Platinum Group Metal Cowboys in Montana

A small-cap company in Montana is exploring to find out if its property contains "Platreef-style" PGE mineralization.

There is a 30-mile long geologic slice of layered magmatic intrusion cutting through the Beartooth Mountain range in south-central Montana that closely resembles one of the world's most productive mining regions in South Africa. The Stillwater Igneous Complex encases tens of millions of ounces of valuable platinum group metals, along with nickel, copper, cobalt and other commodities.

The platinum group elements (PGE) include platinum, palladium, rhodium, ruthenium, iridium and osmium. These metals have similar physical and chemical properties, and occur together in nature. They have catalytic qualities with high melting points and are resistant to corrosion, making them indispensable to many industrial applications.

With more than 41 million ounces of past production and current Measured and Indicated resources, plus another 49 million ounces of Inferred resources, the Stillwater Igneous Complex is recognized as one of the top regions in the world for PGE-Ni-Cu mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions.

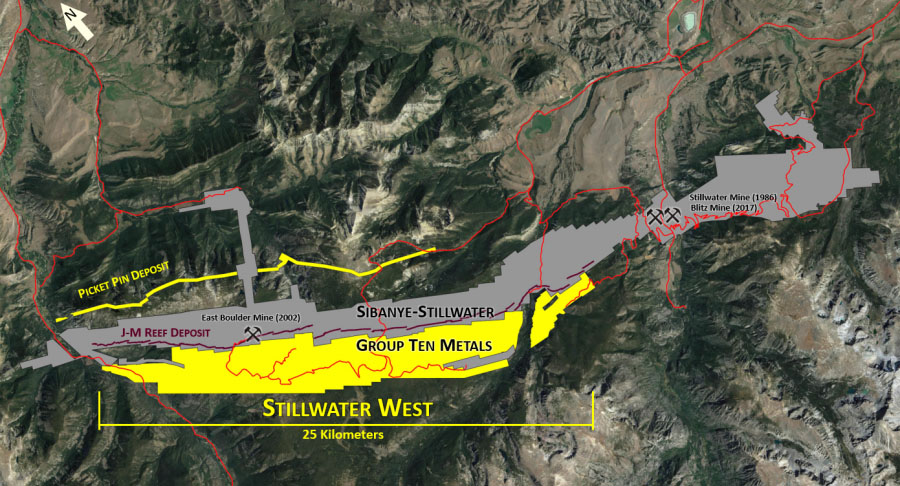

A Vancouver-based firm called Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE) is drilling exploration holes in a large area of the Stillwater Igneous Complex with solid results. The company has a 100% interest on its flagship Stillwater West PGE-Ni-Cu project adjacent to Sibanye-Stillwater's world-leading Stillwater, East Boulder and Blitz PGE mines.

Michael Rowley, President and CEO of Group Ten Metals, told Streetwise Reports, "We've identified mineralized zones based on drilling to date in five of the fourteen target areas. We are now drilling the Iron Mountain and Camp Zone target areas at Stillwater West two of three priority targets with the aim of both proving our model and also moving those mineralized zones towards formal resource status.

"One of the best past holes at Iron Mountain is IM2002-07, which returned 8 meters of 3.65 g/t Pt+Pd+Au starting at surface, plus 0.16% combined nickel and copper, and significant cobalt. That high grade is directly comparable to grades now being mined in the market leader, South Africa. A nearby hole returned 26.8 meters of 0.98% Ni and 0.45% Cu within a broader 259 meter interval of 0.25% Ni and 0.20% Cu. Very limited PGE data is available for that hole, but the assays that we do have are compelling, confirming PGEs of up to 2.7 g/t Pd."

The Stillwater West PGE-Ni-Cu Project consists of 14 multi-kilometer-scale target areas along a 25 km strike length adjoining and directly adjacent to Sibanye-Stillwater's high-grade Stillwater, East Boulder and Blitz mines. Group Ten Metal's developing project covers the lower part of the Stillwater Complex along with the Picket Pin PGE Reef-type deposit in the upper portion, and includes extensive historical data, including soil and rock geochemistry, geophysical surveys, geologic mapping and historical drilling.

Rowley explained, "The new round of drilling follows two years of compilation work and over 28,000 meters of past drilling in more than 200 holes. The results are compiled in a database which includes geological, geophysical, and soil geochemical surveys. It's worth noting that we have about 12,000 meters of that core in our possession."

Rowley said his geologists are looking for "Platreef-style" bulk tonnage PGE-Ni-Cu-Co deposits. "Platreef" is the name of Ivanhoe Mines' remarkable PGE discovery in the Bushveld, and "it is one of several in the Platreef district that are defining a new age for the production of platinum group elements, nickel and copper through the application of bulk mining techniques that are distinct from the narrow "Reef-type" mines elsewhere in South Africa," Rowley stated.

Rowley recalls Dr. David Broughton, co-discover of Ivanhoe's historic find, making the observation that Group Ten Metals' Stillwater formation strongly resembles the Platreef and "The only unknowns are the good unknowns" at Stillwater West. A rosy prediction, but it makes Rowley and his investors happy.

Rowley explained, "Our project is in the same geologic system as the three Sibanye-Stillwater mines operating just to the north of us. The Stillwater Igneous Complex hosts the world's highest grade major palladium and platinum mines. There's a lot of metal in the system. It is producing 17 grams a ton of combined palladium and platinum across many kilometers, which is extraordinary.

"The prolific Stillwater mines just north of our main claim block were bought for US$2.2 billion by Sibanye in May 2017. Sibanye-Stillwater is now the globe's leading palladium producer, and we are located right next door.

"In fact, our ground was owned by Sibanye-Stillwater's predecessor. The property has been mined sporadically in the past for a number of commodities including high-grade nickel and copper, as well as PGEs and chrome. But we are taking it to an entirely new level of PGE exploration and development by undertaking the first systematic programs in the Stillwater district to explore for deposit types now in production on South Africa's Platreef district."

It is early days to consider mining methods, however, in discussion Rowley noted Ivanhoe's underground bulk tonnage method that is now in construction, and also noted Sibanye-Stillwater's underground operation some hundreds of meters north of Group Ten, in the Stillwater Complex.

Group Ten Metals is part of the Metallic Group, which is a collaboration of precious and base metals exploration companies specializing in acquiring large, brownfields assets in established mining districts adjacent to some of the industry's highest-grade copper, silver and platinum/palladium producers. The other members of Metallic Group are Granite Creek Copper Ltd. (GCX:TSX.V) in the Yukon's Minto copper district and Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCMKTS) in the Yukon's Keno Hill silver district.

Rowley noted, "Each of the three Metallic Group companies centers on the strategic acquisition of a large, brownfield property position during bear market conditions. We share an office, administration costs and a network of consultants who are adept at mineral exploration, resource modeling and project development. Our management teams have decades of experience in the capital markets, and we expect to move each of these companies to resource delineation stage in the coming year."

Group Ten recently closed a non-brokered private placement, issuing 17,500,000 units at a price of $0.14 per unit for gross proceeds of $2,450,000. Each unit consists of one common share and one half-share purchase warrant. Each full warrant entitles the holder to acquire one common share at $0.21 per share for 36 months. The company has a further $2.2 million of in-the-money warrants. And in a sign of managerial self-confidence, Rowley and his team own 37% of the company's undiluted shares.

Group Ten Metals is also exploring the high-grade Black Lake-Drayton Gold project in the Rainy River district of northwest Ontario and the Kluane PGE-Ni-Cu project on trend with Nickel Creek Platinum's Wellgreen deposit in Canada's Yukon Territory.

[NLINSERT]Disclosure:

1) Peter Byrne compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals, Granite Creek Copper and Metallic Minerals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Group Ten Metals, Granite Creek Copper and Metallic Minerals. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Group Ten Metals, Granite Creek Copper and Metallic Minerals, companies mentioned in this article.