Pacton Gold a relative value Pilbara speculative play

John Kaiser kicks off his latest Discovery Watch (February 14th) reviewing the latest S2 Resources drilling at its Ecru project in Nevada characterizing the results as neither making or breaking it. The meat of the broadcast is found in the middle segment where Kaiser gives a thorough update on the status of exploration in the Pilbara region of Australia which made big waves a few years ago with the discovery of visible gold.

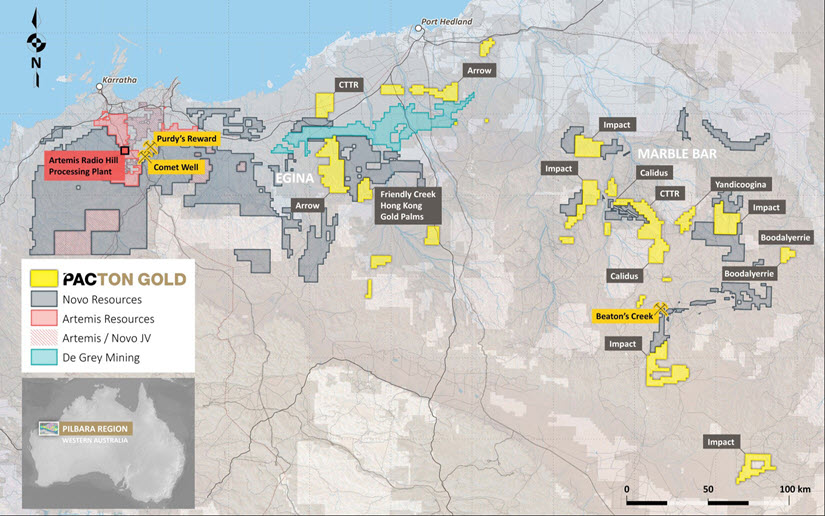

Pacton Gold's description of the Pilbara play (click for larger)

He ends with a tip on what to look for from Midland Exploration (MD) over the next few weeks.

The two holes that S2 Resources drilled at its Ecru project were looking for deep targets on the eastern edge of the Newmont (NEM) sub-lease claim. According to Kaiser, the first hole reached a depth of 1,885 feet, only two-thirds of its target depth. Several short intervals of gold with silver by-products were found. The second hole did not yield any significant results but managed to get to 2,220 feet (about 75% of target depth).

Mr. Kaiser estimates the drilling probably cost S2 $1 million and they need to spend $3 million by 2022 to vest for 70% of the project from Ren Gold (REN). At this point, it is not clear what the next step will be at Ecru. However, Kaiser remains upbeat about the longer-term prospects for Ren Gold thanks to its project pipeline.

Moving to Down Under, Kaiser notes that while not much is going on in Australia's Pilbara region right now due to hot weather, activity is expected to pick up in April. Kaiser describes Novo Resources (NVO) as having "four story tracks" underway in the Pilbara region.

Attempt to convince Australian regulators to allow large scale bulk sampling without first having a resource estimate. If they get the green light, they'll go back in there and start doing 10,000 tonne samples, which would be a key milestone for figuring out the development potential of the discovered gold conglomerate unit which is pervaisive over the PilbaraWhile waiting for regulators, pursue marine terraces targets which are more traditional in natureBeaton's Creek where they have been collecting bulk samplesEast Pilbara where there are quartz veins in the older basement rocks that are gold bearingKaiser says he belongs to the camp that believes that Novo's Quinton Hennigh is right that the source of nugget gold is from a precipitation event. Kaiser suggests that if this really was the case, this phenomenon will have been over much of the Pilbara and there could be billions of ounces in the area. Kaiser sets out the challenge for the company going forward:

How do you actually develop a target for large scale physical mining and what is the average grade going to be?

Kaiser also has his eye on Pilbara player Pacton Gold (PAC)

Pacton mirrors Novo in three of these tracks, yet is a tenth of the valuation.

Kaiser has made Pacton a Kaiser Research speculative favourite based on its relative cheap value. He notes that last year it acquired strategic land positions in the Pilbara from Australia-listed juniors. However, Pacton issued a lot of stock to acquire these land positions and that has been weighing on the stock price. Kaiser sums up the company's strategy right now:

They are watching to see what Novo comes up with in its Egina sampling. In the Friendly Creek area ..they hope to be able to go in there to pursue marine terrace style gold while waiting for Novo to demonstrate that, yes, the conglomerate unit gold can be measured.

In terms of Pacton leadership, Kaiser believes Dale Ginn is well versed in greenstone hosted deposits. That experience will likely be put to work in the Boodalyerrie project located at the east Pilbara where the company has also been acquiring land. Kaiser expects Ginn and his team will be checking to see if there is more quartz veins in the area than has been assumed.

Kaiser closes off the interview with an update on Midland Exploration's Mythril project. He reports that while limited work has been done so far due to early on set of winter. the company was able to identify a 2,400-metre moly, copper, gold and silver trend. However, they do not know what style of deposit it is yet. They just released the results of a geophysical survey. According to Kaiser, the mag portion showed an anomaly tracking the east/west trend. Now they are doing an IP survey over the trend target. This will measure chargeability and Kaiser expects results to be out in a matter of weeks.

John Kaiser will be presenting at the Metals Investor Forum in Toronto on Sunday March 3rd. While attendance is free, there is a seating limit so those interested in attending should sign up soon via the Kaiser Research On-line website.

This post first appeared on INKResearch.com.