Premier Gold Mines Limited (TSX-PG): A Gold Producer with a High-Quality Pipeline of Precious Metals Projects in North America; Interview with Ewan Downie, President and CEO

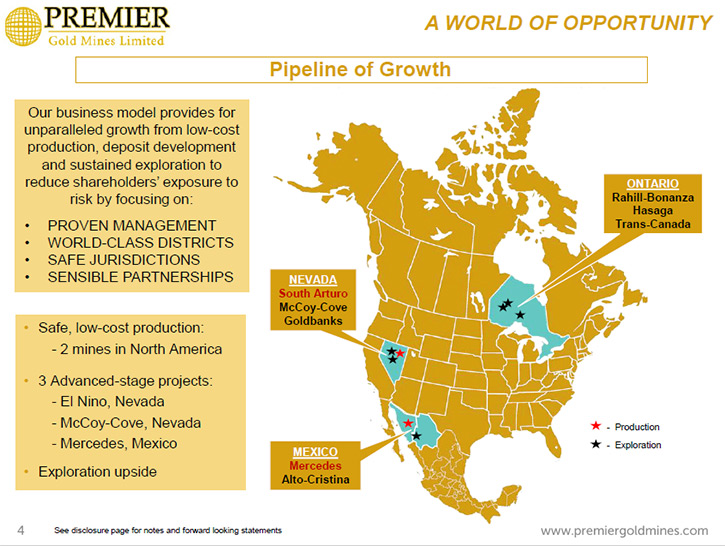

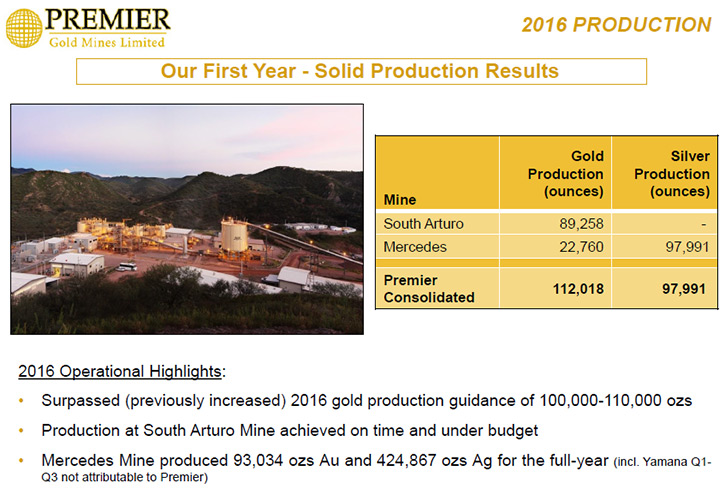

Premier Gold Mines Limited (TSX-PG) is a gold producer and respected exploration and development company, with a high-quality pipeline of precious metals projects in proven, accessible and safe mining jurisdictions in Canada, the United States, and Mexico. We learned from Ewan Downie, who is President and CEO of Premier Gold Mines that they have been producing for approximately six months. They operate two low-cost mines in North America, with solid production results surpassing production guidelines. According to Mr. Downie, Premier Gold is one of the highest margin producers in their sector and they can grow their future assets, without having to go to the market and issue shares. The company has never been in better shape than it is today. PDAC 2017: Ewan Downie, President and CEO of Premier Gold MinesDr. Allen Alper:This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Ewan Downie, who is Premier Gold Mines Limited President and CEO. You're the founder, as well, is that correct?Ewan Downie:Yeah, the company was founded by myself and a company called Wolfden Resources, and Premier was spun out of Wolfden. Back in 2006, if you were a shareholder in Wolfden, you got Premier for free. It's been a good growth story, since we went into production.Dr. Allen Alper:That's great. Could you give our readers an overview of Premier?Ewan Downie:Premier is now a producing gold mining company. We're fairly new as a producer, we've been producing for approximately six months now. I believe the market always viewed Premier as a solid exploration company, but we acquired two projects that are now in production, and we're looking to build a couple of more. I'd say we're one of the lowest cost producers, if not the lowest cost producer in our peer group. We're growing production and continuing great growth potential from our other assets as we continue to deliver with the exploration.

PDAC 2017: Ewan Downie, President and CEO of Premier Gold MinesDr. Allen Alper:This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Ewan Downie, who is Premier Gold Mines Limited President and CEO. You're the founder, as well, is that correct?Ewan Downie:Yeah, the company was founded by myself and a company called Wolfden Resources, and Premier was spun out of Wolfden. Back in 2006, if you were a shareholder in Wolfden, you got Premier for free. It's been a good growth story, since we went into production.Dr. Allen Alper:That's great. Could you give our readers an overview of Premier?Ewan Downie:Premier is now a producing gold mining company. We're fairly new as a producer, we've been producing for approximately six months now. I believe the market always viewed Premier as a solid exploration company, but we acquired two projects that are now in production, and we're looking to build a couple of more. I'd say we're one of the lowest cost producers, if not the lowest cost producer in our peer group. We're growing production and continuing great growth potential from our other assets as we continue to deliver with the exploration. Dr. Allen Alper:Could you tell us your costs?Ewan Downie:Our consolidated co-product all-in sustaining costs in 2016 were US$356/oz.Very high margin compared to a lot of companies.Dr. Allen Alper:That's outstanding. To what do you contribute your success?

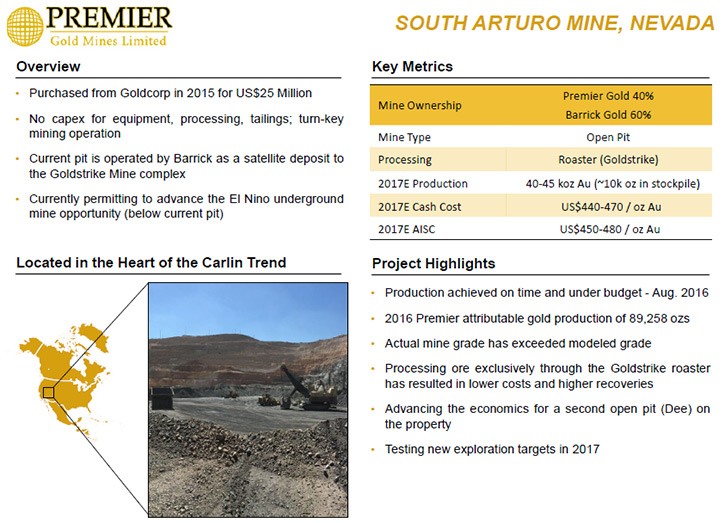

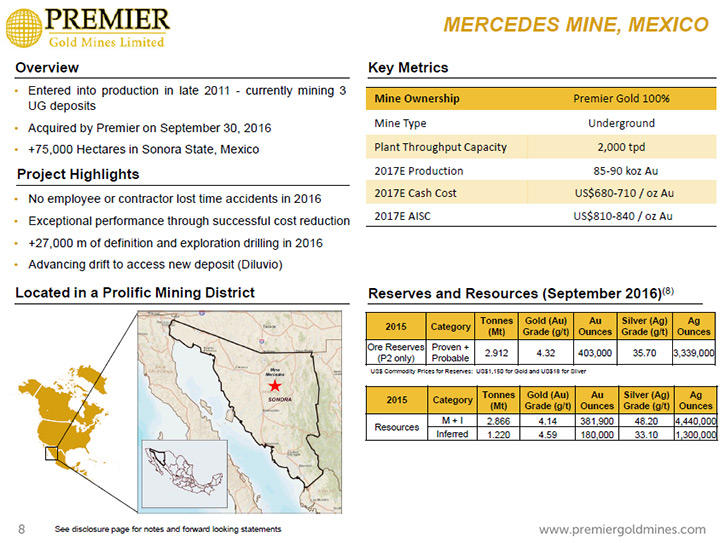

Dr. Allen Alper:Could you tell us your costs?Ewan Downie:Our consolidated co-product all-in sustaining costs in 2016 were US$356/oz.Very high margin compared to a lot of companies.Dr. Allen Alper:That's outstanding. To what do you contribute your success? Ewan Downie:The grades of our South Arturo mine in Nevada. It's an open pit, right beside Barrick Goldstrike Mine. It is open pit, plus five, six grams, so very high grade, and therefore very low cost. Mercedes was the second mine we produced, a little higher cost of production, because it's an underground mine, but still, it's producing at right around that $800 or less U.S., so it's a very strong performer. We expect in 2017 that our all-in sustaining costs for our company will be less than $700 an ounce U.S., where some of our peers are up in the $1,100 and 1,200 area.

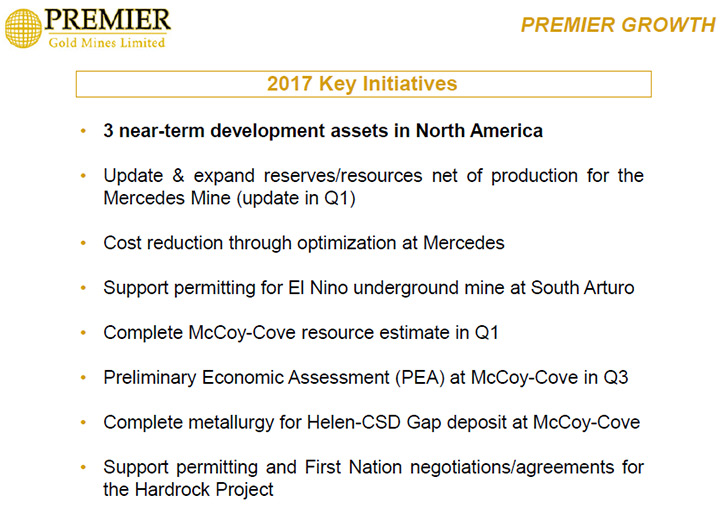

Ewan Downie:The grades of our South Arturo mine in Nevada. It's an open pit, right beside Barrick Goldstrike Mine. It is open pit, plus five, six grams, so very high grade, and therefore very low cost. Mercedes was the second mine we produced, a little higher cost of production, because it's an underground mine, but still, it's producing at right around that $800 or less U.S., so it's a very strong performer. We expect in 2017 that our all-in sustaining costs for our company will be less than $700 an ounce U.S., where some of our peers are up in the $1,100 and 1,200 area. Dr. Allen Alper:Could you tell me a bit about your reserves and resources?Ewan Downie:We have pretty substantial reserves and resources. Some of our biggest resources are undeveloped, as of yet. We have two open pit deposits in Ontario. The Hardrock deposit has reserves of 4.65 million ounces. That's 50% owned by ourselves, 50% by Centerra. Immediately below the pit, there's an additional four-plus million ounces, and just down the highway, we have a 600,000 ounce deposit, as well. There are well over 9 million ounces globally on that property alone. Our Red Lake project, the Hasaga deposit that we're drilling right now, is a 1.65 million ounce deposit, mainly open-pit, we're working in underground zone now. We released the big news for us on March, 24th on our new resource for the McCoy-Cove property in Nevada. It's what we view as our next development project for our company and we're quite excited by the discoveries we've made there. We're so excited about it.Dr. Allen Alper:That sounds great. What is the time table on that project?Ewan Downie:We released the resource on March, 24th for that property. We are going to do full metallurgy on the back of that. We should have the full network completed in the second quarter. In the third quarter with that metallurgy, we're going to do a preliminary economic assessment. It does have a permit to go underground, so assuming the numbers look good in that PEA, the preliminary economic assessment, we expect to start driving around underground as early as Q4 of this year. That will be an advanced project. It's a very high-grade, well-located in the Battle Mountain trend, underground deposit immediately beside an existing open-pit.

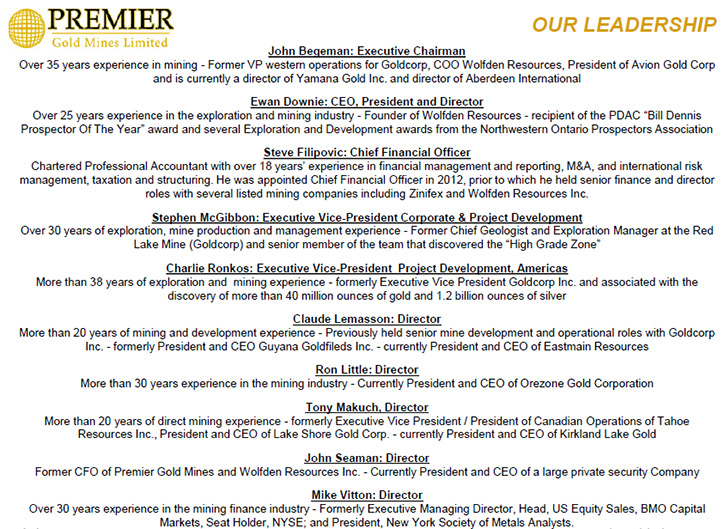

Dr. Allen Alper:Could you tell me a bit about your reserves and resources?Ewan Downie:We have pretty substantial reserves and resources. Some of our biggest resources are undeveloped, as of yet. We have two open pit deposits in Ontario. The Hardrock deposit has reserves of 4.65 million ounces. That's 50% owned by ourselves, 50% by Centerra. Immediately below the pit, there's an additional four-plus million ounces, and just down the highway, we have a 600,000 ounce deposit, as well. There are well over 9 million ounces globally on that property alone. Our Red Lake project, the Hasaga deposit that we're drilling right now, is a 1.65 million ounce deposit, mainly open-pit, we're working in underground zone now. We released the big news for us on March, 24th on our new resource for the McCoy-Cove property in Nevada. It's what we view as our next development project for our company and we're quite excited by the discoveries we've made there. We're so excited about it.Dr. Allen Alper:That sounds great. What is the time table on that project?Ewan Downie:We released the resource on March, 24th for that property. We are going to do full metallurgy on the back of that. We should have the full network completed in the second quarter. In the third quarter with that metallurgy, we're going to do a preliminary economic assessment. It does have a permit to go underground, so assuming the numbers look good in that PEA, the preliminary economic assessment, we expect to start driving around underground as early as Q4 of this year. That will be an advanced project. It's a very high-grade, well-located in the Battle Mountain trend, underground deposit immediately beside an existing open-pit. Dr. Allen Alper:That sounds excellent. Could you tell me a little bit about your background, your team, your board?Ewan Downie:Yeah, we made some big transformations with our board in the last few years. We were primarily a bunch of explorers on the board, and in the past several years, made some changes, so we have seven members. Four are mining engineers, or geological engineers, so we really transitioned to become a miner. Very solid teams. The CEO of Kirkland Lake, which is a large producer on our board, the CO of Orezone is on our board, as well. Solid mining people. Claude Lemasson, who ran the Red Lake mine, is on our board. We've a very strong board. Management team, we've made some real key additions to our management team. Charlie Ronkos joined us after decades of being with Glamis and Goldcorp. He's one of our top guys in Nevada. John Begeman, our Chairman and our top operations guy came to us from Goldcorp years ago and ran Avion that was taken out. Myself, I come from an exploration family. Grew up in mining and started the company Wolfden Resources in 1998. Wolfden was taken out in 2007, primarily a base-metal company. As I mentioned, Premier was spun out. I'm a former recipient of the Bill Dennis Prospector of the Year Award from the PDAC, which is one of the top exploration awards you can get for discoveries. I've been involved in many discoveries throughout my career. We're still making discoveries today.

Dr. Allen Alper:That sounds excellent. Could you tell me a little bit about your background, your team, your board?Ewan Downie:Yeah, we made some big transformations with our board in the last few years. We were primarily a bunch of explorers on the board, and in the past several years, made some changes, so we have seven members. Four are mining engineers, or geological engineers, so we really transitioned to become a miner. Very solid teams. The CEO of Kirkland Lake, which is a large producer on our board, the CO of Orezone is on our board, as well. Solid mining people. Claude Lemasson, who ran the Red Lake mine, is on our board. We've a very strong board. Management team, we've made some real key additions to our management team. Charlie Ronkos joined us after decades of being with Glamis and Goldcorp. He's one of our top guys in Nevada. John Begeman, our Chairman and our top operations guy came to us from Goldcorp years ago and ran Avion that was taken out. Myself, I come from an exploration family. Grew up in mining and started the company Wolfden Resources in 1998. Wolfden was taken out in 2007, primarily a base-metal company. As I mentioned, Premier was spun out. I'm a former recipient of the Bill Dennis Prospector of the Year Award from the PDAC, which is one of the top exploration awards you can get for discoveries. I've been involved in many discoveries throughout my career. We're still making discoveries today. Dr. Allen Alper:That's exciting, that's a great career and you've done a great job with your company.Ewan Downie:Yeah, I'm pretty proud of what we've done with Premier. Our share price, especially last year, was under some consistent pressure, and even the last week. I think as we continue to show ourselves as a solid producer that's margin wise, doing better than most or all of our peers, who are trading at multiples higher than we are in terms of price to NAV, I think there should be a good re-rate of Premier stock in 2017.Dr. Allen Alper:That sounds excellent. Could you tell me a little bit about your share structure?Ewan Downie:Currently we have just over 200 million shares outstanding. Several very large shareholders, Tocqueville is a large shareholder in Premier. Fidelity has been a shareholder with the company since our inception in 2006. Equinox, Orion, and Van Eck, who mainly invests through the ETF. Those five combined would probably be about 30% to 40% of our share position. I'm listed as one of the top 10 shareholders personally. I purchased almost half that position in the open market since we made the company.Dr. Allen Alper:That's great. Shows you really believe in your company and you're putting your money into it.Ewan Downie:Yes. I bought shares personally on Thursday last week, so I continue to add.Dr. Allen Alper:That's great. Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

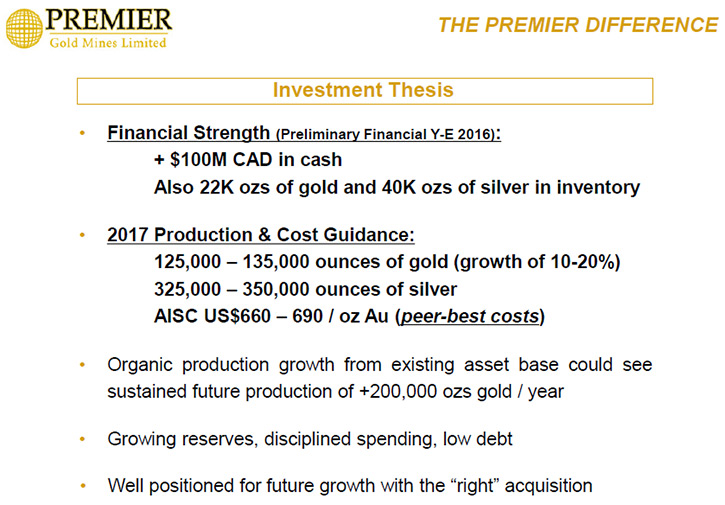

Dr. Allen Alper:That's exciting, that's a great career and you've done a great job with your company.Ewan Downie:Yeah, I'm pretty proud of what we've done with Premier. Our share price, especially last year, was under some consistent pressure, and even the last week. I think as we continue to show ourselves as a solid producer that's margin wise, doing better than most or all of our peers, who are trading at multiples higher than we are in terms of price to NAV, I think there should be a good re-rate of Premier stock in 2017.Dr. Allen Alper:That sounds excellent. Could you tell me a little bit about your share structure?Ewan Downie:Currently we have just over 200 million shares outstanding. Several very large shareholders, Tocqueville is a large shareholder in Premier. Fidelity has been a shareholder with the company since our inception in 2006. Equinox, Orion, and Van Eck, who mainly invests through the ETF. Those five combined would probably be about 30% to 40% of our share position. I'm listed as one of the top 10 shareholders personally. I purchased almost half that position in the open market since we made the company.Dr. Allen Alper:That's great. Shows you really believe in your company and you're putting your money into it.Ewan Downie:Yes. I bought shares personally on Thursday last week, so I continue to add.Dr. Allen Alper:That's great. Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company? Ewan Downie:Our financial results that came out in March, show we're one of the highest margin producers in our sector. We own Premier because we have a great suite of operations. We have significant growth internally from our assets. We expect to be developing McCoy-Cove this year. We're potentially starting an underground operation with Barrick at South Arturo. We continue to deliver, with new discoveries, at the recently acquired Mercedes mine. We believe that will be a long-term mine. It's a company that has high margin on ounces, generating significant cash that can grow our future assets, without necessarily having to go to the market and issue shares, like a lot of other companies continue to do. Financially, I'd say our company has never been in better shape than it is today.

Ewan Downie:Our financial results that came out in March, show we're one of the highest margin producers in our sector. We own Premier because we have a great suite of operations. We have significant growth internally from our assets. We expect to be developing McCoy-Cove this year. We're potentially starting an underground operation with Barrick at South Arturo. We continue to deliver, with new discoveries, at the recently acquired Mercedes mine. We believe that will be a long-term mine. It's a company that has high margin on ounces, generating significant cash that can grow our future assets, without necessarily having to go to the market and issue shares, like a lot of other companies continue to do. Financially, I'd say our company has never been in better shape than it is today.  Dr. Allen Alper:That sounds fantastic. Excellent reasons to consider investing. Sounds like you took an opportunity yourself on Thursday, so that's great. What are your thoughts on what's going to happen with gold?Ewan Downie:I think we're surely set up for a perfect storm. I believe that any way that the U.S. economy goes going forward, all of the plans that the new Trump administration wants to do are actually positive for gold. If they're going to do big infrastructure spends, there could be subsequent quantitative easing starting to happen in the U.S. again. Printing more cash is good for gold. I think raising interest rates, in my opinion, is actually longer term very positive for gold, because as we start to see more and more inflation build in, I think that will be the real generator of a steady, persistent, next wave of growth in the price of gold.Dr. Allen Alper:That sounds like very good insight. Is there anything else you'd like to add, Ewan?Ewan Downie:No, just thanks for interviewing us. I'd be happy to stay in touch. Anybody, who wants to talk mining and see how we're doing, is welcome to visit the company's website or phone our office. We try to make the executives of our company very accessible to anybody who calls. Dr. Allen Alper:That's excellent. I'm very impressed with the work you're doing. I've been following you for some time.Ewan Downie:Thank you.Dr. Allen Alper:Great talking to you. I'm glad we got together. https://www.premiergoldmines.com/Ewan Downie, President & CEO Phone: 807-346-1390 Fax: 807-346-1381 e-mail: Info@premiergoldmines.com

Dr. Allen Alper:That sounds fantastic. Excellent reasons to consider investing. Sounds like you took an opportunity yourself on Thursday, so that's great. What are your thoughts on what's going to happen with gold?Ewan Downie:I think we're surely set up for a perfect storm. I believe that any way that the U.S. economy goes going forward, all of the plans that the new Trump administration wants to do are actually positive for gold. If they're going to do big infrastructure spends, there could be subsequent quantitative easing starting to happen in the U.S. again. Printing more cash is good for gold. I think raising interest rates, in my opinion, is actually longer term very positive for gold, because as we start to see more and more inflation build in, I think that will be the real generator of a steady, persistent, next wave of growth in the price of gold.Dr. Allen Alper:That sounds like very good insight. Is there anything else you'd like to add, Ewan?Ewan Downie:No, just thanks for interviewing us. I'd be happy to stay in touch. Anybody, who wants to talk mining and see how we're doing, is welcome to visit the company's website or phone our office. We try to make the executives of our company very accessible to anybody who calls. Dr. Allen Alper:That's excellent. I'm very impressed with the work you're doing. I've been following you for some time.Ewan Downie:Thank you.Dr. Allen Alper:Great talking to you. I'm glad we got together. https://www.premiergoldmines.com/Ewan Downie, President & CEO Phone: 807-346-1390 Fax: 807-346-1381 e-mail: Info@premiergoldmines.com