442. The S&P/TSX Venture Composite Index softened to close down slightly at 800.98.

The past week saw Kai Hoffmann of Oreninc present at the International Metal Writers Conference in Vancouver, Canada, and he will present at the 121 Mining Investment Conference in New York, USA on 6-7 June. His presentation will be made available on our website in due course as well.

Finally, we recorded the next episode in the podcast serious with Mercenary Geologist Mickey Fulp which is available at www.oreninc.com.

Summary:

Number of financings fell to 29, a three-week low.One brokered financings were announced for $3.5m, a 21-week low.No bought-deal financings were announced this week.Total dollars dropped to $60.0m, a 21-week low.Average offer size decreased to $2.1m, a 12-week low.Financial news highlights

Northern Vertex Mining (TSX-V:NEE) opened a C$26.92 million offering on a strategic deal basis with Greenstone Resources

Settlement of the US$25 million fund raising will occur in US dollarsTo finance the Moss gold/silver project in western Arizona, USAGreenstone is a private equity fund specialising in the mining and metals sector.Northern Vertex has also recently obtained a US$20 million Sprott loan facilityReceived final permits to build MossC$5 million in warrants exercisedUS$9 million in equipment financing facility with CAT FinancialMajor Financing Openings:

Northern Vertex Mining (TSX-V:NEE) opened a C$92 million offering on a strategic deal basis. Each unit includes half a warrant that expires in 60 months. The company also opened a C$6.73 million offering on a best efforts basis, with half a warrant that expires in 24 months.Aldridge Minerals (TSX-V:AGM) opened a C$73 million offering on a strategic deal basis that is expected to close on or about June 15th.Minera Alamos (TSX-V:MAI) opened a C$5 million offering underwritten by a syndicate led by Haywood Securities on a best efforts basis. The deal is expected to close on or about June 29th.Major Financing Closings:

Northern Empire Resources (TSX-V:NM) closed a C$20 million offering underwritten by a syndicate led by Cormark Securities on a best effortsAlmaden Minerals (TSX:AMM) closed a C$25 million offering underwritten by a syndicate led by Sprott Capital Partners on a bought deal basis that included half a warrant that expires in 36 months.Alexco Resource (TSX:AXR) closed a C$04 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis.Cartier Resources (TSX-V:ECR) closed a C$01 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis.Sponsor news

Oreninc is proud to announce that Zinc One Resources (TSXV: Z), Castle Silver Resources (TSXV: CSR) and LiCo Energy (TSXV: LIC) are now sponsors and we will be bringing you their news in the weeks ahead.

Prospero Silver (TSXV: PSL) provided an update on planned drilling of the Matorral, Petate and Pachuca SE projects in Mexico.

Prospero selected a drill contractor for its planned 6,000m program on three projects.Drilling is scheduled to begin in late June with the first four holes at Matorral to be followed by eight holes at Petate and then eight at Pachuca SE.Conclusion

The drilling program aims to test the company's hypothesis for finding silver deposits under geological cover. The drilling is under the terms of a strategic agreement with Fortuna Silver Mines, which will have the ability to select successful projects for a JV arrangement.

Zinc One Resources (TSXV: Z) completed the acquisition of Forrester Metals

Together with the acquisition, Zinc One closed a private placement financing of C$10.0 million and is fully funded to move forward with the exploration and development of the high-grade, zinc-oxide Bongara project in PeruWilliam Williams is the new COO and was formerly CEO of Forrester.The transaction was effected by way of a court approved plan of arrangement and each Forrester shareholder received one share of Zinc One for every 5.5 shares of Forrester.Zinc One issued 24.3 million shares to Forrester shareholders.Zinc One now has 98.7 million shares issued and outstandingThe Bongar?? zinc oxide project consists of the Bongar?? zinc oxide mine and the Charlotte Bongar?? zinc oxide project.Zinc One aims to complete an updated resource estimate by year end with a target of 1.5-2.0 Mt @ >20% ZnConclusion

Now that the acquisition is complete, Zinc One can set about defining new zinc resources and its plans for development at Bongara.