Premier Gold Mines Ltd (TSX: PG): Gold Producer, with High-Quality Pipeline of Precious Metal Projects in World Class Districts; Interview with Ewan Downie, President and CEO

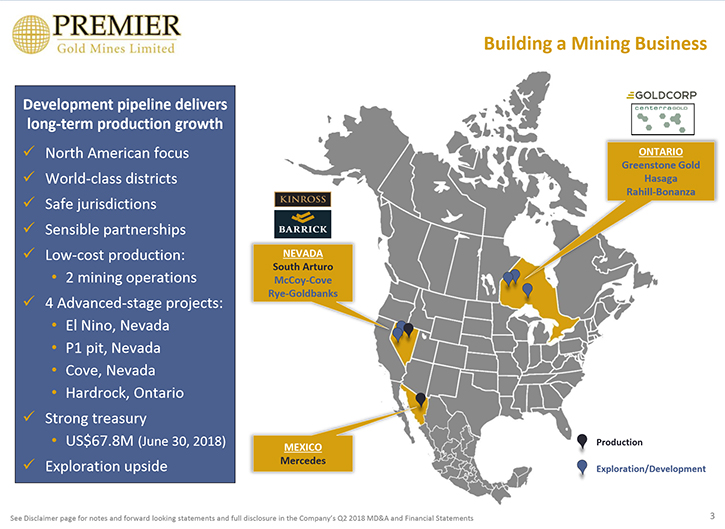

Premier Gold Mines Limited (TSX:PG) is a gold producer, with a high-quality pipeline of precious metal projects in proven, accessible and safe mining jurisdictions in Canada, the United States, and Mexico. The goal is to evolve into a low-cost, mid-tier gold producer, through its two producing mines and the development of its Hardrock Project in Ontario (Greenstone Gold JV) and McCoy-Cove Property in Nevada, where permitting and pre-construction initiatives are well advanced. We learned from Ewan Downie, President and CEO of Premier Gold Mines, that their 100% owned Mercedes Mine, in Mexico, produces around 80,000 ounces of gold a year. Premier also has 40% ownership in the South Arturo Mine, a highly successful joint venture with Barrick in the Carlin Trend. The South Arturo Mine's 2018 operational guidance is 15,000 to 20,000 ozs Au at all-in sustaining costs of US$620 - $670/oz Au. We learned from Mr. Downie, that their key objectives in 2019 are the build outs of the Phase One Open Pit Mine, and the El Nino Underground Mine, at their South Arturo joint venture. Other plans for 2019, include updating reserves and resources at South Arturo and Mercedes, and initiating the underground project at Cove. According to Mr. Downie, Premier's management team has a good track record, in the industry, and its portfolio of projects is unrivaled amongst the smaller producers. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ewan Downie, President and CEO of Premier Gold Mines Limited. Ewan, could you give our readers/investors an overview of your Company, your focus and current activities?Ewan Downie:Certainly. Premier is a diversified producer with all of its operations situated within North America. Our company also holds a series of advanced stage projects that we expect will be our next development and mining projects. Our portfolio of projects are situated in some of the top mining districts of North America, including the famed Red Lake District, the Carlin Trend of Nevada, the Battle Mountain Trend in Nevada, and Sonora State, Mexico.

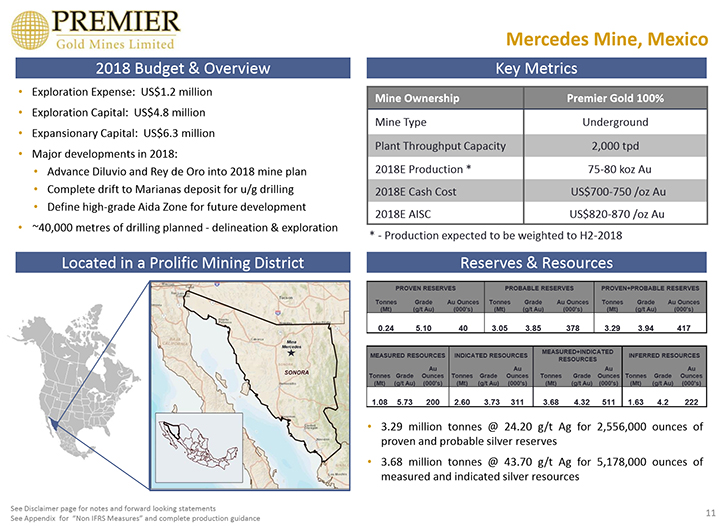

Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ewan Downie, President and CEO of Premier Gold Mines Limited. Ewan, could you give our readers/investors an overview of your Company, your focus and current activities?Ewan Downie:Certainly. Premier is a diversified producer with all of its operations situated within North America. Our company also holds a series of advanced stage projects that we expect will be our next development and mining projects. Our portfolio of projects are situated in some of the top mining districts of North America, including the famed Red Lake District, the Carlin Trend of Nevada, the Battle Mountain Trend in Nevada, and Sonora State, Mexico.  Allen Alper:Those are great areas to be in. A lot of gold there. Ewan Downie:Yes, and we are situated in several of the best places to mine gold in the world.Allen Alper:Excellent. Could you tell our readers/investors a bit more about your operations, the pipeline and a little bit more about your exploration activities?Ewan Downie:Our two mining projects are located in Mexico and the US. We own a 100 percent in the Mercedes Mine in the Senora state of Mexico.Mercedes expected to be a steady 70 to 90,000 ounce a year producer that has been in operation since 2011. We purchased the property from Yamana just over two years ago.

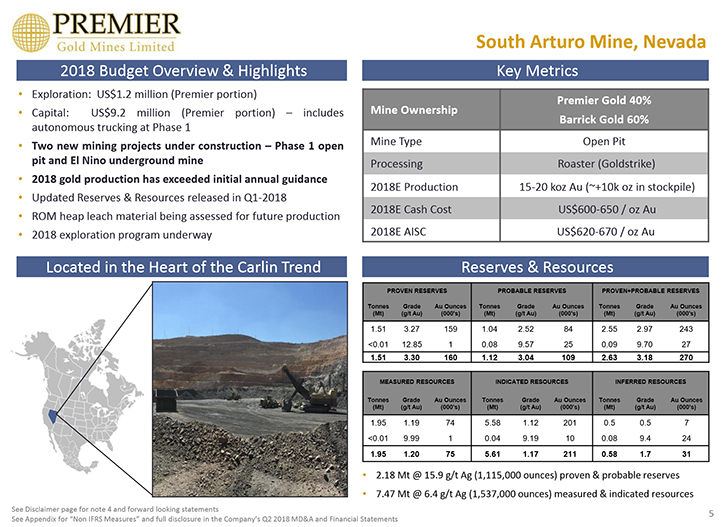

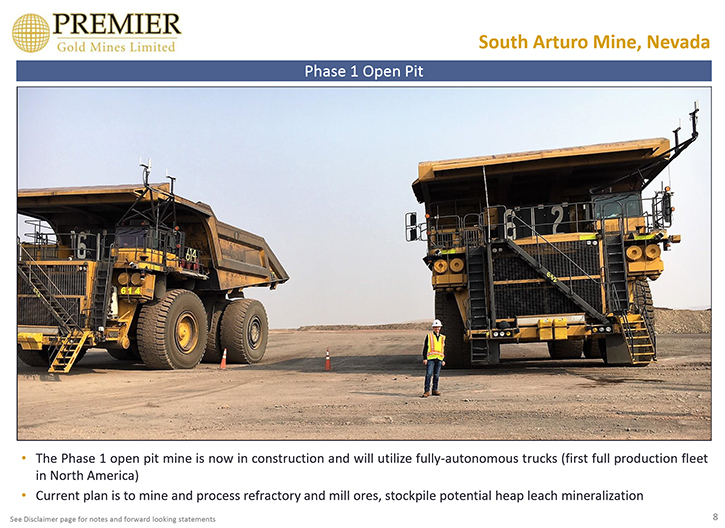

Allen Alper:Those are great areas to be in. A lot of gold there. Ewan Downie:Yes, and we are situated in several of the best places to mine gold in the world.Allen Alper:Excellent. Could you tell our readers/investors a bit more about your operations, the pipeline and a little bit more about your exploration activities?Ewan Downie:Our two mining projects are located in Mexico and the US. We own a 100 percent in the Mercedes Mine in the Senora state of Mexico.Mercedes expected to be a steady 70 to 90,000 ounce a year producer that has been in operation since 2011. We purchased the property from Yamana just over two years ago.  We also have a 40% ownership in the South Arturo Mine, which has been a highly successful development project for us in the Carlin Trend with Barrick. Barrick is the operator, the ore is mined by the Goldstrike Mine Team and processed at the Goldstrike Mine site. We just completed mining the Phase Two Open Pit and are now building two new mines on that property, the Phase One Open Pit, and the El Nino Underground Deposit.El Nino is the down-plunge extension of the Phase Two pit. In addition to that, we're drilling several highly perspective targets in and around the mine, looking to extend the mine life through drilling. In addition to our two mine projects, we continue to advance the Cove deposit, part of our McCoy-Cove property package, in the Battle Mountain Trend.Cove is in the advanced stages of permitting for a planned underground development program to advance the project to feasibility and ultimately, we hope, production. We're hoping that it will be one of our next mines developed in our portfolio. The Cove Deposit itself sits as one of the highest grade undeveloped gold deposits in North America, with a grade of over 11 grams per ton.

We also have a 40% ownership in the South Arturo Mine, which has been a highly successful development project for us in the Carlin Trend with Barrick. Barrick is the operator, the ore is mined by the Goldstrike Mine Team and processed at the Goldstrike Mine site. We just completed mining the Phase Two Open Pit and are now building two new mines on that property, the Phase One Open Pit, and the El Nino Underground Deposit.El Nino is the down-plunge extension of the Phase Two pit. In addition to that, we're drilling several highly perspective targets in and around the mine, looking to extend the mine life through drilling. In addition to our two mine projects, we continue to advance the Cove deposit, part of our McCoy-Cove property package, in the Battle Mountain Trend.Cove is in the advanced stages of permitting for a planned underground development program to advance the project to feasibility and ultimately, we hope, production. We're hoping that it will be one of our next mines developed in our portfolio. The Cove Deposit itself sits as one of the highest grade undeveloped gold deposits in North America, with a grade of over 11 grams per ton.  Lastly, we are also permitting the largest deposit in our portfolio, the Hardrock deposit (Greenstone Gold), which between open pit and underground in all categories is host to approximately nine million ounces of gold. Our Greenstone team is in the very advanced stages of permitting making Hardrock one of the most advanced, near-permitted, multi-million ounce development projects in North America.We have also not lost site on exploration and continue to advance a portfolio of exploration projects in Red Lake and Nevada. Allen Alper:Sounds excellent. Could you give our readers/investors more information on your total resources and reserves?Ewan Downie:It's quite large now, it's been a constantly growing number. Reserves for our company now stand at well over 2.5 million ounces. We have over 3.5 million ounces of M+I resources and another +3.5 million ounces of InferredAllen Alper:That sounds excellent. That's a huge amount of reserves and resources. And you're continuing to build on those with your drilling programs and explorations. Could you tell our readers/investors your key objectives in 2019? Ewan Downie:Our key objectives in 2019 are the mine construction projects at our South Arturo joint venture. These will be important for our future growing production profile as those two new mines ramp up into production. What excites us so much about this project is that the costs are amongst the lowest in the industry. The Phase Two Pit produced at $351 an ounce in 2017.

Lastly, we are also permitting the largest deposit in our portfolio, the Hardrock deposit (Greenstone Gold), which between open pit and underground in all categories is host to approximately nine million ounces of gold. Our Greenstone team is in the very advanced stages of permitting making Hardrock one of the most advanced, near-permitted, multi-million ounce development projects in North America.We have also not lost site on exploration and continue to advance a portfolio of exploration projects in Red Lake and Nevada. Allen Alper:Sounds excellent. Could you give our readers/investors more information on your total resources and reserves?Ewan Downie:It's quite large now, it's been a constantly growing number. Reserves for our company now stand at well over 2.5 million ounces. We have over 3.5 million ounces of M+I resources and another +3.5 million ounces of InferredAllen Alper:That sounds excellent. That's a huge amount of reserves and resources. And you're continuing to build on those with your drilling programs and explorations. Could you tell our readers/investors your key objectives in 2019? Ewan Downie:Our key objectives in 2019 are the mine construction projects at our South Arturo joint venture. These will be important for our future growing production profile as those two new mines ramp up into production. What excites us so much about this project is that the costs are amongst the lowest in the industry. The Phase Two Pit produced at $351 an ounce in 2017.  The second highlight going into the new year is updated reserves and resources for both mines, following a fairly extensive drill program this year. Lastly, the third real catalyst we see next year is the initiation of the underground project at Cove, which will hopefully lead us to a full feasibility study and ultimately to production. Allen Alper:That sounds exciting. 2019 is going to be a great year. That's excellent. Ewan Downie:Yes, 2019 should be a pretty exciting year for the Company. Allen Alper:That's great. Could you tell our readers/investors more about your operations and results?Ewan Downie:Last year we produced more than a hundred thousand ounces in production and Premier was one of the highest cash-flowing companies amongst the smaller producers.This cash flow was due in large part to the success of our Phase Two Mine project at South Arturo. That initial mine is now depleted, as we finished mining Phase 2 last year.This year we are processing some of the remnants, stockpiled from that operation and have commenced the construction of an underground mine from the bottom of that pit. That underground mine is expected to come back into production next year, so 2018 sees a bit of a dip in terms of production. However, in the years 2019, 2020, 2021, forward, we expect to be a company with a significant growth profile in terms of annual production. A large part of that coming from South Arturo. Allen Alper:That sounds excellent. Could you tell our readers/investors about your background? I know you are well recognized, with award-winning accomplishments.Ewan Downie:Yes, Premier and I have been involved in a number of awards. I came into the industry basically through family, my father was a Geologist. I started my first public company in the very late 1990s called Wolfden Resources. Wolfden was subsequently taken over in 2007. Premier Gold was a spin-out of the gold assets to our shareholders, just prior to the takeover. If you were a shareholder back then, Premier would have been a free stock. Premier spent years as solely an explorer. In 2016, after being on the market for nearly ten years, we decided that to survive long-term as a company, we needed to move from being an explorer that solely raised and spent money, to a company that actually made money. We proceeded to make the transition from explorer to producer. Our first move was buying the South Arturo project from Goldcorp, which we constructed with Barrick. It is now the successful mine where we are building two new projects. Subsequently we bought Yamana's Mercedes mine in Mexico, making Premier one of the few companies that has successfully transitioned from explorer to producer. In terms of awards, we've been involved in several Discovery of the Year type projects in Northwestern Ontario and my father and I were recipients of the Bill Dennis Prospector of the Year Award for a discovery we made in Nunavut back in 2004. As an explorer, this is the most prestigious award in mining you can receive from the Prospector and Developers Association of Canada. Allen Alper:That's excellent recognition. Could you tell our readers/investors a bit more about the other members of your team?

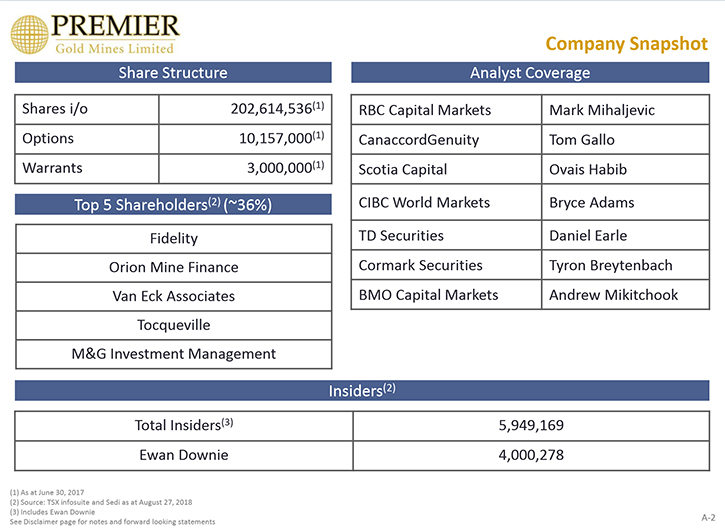

The second highlight going into the new year is updated reserves and resources for both mines, following a fairly extensive drill program this year. Lastly, the third real catalyst we see next year is the initiation of the underground project at Cove, which will hopefully lead us to a full feasibility study and ultimately to production. Allen Alper:That sounds exciting. 2019 is going to be a great year. That's excellent. Ewan Downie:Yes, 2019 should be a pretty exciting year for the Company. Allen Alper:That's great. Could you tell our readers/investors more about your operations and results?Ewan Downie:Last year we produced more than a hundred thousand ounces in production and Premier was one of the highest cash-flowing companies amongst the smaller producers.This cash flow was due in large part to the success of our Phase Two Mine project at South Arturo. That initial mine is now depleted, as we finished mining Phase 2 last year.This year we are processing some of the remnants, stockpiled from that operation and have commenced the construction of an underground mine from the bottom of that pit. That underground mine is expected to come back into production next year, so 2018 sees a bit of a dip in terms of production. However, in the years 2019, 2020, 2021, forward, we expect to be a company with a significant growth profile in terms of annual production. A large part of that coming from South Arturo. Allen Alper:That sounds excellent. Could you tell our readers/investors about your background? I know you are well recognized, with award-winning accomplishments.Ewan Downie:Yes, Premier and I have been involved in a number of awards. I came into the industry basically through family, my father was a Geologist. I started my first public company in the very late 1990s called Wolfden Resources. Wolfden was subsequently taken over in 2007. Premier Gold was a spin-out of the gold assets to our shareholders, just prior to the takeover. If you were a shareholder back then, Premier would have been a free stock. Premier spent years as solely an explorer. In 2016, after being on the market for nearly ten years, we decided that to survive long-term as a company, we needed to move from being an explorer that solely raised and spent money, to a company that actually made money. We proceeded to make the transition from explorer to producer. Our first move was buying the South Arturo project from Goldcorp, which we constructed with Barrick. It is now the successful mine where we are building two new projects. Subsequently we bought Yamana's Mercedes mine in Mexico, making Premier one of the few companies that has successfully transitioned from explorer to producer. In terms of awards, we've been involved in several Discovery of the Year type projects in Northwestern Ontario and my father and I were recipients of the Bill Dennis Prospector of the Year Award for a discovery we made in Nunavut back in 2004. As an explorer, this is the most prestigious award in mining you can receive from the Prospector and Developers Association of Canada. Allen Alper:That's excellent recognition. Could you tell our readers/investors a bit more about the other members of your team?  Ewan Downie:We've been a company that's definitely set up to make the transition to producer. We started our life in '06 pretty much with all, IR or exploration type people. When we made the decision to move to be a producer, we recognized the need to make some changes to our Board of Directors and have gone from having no mining engineers on the Board, to now having four out of seven. Five out of seven of our Board members are either currently or used to be CEO's of other mining companies. In terms of management, we have John Begeman is a Director, but he's also our Chairman and effectively our Acting Chief Operating Officer. He was formerly the CEO of Avion Metals, which was taken over a few years back. Prior to that, he was involved in operations at Goldcorp. Charlie Ronkos, on our Senior Executive team, used to be a Senior Executive at Goldcorp. Brent Kristof is our Vice President of Operations. He leads most of our mining projects and was formerly the Chief Operating Officer at Klondex after having spent a lot of years in Nevada operations, with both Barrick and Newmont. Steve McGibbon is Lead of Corporate Development and leads the charge in exploration. Steve spent 24 years at the Red Lake mine and was a key member, essentially credited with the discovery of the high-grade zone, which effectively made Goldcorp what it is today. CFO, Steve Filipovic has been with me since the Wolfden days, very strong CFO, with a lot of attention to detail. Also on our Senior Executive team is a gentleman named Matthew Gollat, who has made the transition from being an IR to mining and is now Vice President of Business development. Pretty solid rounded team and there are a lot of people not mentioned who have very solid histories in the mining industry. Allen Alper:You have an outstanding team. That's really great. Could you tell our readers/ investors a little bit about your share and capital structures? Ewan Downie:Currently we have just over two hundred million shares outstanding. Not a lot of options and warrants. Several very large shareholders, Fidelity, Orion are near ten percent shareholders of the company and several others make up almost forty percent of our shares and are held by the top five shareholders of our company. I'm a fairly large shareholder, when you look at mining CEO's and ownership in their companies, I'm one of the few who has a very substantial position in the company. I own more than four million shares of Premier. Recently in the pullback I've been a consistent acquirer of stock. So I've increased my position in the last year by more than two hundred thousand shares.

Ewan Downie:We've been a company that's definitely set up to make the transition to producer. We started our life in '06 pretty much with all, IR or exploration type people. When we made the decision to move to be a producer, we recognized the need to make some changes to our Board of Directors and have gone from having no mining engineers on the Board, to now having four out of seven. Five out of seven of our Board members are either currently or used to be CEO's of other mining companies. In terms of management, we have John Begeman is a Director, but he's also our Chairman and effectively our Acting Chief Operating Officer. He was formerly the CEO of Avion Metals, which was taken over a few years back. Prior to that, he was involved in operations at Goldcorp. Charlie Ronkos, on our Senior Executive team, used to be a Senior Executive at Goldcorp. Brent Kristof is our Vice President of Operations. He leads most of our mining projects and was formerly the Chief Operating Officer at Klondex after having spent a lot of years in Nevada operations, with both Barrick and Newmont. Steve McGibbon is Lead of Corporate Development and leads the charge in exploration. Steve spent 24 years at the Red Lake mine and was a key member, essentially credited with the discovery of the high-grade zone, which effectively made Goldcorp what it is today. CFO, Steve Filipovic has been with me since the Wolfden days, very strong CFO, with a lot of attention to detail. Also on our Senior Executive team is a gentleman named Matthew Gollat, who has made the transition from being an IR to mining and is now Vice President of Business development. Pretty solid rounded team and there are a lot of people not mentioned who have very solid histories in the mining industry. Allen Alper:You have an outstanding team. That's really great. Could you tell our readers/ investors a little bit about your share and capital structures? Ewan Downie:Currently we have just over two hundred million shares outstanding. Not a lot of options and warrants. Several very large shareholders, Fidelity, Orion are near ten percent shareholders of the company and several others make up almost forty percent of our shares and are held by the top five shareholders of our company. I'm a fairly large shareholder, when you look at mining CEO's and ownership in their companies, I'm one of the few who has a very substantial position in the company. I own more than four million shares of Premier. Recently in the pullback I've been a consistent acquirer of stock. So I've increased my position in the last year by more than two hundred thousand shares.  Allen Alper:That shows you have total confidence in your company and you're putting your money where it works and in what you believe. Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Premier Gold Mines?Ewan Downie:I think first and foremost, the management team. It's a management team that has delivered in the past and has continued to run companies successfully and have a good track record in the industry. Secondly, the quality of our portfolio of projects is I think, unrivaled, especially amongst the smaller producers. We do have a very active development program going forward, where if you look forward three to five years, we won't just double production, but we have a good path with our current assets to quadruple production, over the ensuing years. Lastly, a company with a strong balance sheet at some point in the future, which wants to be a company that can give back to shareholders by way of a dividend.

Allen Alper:That shows you have total confidence in your company and you're putting your money where it works and in what you believe. Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Premier Gold Mines?Ewan Downie:I think first and foremost, the management team. It's a management team that has delivered in the past and has continued to run companies successfully and have a good track record in the industry. Secondly, the quality of our portfolio of projects is I think, unrivaled, especially amongst the smaller producers. We do have a very active development program going forward, where if you look forward three to five years, we won't just double production, but we have a good path with our current assets to quadruple production, over the ensuing years. Lastly, a company with a strong balance sheet at some point in the future, which wants to be a company that can give back to shareholders by way of a dividend.  Allen Alper:That's excellent, that's a very strong reason for our readers/investors to consider investing in Premier Gold Mines. I'm very impressed with what you and your team are doing and the properties you have. You are all doing an excellent job. Is there anything else you'd like to add? Ewan Downie:Thanks a lot Al, good talking with you again. I appreciate you interviewing us for Metals News.Allen Alper:Thank you for sharing your good news with us. We'll publish your press releases as they come out so our readers/investors can follow your progress. It's going to be very exciting.https://www.premiergoldmines.com/Ewan Downie,President & CEOPhone: 807-346-1390e-mail: Info@premiergoldmines.com

Allen Alper:That's excellent, that's a very strong reason for our readers/investors to consider investing in Premier Gold Mines. I'm very impressed with what you and your team are doing and the properties you have. You are all doing an excellent job. Is there anything else you'd like to add? Ewan Downie:Thanks a lot Al, good talking with you again. I appreciate you interviewing us for Metals News.Allen Alper:Thank you for sharing your good news with us. We'll publish your press releases as they come out so our readers/investors can follow your progress. It's going to be very exciting.https://www.premiergoldmines.com/Ewan Downie,President & CEOPhone: 807-346-1390e-mail: Info@premiergoldmines.com