Pharma Stock's Rally Could Have Legs

A bull signal flashing for MYL could give its recent rally a big boost

A bull signal flashing for MYL could give its recent rally a big boost

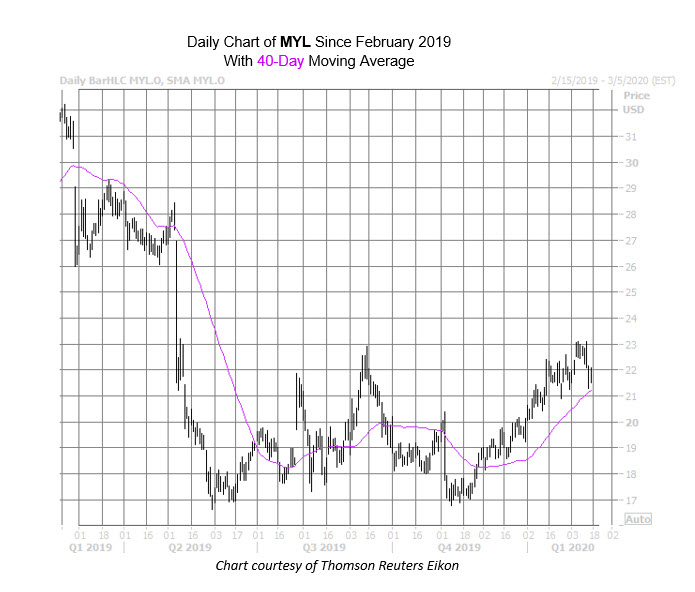

U.K.-based pharmaceutical name Mylan NV (NASDAQ:MYL) has been in rebound mode these past couple months, bouncing off a familiar floor at the $17 region in late November, and gaining roughly 29% in the months following. While the $23 level is, yet again, trying to thwart the security's recent rally, the EpiPen producer just pulled back to a historically bullish trendline that could help the equity topple that ceiling.

Specifically, Mylan just pulled back to its 40-day moving average, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. And while White's modeling shows just one similar pullback in the past three years, the security managed an impressive 11.12% return one month later. A similar move from the stock's current perch at $21.88 would put MYL at $24.31, just above the aforementioned ceiling at the $23 level.

Sentiment surrounding the stock is split, which could lead to tailwind-inducing upgrades should MYL continue its journey higher. Right now seven call the stock a "buy" or better, while seven say "hold."

Shorts have been surging too, up 22.1% in the last two reporting periods. The 24.03 million shares sold short represent 4.7% of the stock's available float, and would take nearly four days to cover at Mylan's average pace of trading, leaving plenty of room for a short squeeze.

For those looking to speculate on MYL's next move with options, now looks like an attractive time. The security's Schaeffer's Volatility Index (SVI) of 44% is higher than just 27% of all other readings from the past year. This means options are pricing in relatively low volatility expectations right now.