Political risk seen on the rise in these key mining markets

Image: Everett Collection | Shuttersock.com

Low commodity prices will continue to be one of the main drivers of political risk for investors this year in major producing countries across Africa and Latin America, a new report suggests.

According to the 2016 Political Risk Outlook, released Friday by Verisk Maplecroft, there will be little respite for investors from the political instability, civil unrest, economic volatility, security crises and geopolitical rivalries that defined the last 12 months.

The experts see Africa and the Middle East -particularly rising tensions between Iran and Saudi Arabia- as one major source of potential crisis.

Verisk Maplecroft expect more strikes and other industrial actions this year in several resource-rich countries, such as DRC and Zambia, following the massive job losses experienced last year.

The impacts of depressed oil, gas and metals prices on domestic government spending and rising living costs across the region, in turn, are likely to stoke social turmoil, the experts say.

"The fact that 31 of sub-Saharan Africa's 49 countries already fall within the high' or extreme' risk category of Verisk Maplecroft's Civil Unrest Index 2016 underscores the threat of disruption for companies operating in these markets," the reports warns. Countries to watch in the region, say the experts, are Central African Republic, Sudan, Kenya, Ethiopia, DRC, South Africa and Nigeria.

Corruption in Latin America

The end of the commodities boom that fuelled Latin America's decade-long growth has laid bare the profligacy of South America's two largest economies, Brazil and Argentina, as well as the region's largest oil producer, Venezuela, says the report.

Lower commodity prices, coupled with chronic economic mismanagement, dealt heavy electoral losses to the ruling parties of Argentina and Venezuela in late 2015. Both countries will experience a rise in political instability as they make the painful adjustments necessary to get back on a more sustainable growth track.

In Brazil, corruption and economic recession will dominate the political landscape. The ongoing impeachment process against President Dilma Rousseff is unlikely to be successful, but it will ensure protracted legislative gridlock during 2016 and prevent the passage of the reforms required to arrest the deteriorating fiscal landscape and restore investor confidence. The mass anti-government protests witnessed in 2015 are set to continue and could spike in the run up to the summer Olympic Games in Rio de Janeiro.

The region's economic problems are compounded by social concerns over graft in 2016, increasing the risks of political and civil instability, as the newly formed lower middle class see their socioeconomic gains threatened or reversed. Verisk Maplecroft's Corruption Risk Index 2016 identifies Argentina, Colombia, Ecuador, Peru, Venezuela and Brazil as posing a high' or extreme' risk.

The analysts conclude that as the public finances of major commodity-producing countries are set to remain under intense strain in 2016, many of them will have to take unpopular fiscal tightening measures, which in turn will increase the risk of societal unrest.

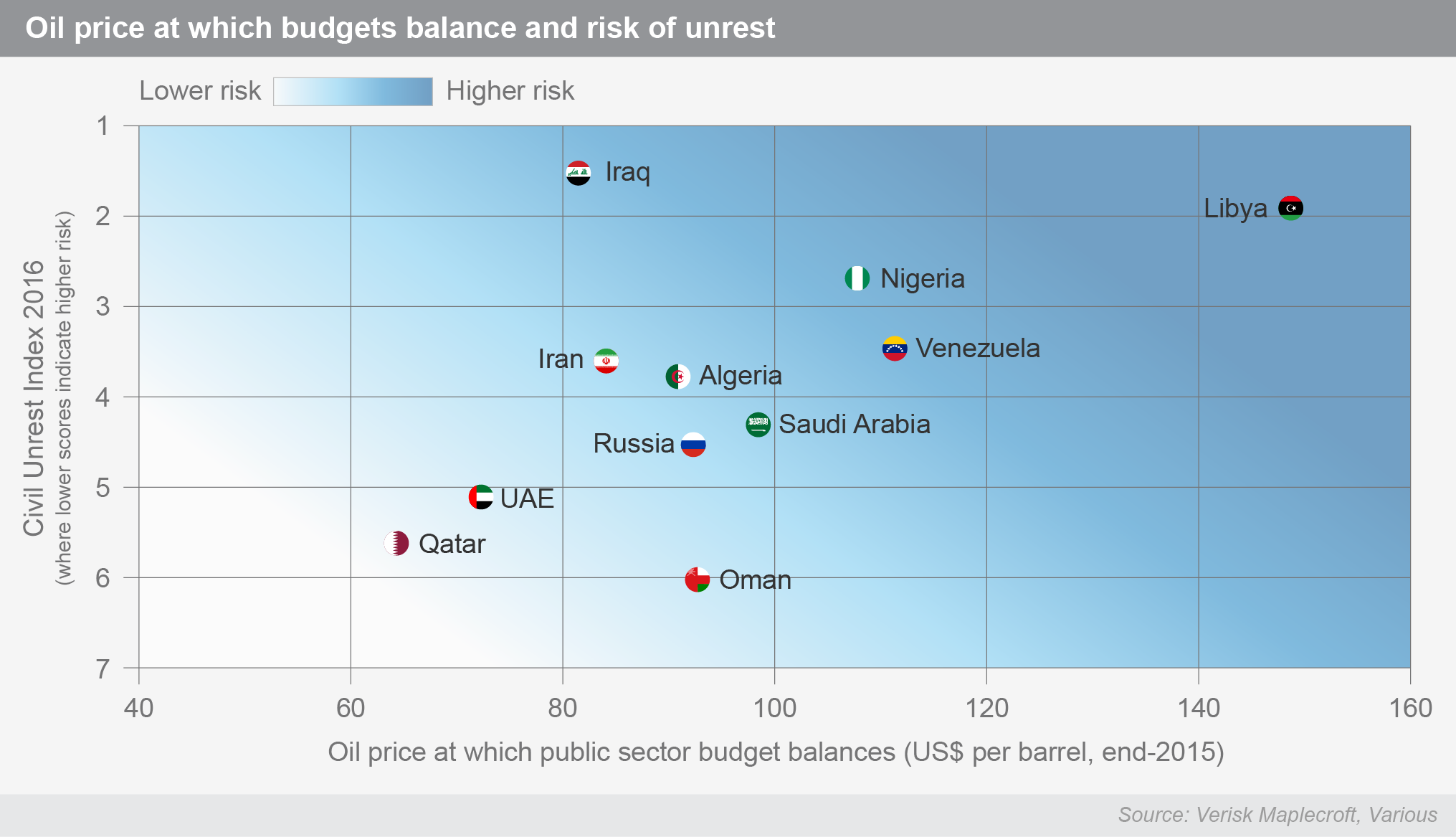

The figure shows the countries where Verisk Maplecroft thinks the risks of frustrations boiling over are greatest.