Precious Metals Resuming Bull Market, Gold, Silver, GDX Trend Forecasts 2021 / Commodities / Gold and Silver 2021

Gold and silver continue tobe bullish, the gold miners are mixed and bitcoin continues to outperform. Despitethe unprecedented events of 2020 the precious metals have had a positive year,the pandemic brought volatility to the market with a sharp drop followed by acontinuation of the upward trend that had begun before Covid disrupted ourlives.

Unprecendented globalliquidity since the pandemic has been the catalyst for much of the recent reflationin markets, Central Bank willingness to maintain ultra low rates, Governmentdeficits, stimulus packages and infrastructure projetcs are all adding torising markets.

Whilst Coronavirus is stillwith us it seems as though we are over the worst of it, with better testing andvaccines available to us, barring an unprecedented mutation it is unlikely toprovide no more than a mild headwind to investors as we head to the peak of theNorthern Hemisphere flu season.

The pandemic has done veryittle to alter the general long term trend of most markets and a weakeningDollar has helped the reflation process. Having said all of the above, therecent gold run began before the pandemic, investors were already concerned aboutthe state of the global economy before the end of 2019. Signs of a slowingeconomy became more pervasive many investors already had expectations ofcentral bank liquidity injections in 2020 prior to the pandemic.

As we come out of the crisiswe expect to see the full effects of the pandemic become more apparent, weexpect Central Banks and Governments to continue to add to liquidity in anattempt to regain lost ground, this will doubtless be good for the preciousmetals complex well in to 2021.

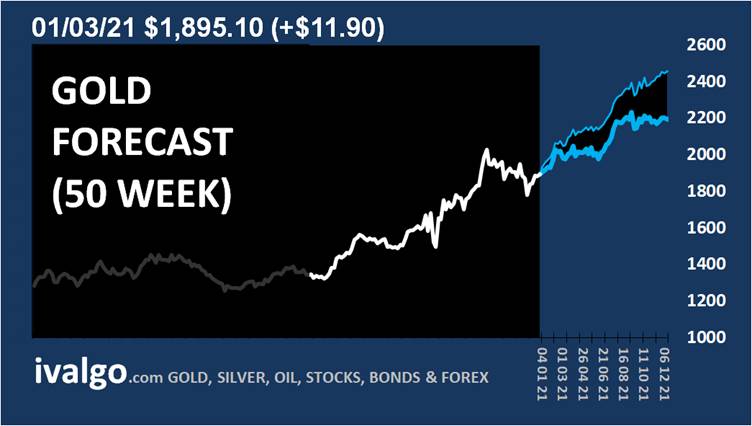

GOLD continues to be bullish on a weekly basis.

SILVER continues to be bullish on a weekly basis.

GDX continues to be bearish on a weekly basis.

VanEck Vectors GoldMiners ETF (GDX)

GDXJ has turned mildlybullish n a weekly basis.

VanEck Vectors Junior Gold Miners ETF (GDXJ)

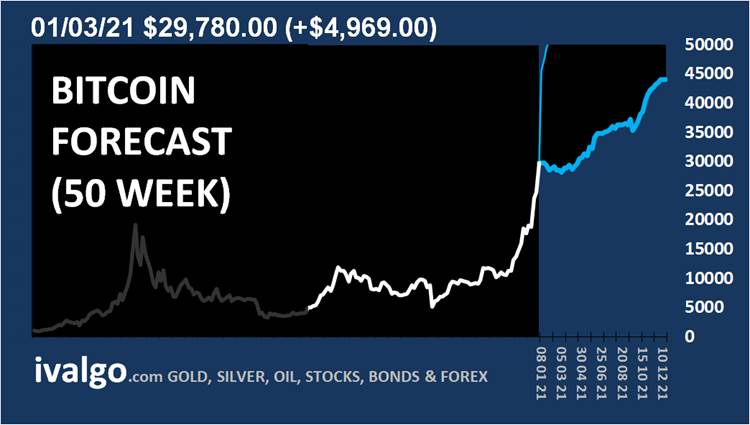

BITCOIN Continues to be bullish on a weekly basis.

BTC/USD - Bitcoin US Dollar

Ken Ticehurst

Founder www.Ivalgo.com

Ken Ticehurst is the publisher of forecasts for a wide rangeof markets at www.Ivalgo.com he has a BSC (Hons.) in Industrial Design anddecades of experience as a data analyst. Having used technical analysis duringover ten years of trading, he became frustrated with how backward looking it isand set about creating a logical mathematical approach to analysing futureprices.

Copyright 2021, Ken Ticehurst. All rights reserved.

Disclaimer: The aboveinformation is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to bereliable, but we cannot be responsible for losses should they occur as a resultof using this information. This articleis intended for educational purposes only. Past performance is never aguarantee of future performance.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.