Orezone Gold: The Bombore Project Provides Significant Upside Potential

Orezone's Bombore project has an after-tax NPV(5%) of $434.7 million at the current gold price of $1,400/toz.

The initial CAPEX is estimated only at $153 million.

At a gold price of $1,400/toz, the mine should generate free cash flow around $140 million, during the first year of full operations (probably 2022).

Obtaining financing shouldn't be a problem, the only question is the extent of share dilution.

The Burkina Faso country risk is the biggest flaw on the Bombore project.

Orezone Gold (OTCPK:ORZCF) is an emerging gold producer, developing its Bombore gold project in Burkina Faso. As can be seen in the chart below, its shares are pretty volatile, bouncing between $0.2 and $1 per share over the last 5 years. Right now, the market capitalization of the company stands approximately at $110 million, with enterprise value around $80 million. It is not too much for a company that is about to start building mine with an after-tax NPV(5%) of $361 million ($434.7 million at the current gold price).

Data by YCharts

Data by YCharts

The Bombore project is 90% owned by Orezone. The remaining 10% is a carried interest of the government of Burkina Faso. It has a very interesting history. Actually, mine construction had been almost initiated 3 years ago. Everything seemed to be on track, the mine was fully permitted and feasibility study was completed; however, on August 22, 2016, Orezone shocked the market by a revision of its resource and reserve estimate. Due to the exclusion of some environmentally sensitive parts of the deposit and also due to some changes in the resource modeling methodology, the gold resources, as well as reserves, declined approximately by 30% and the feasibility study became obsolete.

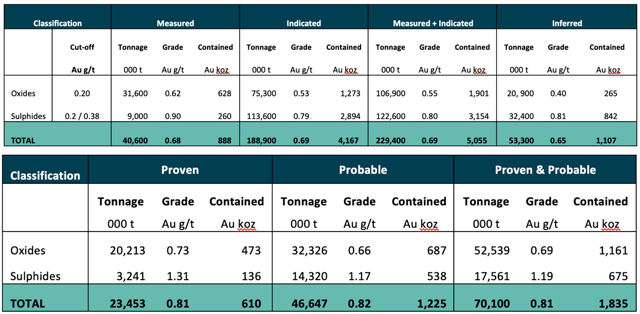

Several years of new exploration, drilling, and economic studies followed, and now, the project is approaching the construction phase once again. On June 26, Orezone announced results of an updated feasibility study. The Bombore project contains measured and indicated resources of 5.055 million toz gold, at a gold grade of 0.69 g/t and inferred resources of 1.107 million toz gold, at a gold grade of 0.65 g/t. In the reserves category, 1.835 million toz gold are included. The reserves grade is 0.65 g/t gold. The huge gap between the volume of reserves and volume of resources leaves a lot of space for future expansion of the mine production rate or of the mine life. Moreover, the exploration continues on the Bombore property.

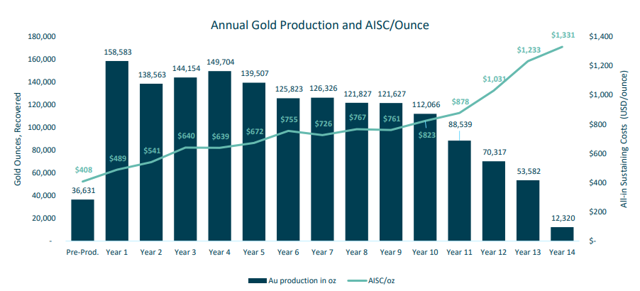

An open pit mine should be focused on mining the oxide ore in Phase 1. The cash flow generated by Phase 1 should be used to construct Phase 2 (the sulphide circuit) that will process sulphide and transition ore. Due to the staged approach, the initial CAPEX is estimated only at $153 million. The Bombore mine should be able to produce 117,760 toz gold per year on average, at an AISC of $730/toz, over initial 13-year mine life. At a gold price of $1,300/toz, the after-tax NPV(5%) is estimated at $361 million and the after-tax IRR at 43.8%. But there is some space left for further improvements. According to the news release, the higher grade gold discoveries made during 2017 and 2018 haven't been included in the resource and reserve estimates yet; however, an update is expected by the end of 2019. Moreover, recent sulphide ore metallurgical tests resulted in higher gold recoveries; however, it hasn't been reflected in the recently published updated feasibility study yet.

As can be seen (chart below), the mine plan is well optimized to maximize cash flows over the initial years. During the first full year of operations, Bombore should produce 158,583 toz gold at an AISC of $489/toz gold. If this projection turns out to be right, the mine should generate free cash flow around $140 million, if the current gold price of approximately $1,400/toz prevails. 90% of this sum, or approximately $125 million, should be attributable to Orezone. Given that the Phase 2 CAPEX is estimated at $63.2 million, Orezone should have enough cash to finance it pretty easily and there should be enough money left to reduce the potential Phase 1-related debt, to acquire another project, to start paying dividends, or to initiate a share buyback program (depending on the prevailing share price).

So the Phase 2 financing should be a slam dunk, Orezone should be drowning in cash after the mine gets in full production (barring any negative surprises). However, to finance Phase 1 may be a little more challenging. Although the economics of the project are good, the CAPEX is not high, Orezone is almost debt-free (long-term debt of $2.5 million as of the end of Q1 2019) and sentiment in the gold mining sector is improving, it is hard to expect Orezone to obtain debt financing that will be able to cover the whole CAPEX of $153 million. A very good thing is that as of the end of Q1, Orezone held cash of $27.5 million which should be enough to cover the pre-construction costs of the company. However, during the construction period, Orezone will have also some costs unrelated to the project development itself. It means that it will have to raise more than $153 million. Let's assume that it will be around $170 million.

It means that if there are no negative surprises, Orezone shouldn't have to raise more than $170 million. It is reasonable to expect that only 2/3 of this amount will be financeable via debt. The remaining $57 million will have to be financed via a sale of a gold stream or via an equity financing. The worst case scenario is a $57 million equity financing which would lead to an approximately 53% share dilution, using the current share price of $0.51. The share count would increase from 212.3 million to 324 million. Although a 53% share dilution may look scary, it would still leave a significant upside potential for the current shareholders. At a gold price of $1,300/toz, the after-tax NPV(5%) of approximately $325 million should be attributable to Orezone. At a share count of 324 million, it equals approximately to $1 per share. Moreover, at the current gold price of $1,400/toz, it equals around $1.2 per share. Of course, these are only some very rough estimates, but they show that even in a conservative scenario, the upside potential is 100%, maybe more, depending on the final structure of the financing package and the prevailing gold price.

Using the average life of mine metrics, Bombore should be able to produce 117,760 toz gold per year at an AISC of $730/toz. These are the average numbers, during the first years of operations, the production should be substantially higher and AISC substantially lower. But to make it even more conservative, let's calculate with a production of 115,000 toz gold per year at an AISC of $750/toz. At a gold price of $1,300/toz ($100 below the current market price), the mine should be able to generate an annual free cash flow around $63 million. Approximately $57 million should be attributable to Orezone. Using a very conservative multiple of 5, in order to reflect the country risk, we can come to a market value of $285 million. At a share count of 324 million, it equals almost to $0.9 per share. This is another rough estimate, with some very conservative assumptions and the upside is 80%.

All in all, the financing risk isn't too big. Nor is the permitting risk. The oxide operation is fully permitted. Some updates are needed due to the sulphide circuit; however, they are expected to be obtained in Q1 2020. Given that the government of Burkina Faso holds a 10% carried interest in the project, it is hard to expect any meaningful complications with the permitting process.

However, the political and security risks may prevent Orezone from commanding valuation multiples similar to its peers from safer jurisdictions. Burkina Faso is a poor African country; moreover, the northern and eastern regions of the country have to face problems with various terrorist and rebel groups. Although the Bombore project is located in a safer part of the country, moreover close to a military base, the overall perception of Burkina Faso is not good and it will hurt the company also in the future.

Conclusion

Orezone's Phase I Bombore operation is fully permitted, with remaining permits for the Phase II operation expected in early 2020. The feasibility study is positive, the initial CAPEX is reasonable and it shouldn't be too hard to obtain the project financing. A village resettlement is underway. The plan is to complete it by the end of this year. Also, the financing package should be completed by the end of this year. If everything goes well, the mine construction could start in Q1 2020 and first gold should be produced in the middle of 2021. The Phase 2 construction should start in early 2023 with first gold from sulphide ore produced in Q1 2024.

Although there is a risk of some share dilution and also the political and security risks related to Burkina Faso are non-negligible, Orezone provides significant upside potential. I believe that it's around 100% in a conservative scenario and more than 100% if the financing package is able to avoid excessive share dilution or if the gold price provides some further support.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ORZCF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Peter Arendas and get email alerts