Powerful Lessons of Silver's Daily Reversals / Commodities / Gold & Silver 2019

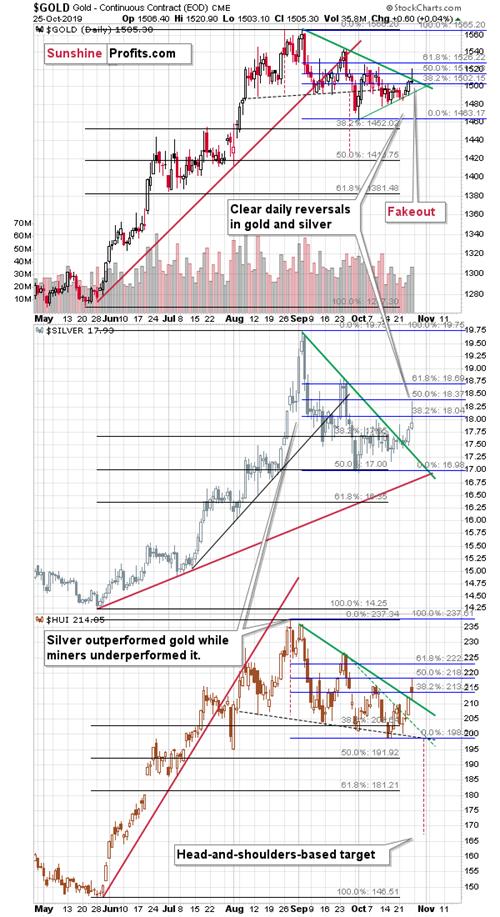

Friday’ssession was exceptional for several reasons and the most profound ones aregold’s and silver’s sizable intraday rally, and the subsequent slide. Thereversals that both metals created are practically screaming signs pointing towhat’s next. The way mining stocks behaved, and how gold closed relative to itsprevious tops also have important implications, but let’s start today’sanalysis with the former.

Friday’ssession was exceptional for several reasons and the most profound ones aregold’s and silver’s sizable intraday rally, and the subsequent slide. Thereversals that both metals created are practically screaming signs pointing towhat’s next. The way mining stocks behaved, and how gold closed relative to itsprevious tops also have important implications, but let’s start today’sanalysis with the former.

Silver,the less valuable (at least so far) of the most popular preciousmetals and many small investors’ metal of choice, reversed in a particularlymeaningful way.

Friday’sPMs Reversals

Allthree parts of the precious metals sector: gold, silver, and mining stocks (HUIis a proxy for goldstocks)moved to or above their respective 50% Fibonacciretracements based on the September – October declines, but only silver closed visibly belowthe 38.2% retracement. That’s one of the reasons why silver’sreversal was so important. Silver simply moved up and down the most. That’s far from itall, though. The big deal about thisreversal is how similar it is to what silver has done in the previous yearsafter similar reversals.

Yousee, silveris known to rally very high and outperform gold and mining stocks right before or whileforming a top (often creating a fake breakout a.k.a. fakeout), butit doesn’t necessarily happen on one day. Silver might rally for a day or a fewdays, when gold and miners are not doing much, or simply visibly less thansilver. At times, the above and the subsequent slide take place during the sametrading day, but it is not very common. This means that such sessions arerelatively easy to find among other days simply because they stand out.

Wewon’t be able to provide you with a complete list of silver’s profound dailyreversals, but we will feature some of them that should make you think at leasttwice before viewing the initial “strength” in the white metal as beinganything close to bullish.

Let’sstart the silver time machine and set it back to about three years ago. Whoosh!

Silver’sTimeless Reversals

We’renow in the second half of 2016. Precisely, at the beginning of July. Silverjust soared several dollars, but it reversed some of its daily gains. All silveranalysts are cheering as silver ended the session higher than the previous one, and thewhite metal gained a bit more on the following day. That was true, but theperceived – bullish – implications were entirely off. Silver had just reversedand that intraday high turned out to be the yearly high.

Beforedeclining in the most profound way (in October), silver flashed thedaily reversal once again, at the end of September. One could say that themid-August session was also a daily reversal, which also had bearishimplications for the following days and weeks.

Basedon what happened in 2016, it seems that silver’s daily reversals should atleast raise an eyebrow.

Let’sget back to the time machine. This time, we’re setting it to 2013. Whoosh!

It’smid-June 2013, and silver is after a steady decline. It just moved almost afull dollar higher during just one day, but it gave away most of these gainsbefore the session was over. The following session opened a bit higher, butsilver closed the day lower. And it declined on the next day. And the next onetoo. And then silver plunged almost $2 in just one day, only to decline somemore in the following days. And it all started with the daily reversal.

Thetake-away is that silver’s daily reversals might be worth more than just araised eyebrow.

Thetime machine still has some fuel left. Let’s get back one additional year. Whoosh!

It’sthe first day of October 2012 and silver just rallied to new highs,after rising about $12 in less than 2 months. Silver didn’t manage to holdthese intraday gains, and closed the day only a bit higher. The outlook seemedquite optimistic. But in reality, it was very, very, very far from that. Thedaily reversal marked the end of the volatile counter-trend rally, and startedthe decline that continued for years (in fact, the odds are that thismedium-term downswing continues up to this day). In other words, since thefirst day of October 2012, we haven’t seen silver prices at higher levels.

Allin all, silver’s daily reversals should do much more than just raise both ofone’s eyebrows, especially when they take place in October. They should make investorsprepare for much lower silver prices - if not immediately, then relativelyshortly. And we have just seen a profound daily silver reversal on Friday.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.