Pre-Earnings Bull Signal Sounds for SunPower Stock

SunPower pulled back to a historically bullish trendline ahead of tomorrow's earnings report

SunPower pulled back to a historically bullish trendline ahead of tomorrow's earnings report

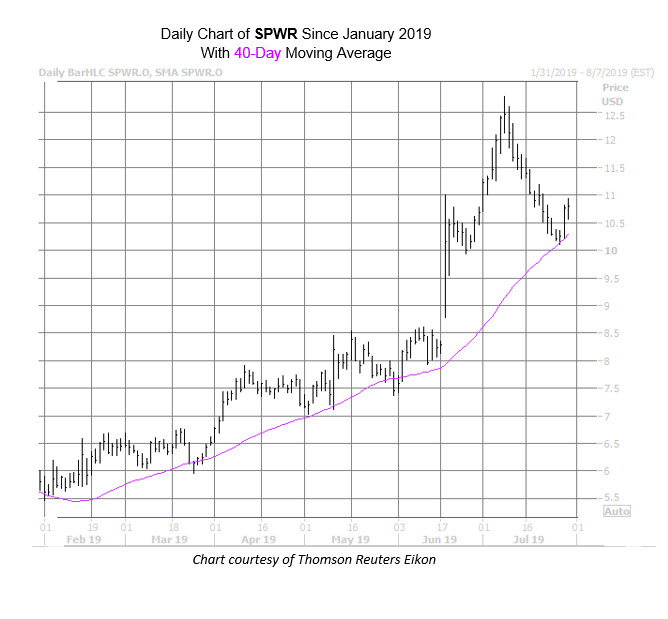

Solar energy concern SunPower Corporation (NASDAQ:SPWR) has been on a tear this year. The stock has gained roughly 117% so far in 2019, and just hit a nearly three-year high of $12.79 earlier this month. What's more, the equity landed on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks with a 50% year-over-year return. And while the stock has cooled ahead of the company's second-quarter earnings report, set for release tomorrow evening, a historically bullish signal just sounded that could propel SPWR even higher.

As we noted recently, SPWR shares tend to outperform on pullbacks to the 30-day moving average. Plus, new data from White shows that SPWR just came within one standard deviation of its 40-day moving average after a lengthy stretch atop the trendline. According to this data, six similar pullbacks have been made by the security in the last three years. One month later, the stock was higher 67% of the time, averaging an impressive 13.7% gain. Currently, the stock is perched at $10.79, and a move of similar magnitude would put SPWR right back below its recent peak, at $12.27.

SPWR'spost-earnings history might bode well for its next move, too, with the equity closing higher the day after earnings in five of the last eight quarters -- including the two most recent. The stock has averaged a 9.1% post-earnings swing over the past two years, regardless of direction, but this time the options market is pricing in an even wider return of 14.3% for Thursday's trading.

There's been plenty of chatter among the brokerage bunch ahead of SPWR's upcoming earnings release. Just yesterday, Credit Suisse lifted its target price to $8 from $7, saying the solar power name will likely benefit from a lowered discount rate and strong demand for the solar sector in Europe and Vietnam. Plus, CFRA raised its rating to "buy" from "hold." Prior to today, one analyst considered SunPower a "strong buy," while seven called it a "hold" or worse. Should more analysts change their tune, a round of upgrades could put even more wind at the equity's back.

Options players, on the other hand, have been leaning in a more optimistic direction. During the last 10 days, 7.38 calls have been bought to open for every put on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio sits in the 72nd percentile of its annual range, suggesting a much healthier appetite for bullish bets of late.