Outlook 2018

January 16, 2018 / www.gold.org / Article Link

In 2017, investors added gold to their portfolios as incomes increased, uncertainty loomed, and gold’s positive price momentum continued. As 2018 begins we explore four key market trends and their implications for gold:

- synchronised economic growth

- shrinking central bank balance sheets and rising rates

- frothy asset prices

- market transparency, efficiency, and access.

We believe that these trends will support demand and maintain gold’s relevance as a strategic asset.

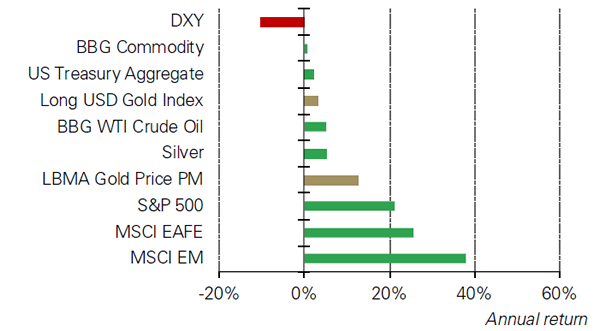

Chart 1: Gold outperformed major asset classes in 2017*

*Calculations based on total return indices except for spot DXY, gold and silver. Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Recent News

Gold stocks lead the large cap miners by far over H1/25

July 07, 2025 / www.canadianminingreport.com

Gold stocks up as the metal price and equities gain

July 07, 2025 / www.canadianminingreport.com

Mixed outlook for gold as it remains range bound for past three months

June 30, 2025 / www.canadianminingreport.com

Gold stocks down on flat metal price

June 30, 2025 / www.canadianminingreport.com

Gold stocks down on metal decline

June 23, 2025 / www.canadianminingreport.com