Precise Benchmarks If the Selloff Continues

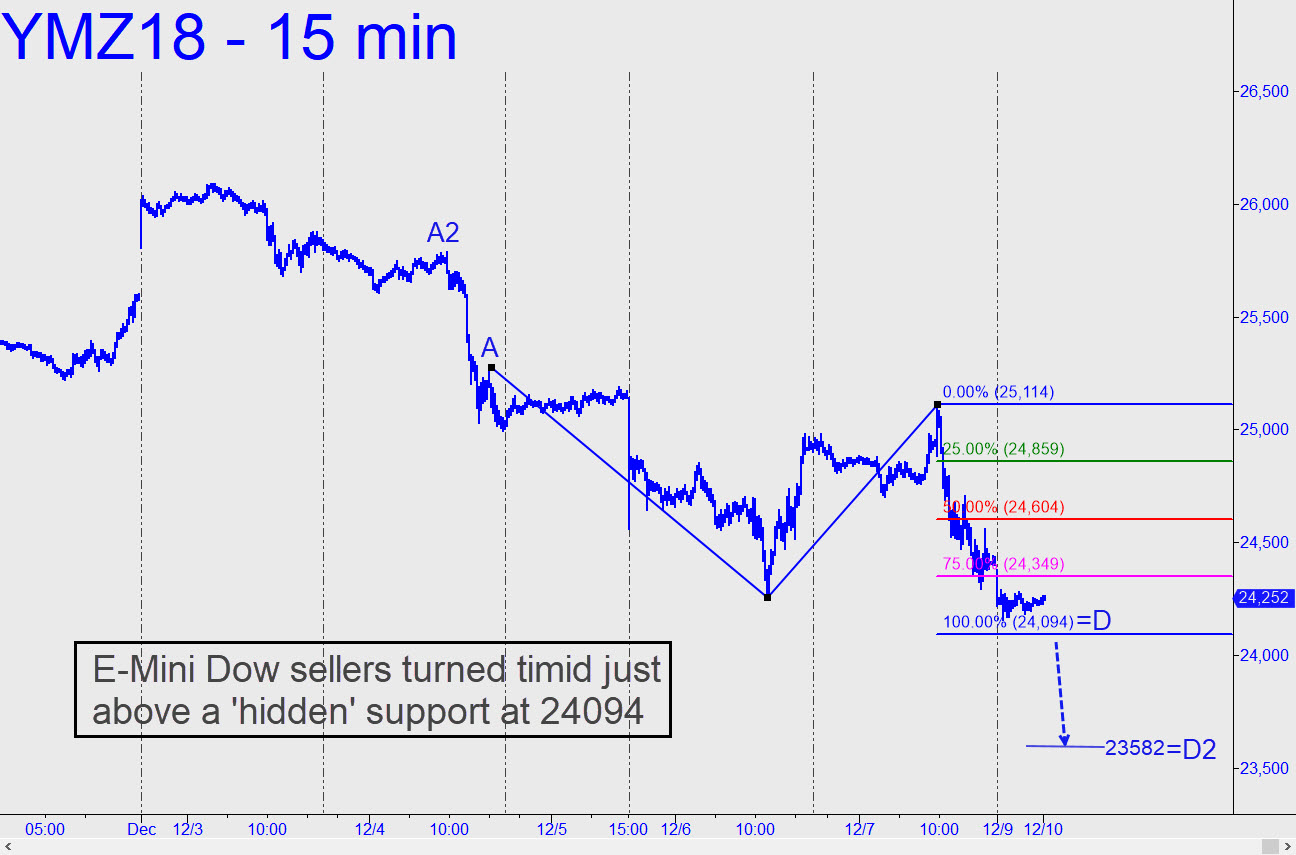

Index futures were groping for a bottom Sunday night, extending Friday's losses by about a 35% on light volume. DaBoyz will have a chance to exhaust sellers at somewhat lower levels, since the Mini-Dow and the Mini S&P were within easy distance of Hidden Pivot supports that lie, respectively, at 24094 and 2599.25. If neither holds, we'll shift our attention to market bellwether AAPL, which could fall as far as 160.23, a little more than $8 below current levels, if a 166.41 'secondary pivot' fails. As of midnight, sellers were backing off, presumably because they haven't forgotten the massive short-squeeze that hit stocks last Monday. Look for a test of the supports flagged above in any case, and assume the worst if they are easily breached. The next stop on the way down for the Mini-Dow would be 23582. If you don't subscribe but want a peak behind the headlines, click here for a free two-week trial to Rick's Picks. It will give you instant access to all features and services, including a 24/7 chat room where great traders from around the world share ideas that can help you make money.