Precious Metals Shine in August: Gold and Silver Surge Ahead / Commodities / Gold & Silver 2024

As the summer winds down, investors are keeping a close eye on the precious metals market. August proved to be a stellar month for both gold and silver, with gold prices rising a solid 3.5% and silver not far behind at 3.2%.

But what does the future hold? Well, according to Bank of America, the outlook is positively golden. In a recent note to clients, the bank stated, “We believe gold can hit $3,000/oz over the next 12-18 months…”. That’s a nice 20% move up from here. If silver holds its 3x typical ratio, that’s $50 silver, which we wrote on two weeks back.

Speaking of Bank of America, strategists have a bold prediction for investors: commodities are the way to go for the rest of the 2020s. In a recent note, they argue that a “commodity bull is just starting” due to a structural rise in inflation. “Commodities are a better bet than bonds for the rest of the 2020s.”

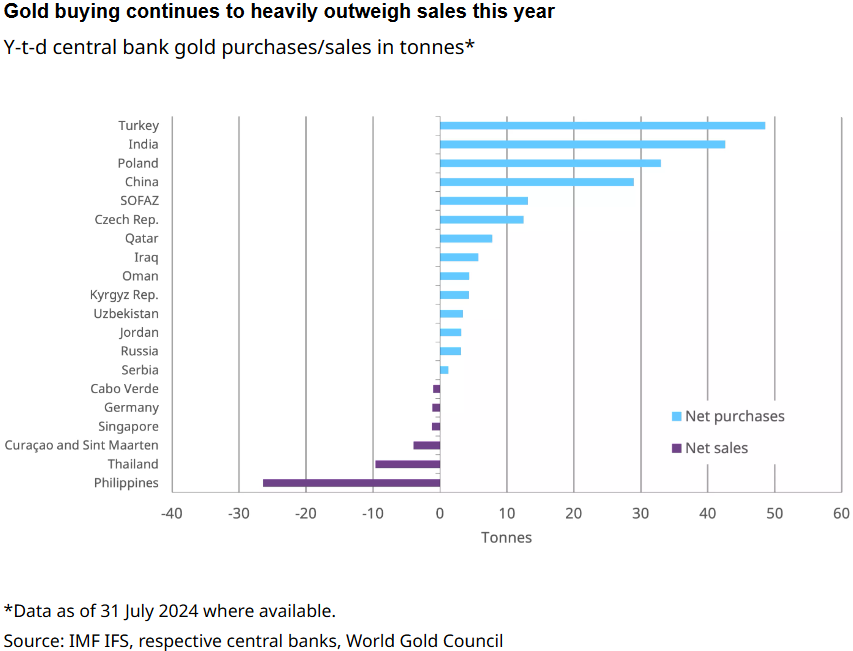

However, it’s not all smooth sailing ahead. Geopolitical tensions are heating up, and investors would be wise to keep a close watch on Turkey. So far this year, Turkey has purchased nearly 50 metric tonnes of gold, likely as a strategy to protect itself amid rising inflation and its recent application to join BRICS. This unique position—being a NATO member while also seeking ties with BRICS—adds an intriguing twist to the geopolitical chess game.

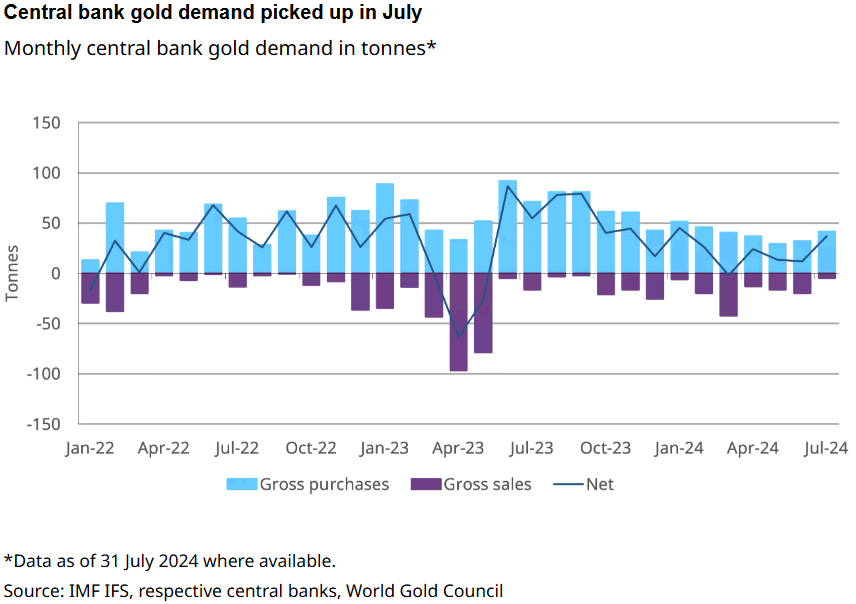

In the end, August proved that precious metals are still a force to be reckoned with. And with central banks doubling their net buying from June to a whopping 37 metric tonnes in July, it’s clear that the big players are still bullish on gold. So, keep your eyes peeled for more glittering gains in the months ahead.

Brandon Green

Neptune Global, Director of Sales

© 2024 Copyright Kelsey Williams- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.