Peru, Brazil to emerge as Latin America's new mining gems

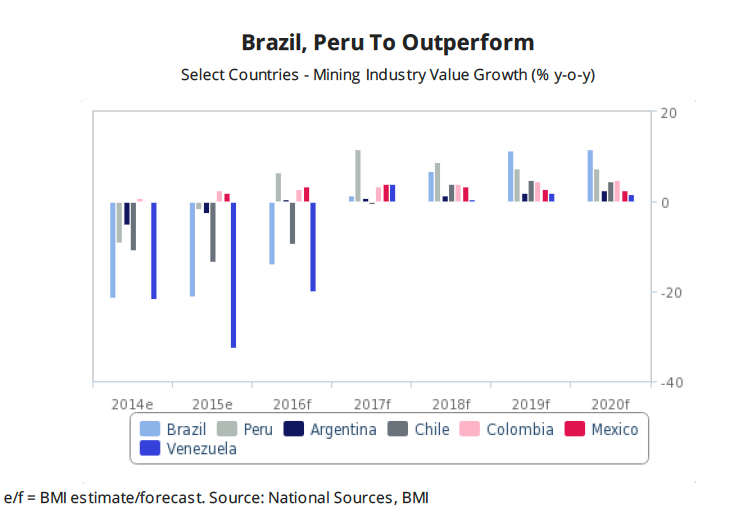

Latin America's mining sector is finally recovering from an economic downturn brought by almost two years of sustained slump in commodity prices. But growth in the region won't be led by the usual favourites, such as Chile, but by two of the countries that have steadily fallen out of favour with investors as of late - Peru and Brazil.

According to the latest analysis by BMI Research, Peru's significant copper project pipeline and Brazil's competitive iron ore sector are set to offset internal political and operational risks to consolidate them as the main drivers of investment in Latin America's mining sector.

Chile, however, will continue to be the No.1 mining country, especially when it comes to copper, producing an additional 346,000 tonnes between now and 2020. While Argentina, with its new pro-mining President Mauricio Macri, is expected to recover some lost ground.

The road ahead for Argentina won't be easy. Despite holding rich deposits of copper, gold, silver, zinc and lithium, local regulations are tough - seven of the country's 23 provinces currently ban open-pit mining altogether due to environmental concerns.

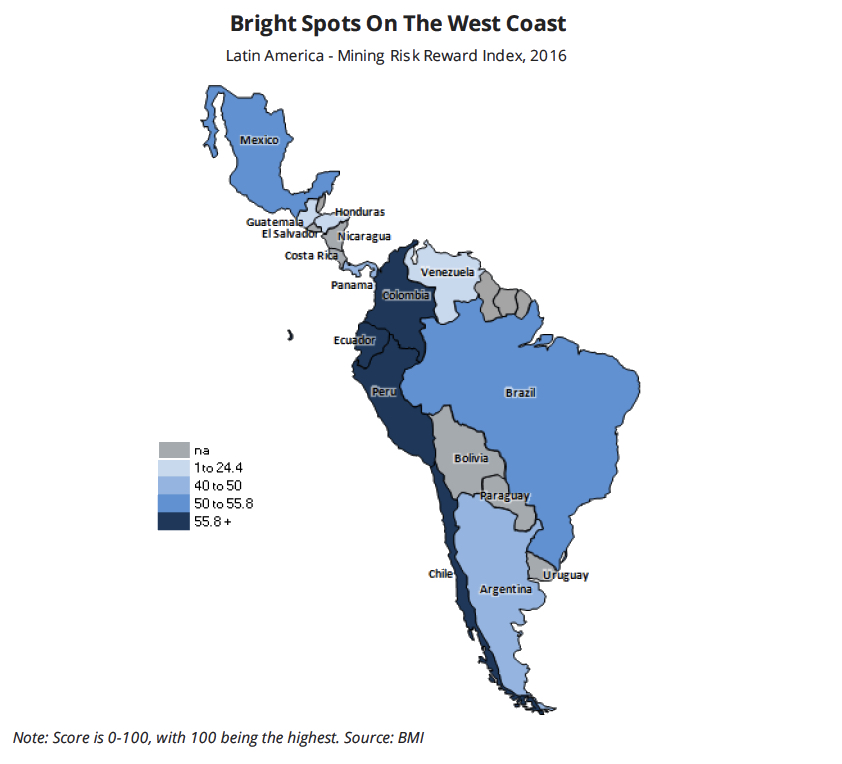

BMI Research expect companies operating in Latin America to continue facing several key political and operational risks, including underdeveloped infrastructure, labour unrest and illegal gold mining. But the expert say the severity of those issues will vary significantly in each country.

They predict a relatively smooth sailing for miners in Chile, Colombia, Mexico and Brazil. Central American countries and Venezuela, on the other hand, are expected to pose more challenges, particularly in terms of limited infrastructure, lack of reforms and heightened security and political risks.

Labour unrest is another big risk in the area as strikes raise costs and dent output for firms, as it happened with BHP Billiton's Spence copper mine in Chile and South32's nickel output at the Cerro Matoso mine in Colombia.

Finally BMI report warns that environmental regulations will likely tighten, especially after the Samarco disaster in Brazil, and predicts this factor will result in higher costs and possible project delays for miners.