Peak Gold and the Coming Supply Crunch / Commodities / Gold & Silver 2019

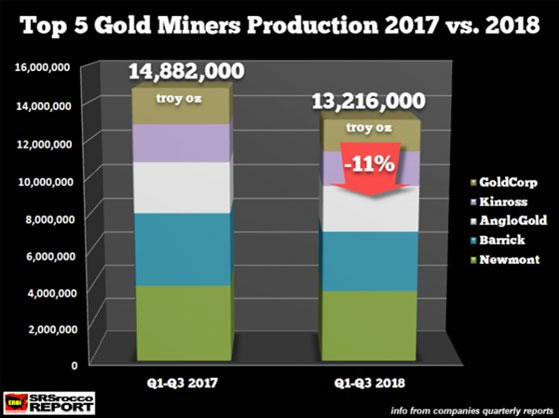

Duringthe lackluster and otherwise unremarkable trading of 2018, a hugely importantdevelopment took place in the precious metals markets. Gold production, in theestimation of some top industry insiders, peaked.

Duringthe lackluster and otherwise unremarkable trading of 2018, a hugely importantdevelopment took place in the precious metals markets. Gold production, in theestimation of some top industry insiders, peaked.

Peak goldrepresents the point at which the total number of ounces being pulled out ofthe ground by miners reaches a maximum.

Itdoesn’t necessarily mean gold production will suffer a precipitous fall. But itdoes mean the mining industry lacks the capacity to ramp up production in orderto meet rising global demand and even higher prices would not make it happen.

One ofthe leading proponents of the peak gold thesis is Ian Telfer, chairman ofGoldcorp (which was recently acquired by Newmont Mining to become the world’sbiggest gold company).

Telferremarked in 2018, “In my life, gold produced from mines has gone up prettysteadily for 40 years. Well, either this year it starts to go down, or nextyear it starts to go down, or it’s already going down… We’re right at peak goldhere.”

We’llsoon find out whether his call for gold production to fall in 2019 pans out. Ifit does, the implications for precious metals investors are enormous.

Theconcept of peak gold is controversial, to be sure.

Skepticspoint to the thwarting of peak oil over the past decade. Just as technologicalbreakthroughs in fracking and horizontal drilling caused an unexpected surge incrude oil supplies, could not advances in gold mining techniques also lead toan unforeseen supply surge?

Whenhuman ingenuity combines with the right market incentives, nothing can be ruledout. But unlike crude oil which is a byproduct of decayed living organisms andexists in various grades all over the world, gold is a basic element that cameto us from exploding stars billions of years ago.

Theamount of gold in earth’s crust is fixed. By contrast, oil and otherhydrocarbons can be produced synthetically from renewable biomass.

Perhapsone day we’ll mine for gold in space or generate it in nuclear reactors orparticle accelerators. Theoretically, it’s possible. Practically, there’s noprospect of these unconventional methods of boosting earth’s gold reservesbecoming economically viable in our lifetimes. It would take a true “moon shot”in the gold price and/or atechnological breakthrough that might be decades away from coming to fruition.

In themeantime, the gold mining industry isexperiencing a major wave of consolidation.

Last yearBarrick Gold and Randgold merged. This year Newmont Mining acquired Goldcorp.Many lesser known junior mining and exploration companies have been or may soonbe gobbled up by senior producers looking for an economical way to grow theirreserves.

Developingnew mines is expensive, time consuming, and risky.

It’sdifficult these days for the majors to even identify viable new projects thatwould add significantly to their asset base. As new discoveries shrink, manyhave decided it makes more sense to buy up the assets of smaller competitorswhile they are on sale.

It mayprove beneficial to corporate bottom lines, but M&A activity doesn’tnecessarily translate into more ounces being pulled out of the ground on anindustry-wide basis. To the contrary, it’s a sign that mining companies aren’tkeen on investing in the exploration and development of new mines.

Afteryears of “high grading” – processing the easier to get, higher quality depositsfirst – future gold extraction costs could get progressively steeper forexisting major mines.

Even at$1,300 an ounce, gold prices aren’t high enough to generate attractive returnson investment. Many gold mining companies are barely breaking even after theirall-in costs are considered.

Canadianmid-tier producer Iamgold announced recently that it will halt construction atone of its gold projects in Ontario. Iamgold CEO Stephen J.J. Letwin said thecompany will “wait for improved, and sustainable, market conditions in order toproceed with construction.”

That’sjust one example among many of why gold production could begin to taper off anddecline overall in 2019.

RefinitivGFMS analysts forecast gold mining output will decrease slightly this year –from approximately 3,282 tonnes in 2018 to 3,266 tonnes.

Theexpected fall-off may not be huge, but the wider impact on the precious metalsmarkets very likely will be. With central bank buying continuing to be robust,jewelry demand in India back on the upswing, and investor interest returningamidst volatile financial markets, a slight decrease in production relative torising demand — sets the stage for a rip-roaring secular bull market.

Stefan Gleason isPresident of Money Metals Exchange, the national precious metals company named 2015"Dealer of the Year" in the United States by an independent globalratings group. A graduate of the University of Florida, Gleason is a seasonedbusiness leader, investor, political strategist, and grassroots activist.Gleason has frequently appeared on national television networks such as CNN, FoxNews,and CNBC, and his writings have appeared in hundreds of publications such asthe Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2019 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.