Pandemic 2020 Is Gone! Will 2021 Be Better for Gold? / Commodities / Gold and Silver 2021

Hurray! The disastrous year of 2020, which brought about the COVID-19 pandemic , the Great Lockdown , and the economic crisis , is over! Now, the question is what will 2021 be like – both for the U.S. economy and the gold market.

To provide an answer, below I analyze the most important economic trends for the next year and their implications for the yellow metal.

1.Society gains herd immunity by vaccination and the health crisis is overcome.

2.With herd immunity approaching, the social fabric returns to normality, and the economy recovers.

3.The vaccine rollout increases the risk appetite, reducing the safe-haven demand for both gold and the greenback .

4.The return to normality and realization of the pent-up demand (comeback of spending that was put on hold during the U.S. epidemic ) accelerates the CPI inflation rate .

5.The Fed stays accommodative, but the recovery in the GDP growth and the labor market makes the U.S. monetary policy less aggressively dovish than in 2020.

6.However, the Fed continues to use all of its tools to support the economy in 2021 and, in particular, it does not hike the federal funds rate , even if inflation rises.

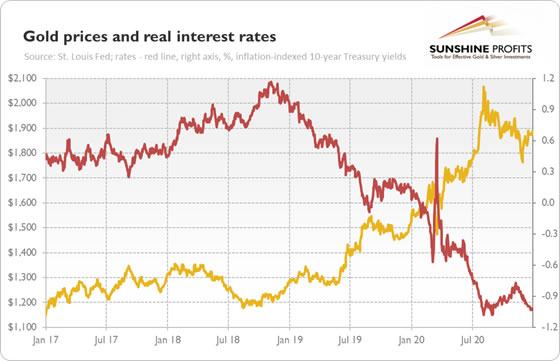

7.As a result, the real interest rates stay at ultra-low levels. However, the potential for further declines, similar in scale to 2020, is limited, unless inflation jumps.

8.The American fiscal policy also remains easy, although relative to 2020, government spending declines, while the budget deficit narrows as a share of the GDP.

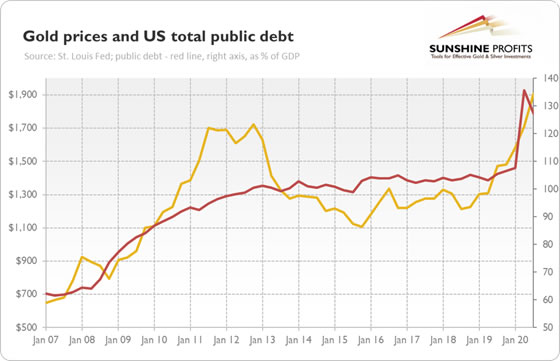

9.However, the public debt burdens continue to rise. Although the ratio of debt to GDP decreased in Q3 2020 amid the rebound in the GDP, it’s likely to increase further in the future, especially if Congress approves the new fiscal stimulus.

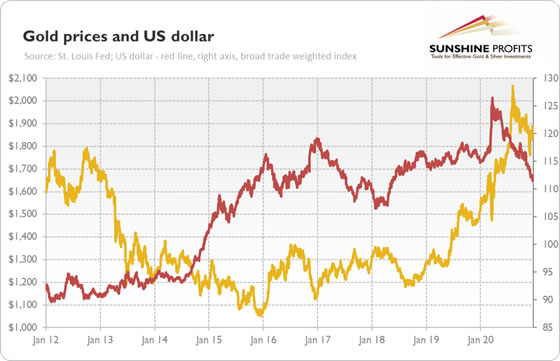

10.Given the dovish Fed conducting a zero-interest rate policy , increasing debt burden, and strengthened risk appetite amid the vaccine rollout, the U.S. dollar weakens further. The American currency has already lost more than 11 percent against a broad basket of other currencies since its March peak.

What does this macroeconomic outlook imply for the gold prices? This is a great question, as some of the trends will be supportive for the yellow metal, while others might constitute headwinds, and some factors could theoretically be both positive and negative for the price of gold. For instance, the end of the recession seems to be bad for the yellow metal, but gold often shines during the very early phase of an economic recovery, especially if it is accompanied by reflation , i.e., a return of inflation.

The tailwinds include the continuation of easy monetary and fiscal policies . The federal debt will remain high, while the interest rates will stay low, supporting the gold prices, as was the case in the past (see the chart below).

There is also an upward risk of higher inflation. In such a macroeconomic environment, the U.S. dollar should weaken against other currencies, thus supporting gold prices . As a reminder, the relative strength of the greenback in recent years (see the chart below) limited the gains in the precious metals market.

However, there are also headwinds . You see, levels are significantly different concepts than changes. The latter often matter more for the markets. What do I mean? Well, although both monetary and fiscal policies will remain accommodative, they will be less accommodative than in 2020. Although the real interest rates should stay very low, they will not decline as much as last year (if at all).

In other words, the economy will normalize this year after suffering a deep downturn in 2020, so the economic policy will be less aggressive. Hence, the level of bond yields and the ratio of federal debt to GDP should stabilize somewhat – actually, thanks to the rebound in the GDP in the third quarter of 2020, the share of public indebtedness in the U.S. economy has decreased, as the chart below shows.

Hence, although the price of gold could be supported by the continuation of easy monetary and fiscal policies, low real interest rates, and weak dollar, it’s potential to rally could be limited. The accommodative stance of central banks and unwillingness to normalize the monetary policy for the coming years should prevent a significant bear market in gold , but without any fresh triggers of further declines in the bond yields or without the spark of inflation, the great bull market is also not very likely. So, unless we either see a serious solvency crisis or sovereign debt crisis , or an substantial acceleration in inflation, gold may enter a sideways trend . Or it can actually go south, if it smells the normalization of monetary policy or increases in the interest rates.

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.