Pot stock insider sentiment remains weak

In our June Top 40 Report, Pot is out and peas are in, we noted that insider sentiment in the pot-stock heavy Pharmaceuticals industry was not sending a bullish signal and suggested more weakness or consolidation ahead for cannabis stocks. Since the report, the Horizons Marijuana Life Sciences ETF (HMMJ) is flat as of late Thursday morning. Meanwhile, the longer-term trend continues to look weak with the ETF trading below its 200-day moving average.

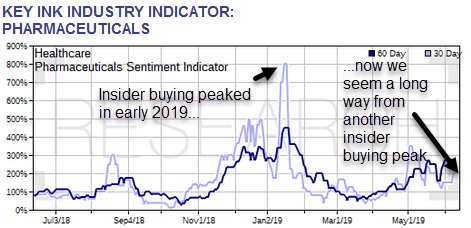

Insider sentiment does not suggest a reversal in the downward trend any time soon. Our 30-day Pharma Indicator has yet to put in a clear peak which would signal peak insider buying. Typically, peak buying coincides with stock price lows.

Our 30-day indicator confirmed an uptrend in stocks in January, but not now

We had a good example of the confirmation power of the 30-day indicator in early January when it peaked two months before the HMMJ hit its year-to-date high of $23.87 on March 19th. Indicator lows can also serve to warn of tops. So far, the recent bottom in the 30-day indicator seems to have been right on time.

Sentiment can change quite quickly among insiders in the group. For those playing in the space, it is worth keeping an eye on our 30-day Pharma Indicator's path.

An earlier version of this article appeared on INKResearch.com.