Plunging Stocks to Push Gold Higher? Fat Chance! / Commodities / Gold and Silver 2018

Thebearish case for gold continues as fresh new bearish confirmations have justemerged. You have already read about gold’shuge weekly volume, gold stocks’ underperformance and many otherfactors. Yesterday’s session provides us with even more bearish details. But,there’s one thing that looks promising for gold bulls – the possibility of abig and sharp decline in the stock market. Some expect money coming out of thestock market to flow into precious metals, thus pushing their prices higher. Asmuch as we love gold (and silver even more) as a very long-term investment, intoday’s analysis, we dismiss the above stock-based hope.

Thebearish case for gold continues as fresh new bearish confirmations have justemerged. You have already read about gold’shuge weekly volume, gold stocks’ underperformance and many otherfactors. Yesterday’s session provides us with even more bearish details. But,there’s one thing that looks promising for gold bulls – the possibility of abig and sharp decline in the stock market. Some expect money coming out of thestock market to flow into precious metals, thus pushing their prices higher. Asmuch as we love gold (and silver even more) as a very long-term investment, intoday’s analysis, we dismiss the above stock-based hope.

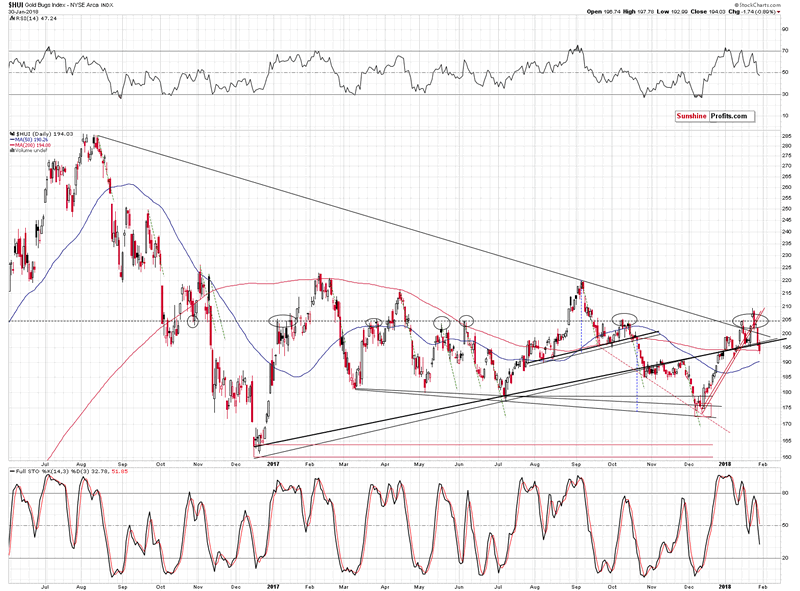

However,before we move to the above discussion, let’s check yesterday’s priceperformance of goldminers (charts courtesy of http://stockcharts.com).

Inshort, gold miners broke below all important nearby support levels that couldbe broken:

Themid January high.Theearly January high.Thelate January low.The205 level (invalidating the breakout).Thedeclining, medium-term resistance line (invalidating the breakout).Therising, medium-term resistance / support line.Therising short-term (red) resistance / support line.

Theimplications of the above are very bearish and they are confirmed by the sellsignal from the Stochastic indicator.

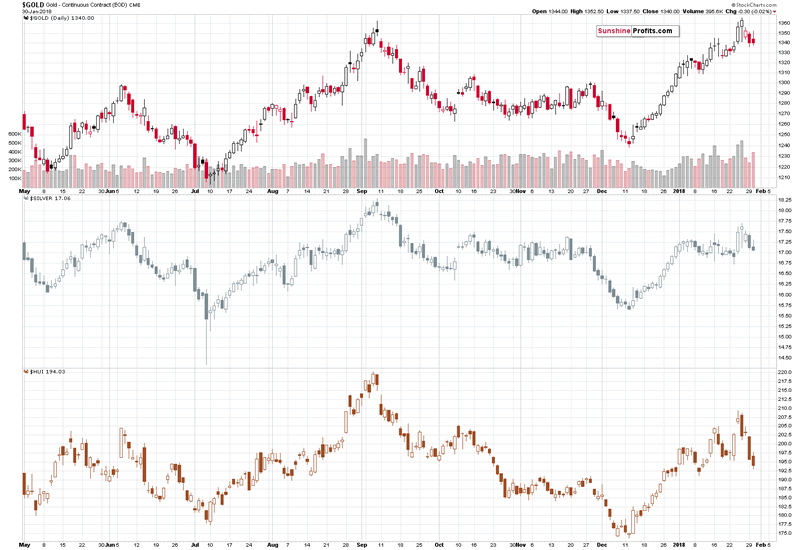

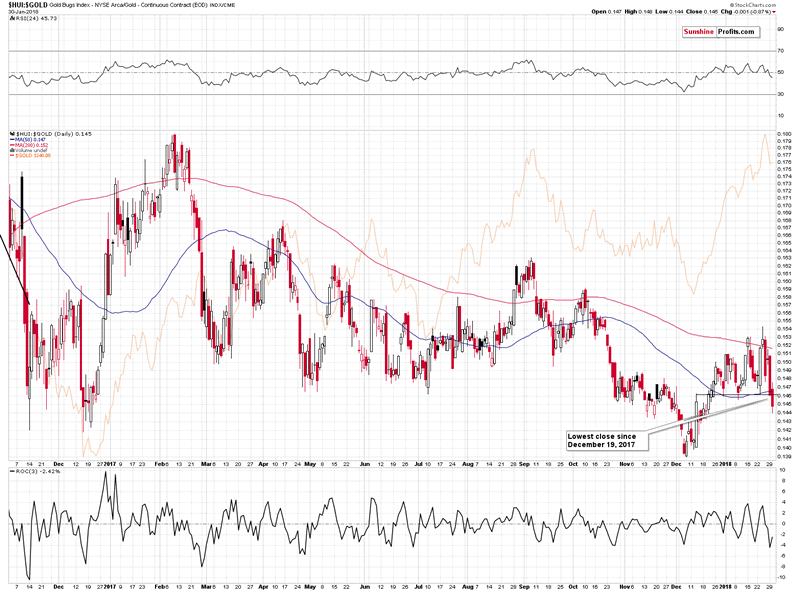

Still,it is not the decline in gold stocks by itself that’s so bearish. It’s itsrelationship with gold.

Bothof the above charts show that the underperformance of gold stocks is clearlyunderway. While gold closed yesterday’s session relatively nearby to theprevious closing prices, the HUIIndex once again closed visibly lower.

Consequently,we see another sizable move lower in the HUI togold ratio.The implications of this underperformance are bearish.

Havingdiscussed the short-term developments, let’s discuss the main topic of today’sanalysis – gold’s link with the main stock indices.

Whatabout Gold and Stock Market?

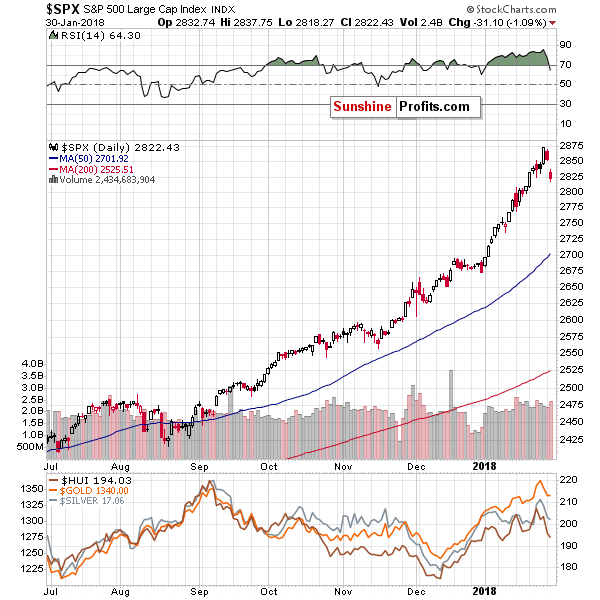

Let’sstart with the stock market itself. As Paulcorrectly expected, the general stock market plunged. Does this markthe start of a 2008-like decline? Time will tell, but the thing that we wouldlike to discuss today is what could take place in the precious metals market ifa bigger decline is indeed seen in stocks (not necessarily as big as in 2008).

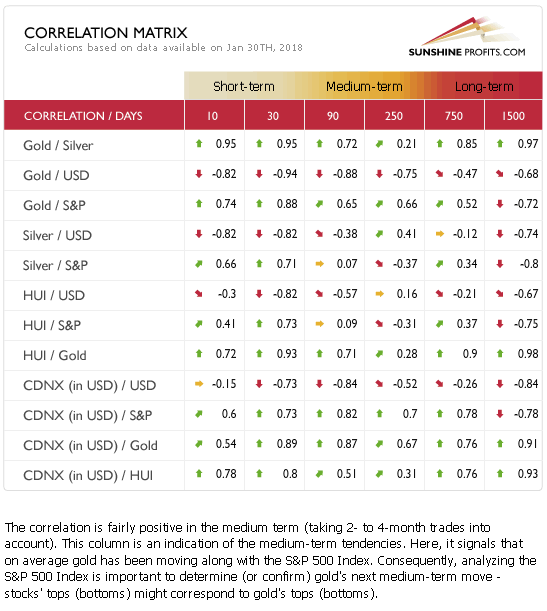

Let’sstart with looking at the correlations, using our CorrelationMatrix.

Theabove description is for the 90-trading-day column and the Gold / S&P 500row. Indeed, the correlation in the past 90 trading days was rather positive,but the strength of the link is nothing to call home about. It’s more visiblein the case of the past 30 trading days as both markets moved in tune (mostlyrallying). So far there’s nothing that would indicate a negative relationshipbetween stocks and gold – in fact, it seems that stocks could rally and declinealong with gold in the coming months.

Thelongest analyzed time-frame, however, (1500 trading days) shows visiblynegative correlation. No wonder – in the past 6 years gold moved lower, whilestocks moved higher.

Thisgives us an indication that the general rule that we presented in the openingparagraph of today’s analysis may be true and the money that will flow out ofthe stock market will move into precious metals. But, it may take years for the process to materialize.It’s pointless to expect this to be of any help in the short- or medium term.Even a yearly decline might not be enough for the above factor to kick in.

Beforemoving further please note that the link between gold and the USD index is muchmore stable, especially in the short term. Consequently, if gold and stocks areboth affected by a move in the USD, then this will be the key driver for gold.A move in the stock market would, in this case, be a result and not the cause.Given the current situation in the USD Index, the above scenario seems to belikely.

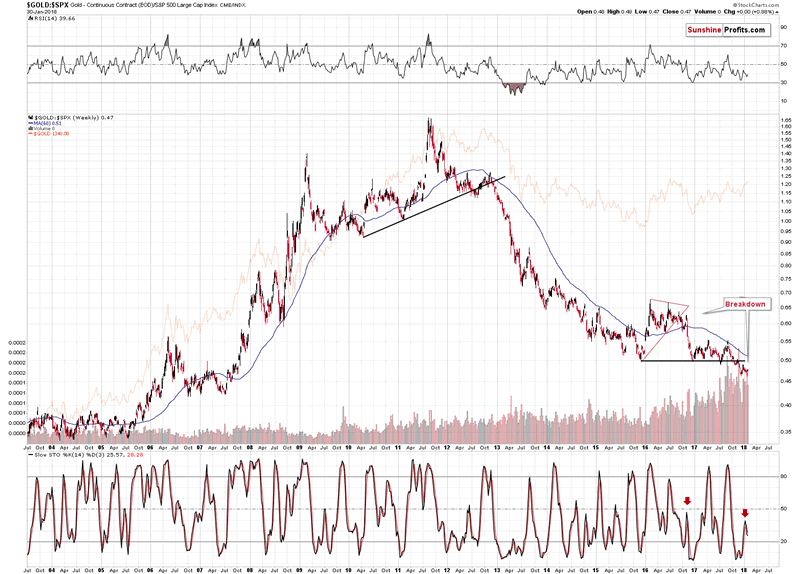

Wedescribed the detailsbehind the gold to S&P 500 ratio on Monday and these commentsremain up-to-date. Today we would like to add that even if stocks declinefaster than gold, then there’s still room for the ratio to move higher beforeit changes anything regarding the outlook for both the ratio and the price ofgold.

Butwill the ratio rally at all? Back in 2008 during the decline, the ratio movedin tune with gold, not against it – at least in the first part of the decline.

Allin all, based on the factors that we have discussed so far, it seems that thelink between gold and the general stock market is somewhat unclear.

Thisbrings us to the most important part of today’s gold –S&P 500 Index analysis. This part will make the link muchclearer, but not in the way many gold investors would expect.

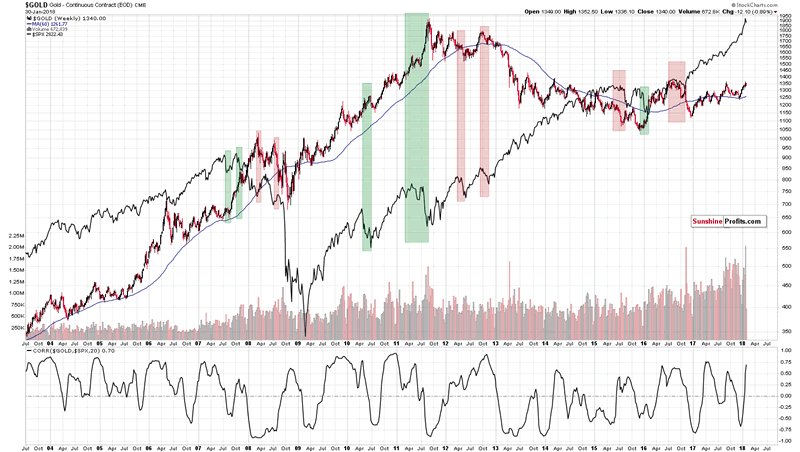

Theabove chart features gold (candlesticks) along with the S&P 500 Index(solid black line). We marked the bigger declines in the latter withsemi-transparent rectangles.

Thegreen rectangles represent cases when gold rallied during a decline in thestock market and the red rectangles represent cases when gold declined alongwith the stock market.

What’sone thing that – right from the start – differentiates between the above twokinds of reaction? Autocorrelation. Autocorrelation is a fancy way of sayingthat what happens first, makes the same reaction likely, which makes thefollow-up to the follow-up likely to be the same as well – and so on. In otherwords, the way gold initially reacted tothe decline in the S&P 500 was the way in which it kept on reacting in thefollowing weeks and – sometimes – months.

Whatkind of price action did we see yesterday and on Monday? The S&P declinedalong with gold. So, what’s the likely impact that a declining stock market isgoing to have on the precious metals market? It’s likely going to be negativein the following weeks and – perhaps – months.

Summingup, the USD’s epic turnaround along with gold’s extraordinary weakness relativeto the USD’s intraday decline along with multiple bearish confirmations paint avery bearish picture for the precious metals market for the following weeks.The situation was very bearish for PMs based on the above, but therecord-breaking weekly volume in gold took the bearishness to a new – even moreextreme – level. This week’s very significant underperformance in gold stocks servesas a perfect bearish confirmation.

Thedeclining stocks market is often viewed as something that could trigger a rallyin gold, but it doesn’t seem that it will be the case in the following weeks.Conversely, it seems likely that declining stock market will have negativeimpact on the precious metals sector.

If you enjoyed the above analysis and would like toreceive free follow-ups, we encourage you to sign up for our gold newsletter –it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. Ifyou sign up today, you’ll also get 7 days of free access to our premium dailyGold & Silver Trading Alerts. Signup now.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.