Pacific Empire Drills Striking Copper Gold in Inaugural Hole in BC

Bob Moriarty shares his thoughts on the DSI and one stock with a drill program that he believes could catapult the stock.

Bob Moriarty shares his thoughts on the DSI and one stock with a drill program that he believes could catapult the stock.

Those who have followed my writings are acutely aware that I place immense value on gauging market sentiment. The preeminent sentiment indicator I've ever encountered is Jake Bernstein's Daily Sentiment Indicator or DSI. As silver blasts through historic peaks daily and platinum gears up to crash the festivities, sentiment emerges as the ultimate tool in my arsenal. We're unquestionably navigating uncharted seas, with gold soaring towards $4,400 an ounce on October 20 and silver cresting an unprecedented zenith last Friday, grazing $68 an ounce. Platinum trails a mere 10% shy of its all-time apex and has been rocketing skyward as well.

Even copper yearns to enlist in the precious metals brigade, closing at $5.41 on Friday after brushing an all-time high of $5.80 in July. A monumental shift is afoot. For those yearning to decipher sentiment to divine forthcoming moves, the time is nigh.

I downloaded Friday's closing DSI figures with astonishment. They'll stun you, too.

In essence, the masses are less intelligent than bricks. If this eludes you, you must download and absorb the seminal tome on investing, penned nearly 175 years ago, "Extraordinary Popular Delusions and the Madness of Crowds." You see, humans crave joining the herd. We're herd creatures, akin to a school of fish or a flock of birds. But the birds are likely brighter. If you deem spending $0.99 for a sentiment education unworthy, you're unequivocally too dim-witted to invest.

The throng is perpetually misguided. They crave buying at peaks and dumping at troughs. No expertise in gold, silver, platinum, or even copper the newest metal to attain precious status is necessary. Disregard the Fed, brush off your hunches about interest rate trajectories, and overlook the $12 trillion unwinding of the Japanese Carry Trade. When 100% of investors are bullish, and the DSI hits 100, the ensuing trade will plummet in a crash. When 100% of bettors, or a DSI of 0, are bearish, the market is poised to detonate higher.

At silver's historic price on Friday, the DSI registered 77. Gold wasn't at an all-time new peak but hovered close. Gold's DSI clocked in at 77 on Friday, neither signaling a warning. Platinum's DSI hit 88, merely hinting at an impending correction. Even copper's DSI only reached 76.

We're not merely distant from a pinnacle; the metals' DSI implies average investors haven't even penetrated these markets thus far. We could ascend considerably higher. When these metals' DSI strikes around 95, we'll encounter a top. We're nowhere near that juncture.

When everyday investors awaken to the potential in metals and resource stocks for these metals, they'll be presented with a life-altering chance to profit by investing in junior resource stocks that have scarcely begun to budge. I conducted research last week into the total market cap of all juniors under $100 million. Tallying the market cap of every junior below $100 million yields a sum of roughly $14 billion.

That figure might resonate as substantial, but the Japanese Carry Trade hovers around $12 trillion, nearly a thousand-fold higher. The clipto currencies surged as high as $4 trillion before people wised up and started jettisoning the 17,000 permutations of random number generators that people perceive as valuable. They aren't. When the dust settled after Beanie Babies collapsed, you at least possessed a $0.79 plush toy. The Donald Trump Meme coin has shed 88% of its value, while the Melanie Trump Meme coin has nosedived by 99%. Those aren't investments; they're cons.

I invested in a diminutive copper/gold junior with two projects in BC's Quesnel Terrane a while back. I participated in two private placements in the company, Pacific Empire Minerals Corp. (PEMC:TSX.V; PEMSF:OTCMKTS), for pennies. On the 15th, they unveiled their inaugural results from this year's drill program. It was a grand slam: 183 meters of 1.23% Copper Eq from 9 meters. That was the maiden hole of a 2,500-meter drill program. The shares vaulted from CA$0.06 to CA$0.16 that day as 10% of the shares changed hands. The company has approximately 46 million warrants outstanding at an average price just over CA$0.08 each, so the stock bobbed and weaved between CA$0.175 and CA$0.12 the rest of the week as warrant holders offloaded shares to exercise solidly in-the-money warrants.

What does 183 meters of 1.23% CuEq signify for a junior? Well, when Hercules Metals Corp. (BADEF:OTCMKTS; BIG:TSXV) proclaimed their Idaho discovery hole of 184 meters of 0.84% Cu, the shares surged from CA$0.20 to CA$1.60, endowing the company with a market cap of about CA$400 million.

With PEMC's Friday close at CA$0.155, the company sported a market cap of roughly CA$30 million. And here's the kicker: PEMC didn't release the entire hole, just the portion for which they had assays. The remaining segment of the hole should be unveiled soon.

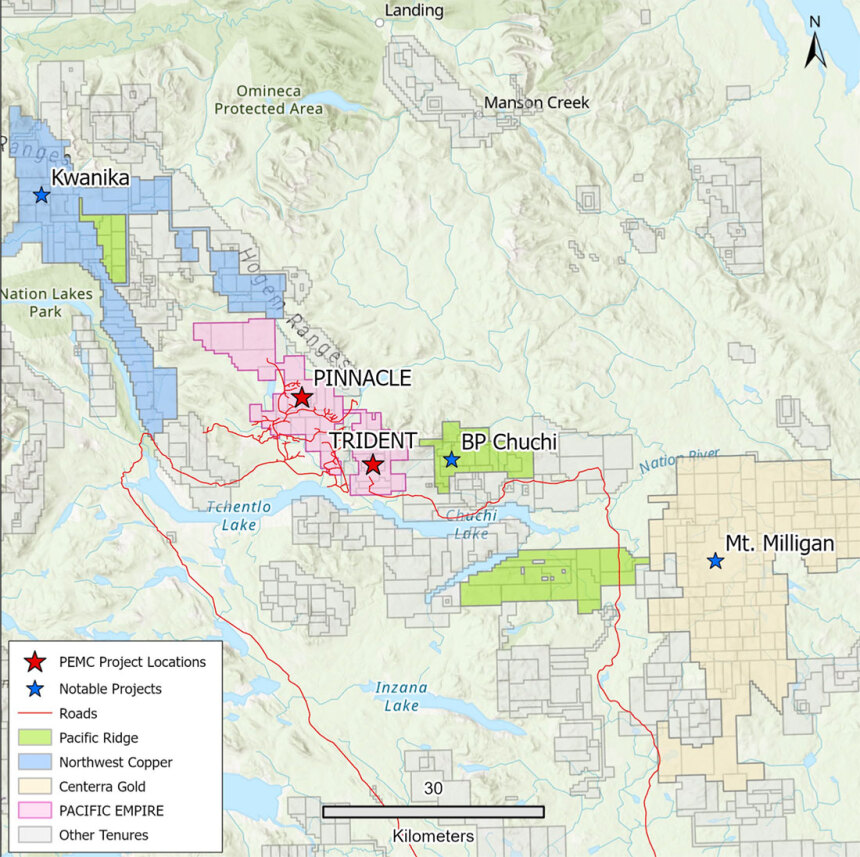

Pacific Empire's Trident and Pinnacle copper/gold properties nestle just over 30 KM NW of the Mt. Milligan Copper mine in Northern BC. In 2024, Mt Milligan yielded 168,000 ounces of gold and 54 million pounds of copper.

Pacific Empire aims to execute a 10,000-to-15,000-meter phase 2 drill program at Trident in 2026. The outstanding warrants could inject about CA$4 million in cash, but ideally, PEMC management would likely aspire to bring in a major or two to bankroll the drilling program and furnish technical assistance. With results like their very first hole, they hold the upper hand. Copper is sizzling and scarce.

The outstanding warrants will tend to cap the stock price as investors sell shares to exercise the warrants. The yet-to-be-announced lower portion of hole DD25-TRI-001 and the other five holes comprising the Phase 1 drill program could catapult the stock.

| Want to be the first to know about interestingGold,Copper andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Bob Moriarty: I, or members of my immediate household or family, own securities of: Pacific Empire. My company has a financial relationship with Pacific Empire. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.