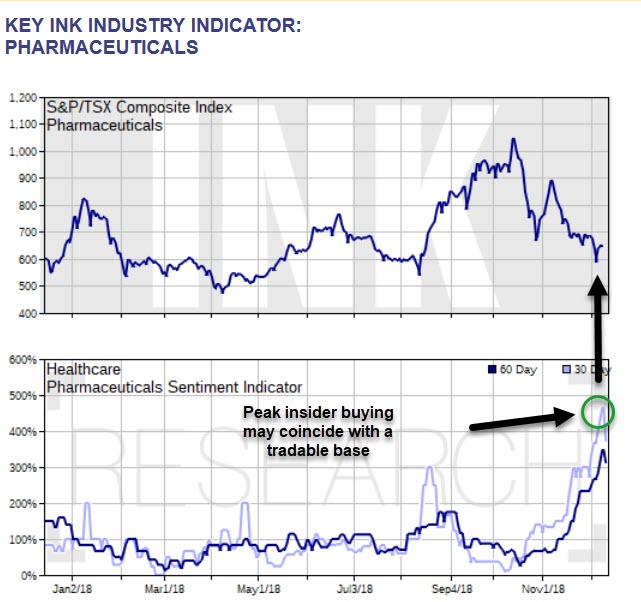

Peak insider buying in Pharmaceuticals and cannabis stocks

As we wrote in our Monday market update, our 30-day Pharmaceuticals Indicator seems to have a decent ability to time the group's highs and lows. When the indicator peaks above 200%, it represents a strong peak in insider buying that has, at times, coincided with a base in stock prices. As of Tuesday, it appears the indicator has peaked at a level not seen since September 2017. This development should catch the interest of cannabis stock speculators as many of those companies are found in the Pharmaceuticals industry classification.

Given the current backdrop of a tighter Fed, we tend to believe any rallies should be rented and not owned. With that in mind, we will be watching for the same indicator to put in a trough below 50%. When that happens, we will be at peak insider selling. That would probably be a good time to take money off the table.

This is a partial excerpt from an earlier post made available to INK Research subscribers before the market open which included our list of the top 7 ranked Pharmaceutical stocks based on the INK Edge criteria of value, insider commitment and price momentum. Read upcoming INK morning reports to see what cannabis and other stocks make our screens for either upside or downside potential. Click here for subscription information.