Price of Silver's Next Move Will Be Determined by These 2 Indicators

Since my last update, the price of silver has given back most of the gains from the previous week. In fact, the price of silver actually finished the month of March in the red. After topping out at $16.50 on March 27, the precious metal dipped below $16.30 just two days later.

But there is a bright spot in this recent movement for precious metal investors.

Despite moving in a narrow range between $16.25 and $16.80 since early February, silver has bounced back on weakness from both the stock market and the dollar.

That allowed silver to establish a higher low at the end of last week before entering the long Easter weekend. And that may be our sign that silver's ready to join gold in what's traditionally been a bullish seasonal period for the precious metal.

Meanwhile, a couple of my favorite silver indicators are lining up to suggest higher silver prices in the near future.

Before we get to those two indicators, here's how the price of silver has trended this week…

How the Price of Silver Is Trending Now

The early part of last week saw silver dominated by strong stocks, then the second half of the week was dominated by a stronger dollar.

On Monday, March 26, stocks enjoyed a healthy rally while the dollar stayed weak. That was enough to support silver, which jumped shortly after the open from $16.60 to touch $16.75. From there it backed off, consolidating into the afternoon and eventually closing at $16.72.

You Must Act Now: America is headed for an economic disaster bigger than anything since the Great Depression. If you lost out when the markets crashed in 2008, then you are going to want to see this special presentation…

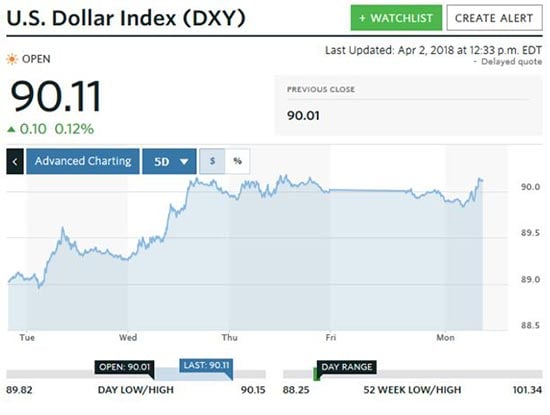

Then, on Tuesday, renewed dollar strength and early day stock strength weighed on the gray metal. Silver opened lower, at $16.59, and kept falling until it bottomed at $16.45 at 11:00 a.m. After 1:00 p.m., stocks started heading south. The safe-haven dollar rallied at the open, pushing the U.S. Dollar Index (DXY) all the way up to 89.50 by 8:00 a.m., then retreated and consolidated around 89.40. That kept silver in check, which only managed to recuperate and close at $16.50.

Here are the DXY and Dow Jones for the past week.

Wednesday would be a repeat for silver, as stocks moved sideways, and the DXY rallied to 89.80 by 10:00 a.m. The DXY continued rallying to 90.10 by midafternoon. Silver opened at $16.43 and immediately sank to $16.26 by 11:00 a.m. With the dollar consolidating high, silver only gained back $0.01 to close at $16.27.

Then, on Thursday, the last trading day before the long Easter weekend, the DXY hovered above 90 most of the day while stocks rallied. Silver opened at $16.27, then showed a bit of strength, rising on the day to $16.35.

On Easter Monday, stocks sold off as news of Chinese trade tariffs emerged, helping to light a fire under silver prices. The DXY bounced to 90.10 as the Dow Jones tanked, losing 640 points, or 2.65%, by early afternoon. Silver opened at $16.53, then soared to $16.67 by 2:00 p.m.

Now that we've examined how the price of silver was trending this past week, these are the indicators that will be driving silver's momentum in April…

Peter Krauth

Peter Krauth