Private capital is ready to invest $7 billion in mining

According to a study of private capital in the resources sector from industry tracker Preqin, half of investors in the mining and metals sector will deploy more capital this year despite two-thirds of institutional investors displaying less appetite for the sector compared to a year ago.

The pullback comes after fundraising for natural resources investment reached record levels in 2015, with 74 funds raising a total of $67.8bn.

In total natural resources investment firms have $400 billion assets under management. Of this $243 billion represent unrealized value with the remaining $157.3 billion so-called dry-powder capital ready to invest. The vast majority is destined for North America.

A full two-thirds of institutional investors have a decreasing appetite for metals and mining investmentsOnly $6.9 billion of the dry powder money in 2016 is for metals and mining although a portion of the diversified funds' $9.7 billion will also go into projects and assets in the sector. Fund managers also still have to exit some $8.3 billion in mining investments.

The survey found that fund managers' views differed most widely in their approach to metals and mining assets. Although 50% of fund managers investing in metals & mining expect to increase the amount of capital they deploy in 2016, 25% expect to decrease the amount of capital deployed, including 8% that plan to invest significantly less capital:

While this partly reflects the relative lack of success by metals and mining-focused funds in raising capital in 2015, it may also be the case that some non-specialists, including diversified and energy-focused funds that also invest in mining, are holding off deploying capital in this area until metals markets show greater signs of recovery.

The number one concern according to the survey is commodity prices. Global market volatility and uncertainty is also a top concern. At the same time 50% of surveyed fund managers believe it's easier to find attractive investments in the sector.

The five biggest mining and metals funds of the past ten years in terms of aggregate capital raised have zero funds currently in the marketTellingly, the five biggest mining and metals funds of the past ten years in terms of aggregate capital raised - Resource Capital Funds, Orion Resource Partners, Sentient Group, Pamodzi Investment and Waterton Global Resource Management - have zero funds currently in the market.

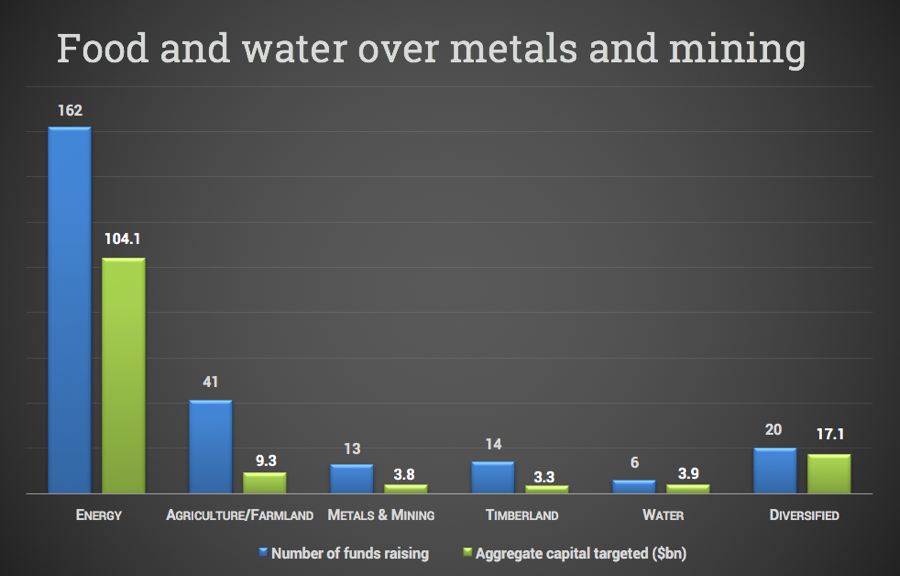

In terms of fundraising, as of March there are 256 natural resources funds in the market targeting $141.5bn in aggregate capital.

Mining is the smallest subset with 13 metals and mining focused private closed-end funds hoping to raise $3.8bn in 2016 representing 5.4% of the total.

A Preqin survey of fund managers showed significant changes in appetite for natural resources. A full two-thirds of institutional investors have a decreasing appetite for investments in metals and mining compared to a year ago, the only sector where investors interest are, on the whole, on the wane.

While 2016 certainly isn't looking that encouraging. Last year was a particularly dismal year to raise money to put into mining projects - the sector made up a paltry 0.6% of funds raised with just two funds closing on $400 million in 2015.

Last year mining attracted less capital that timberland while nearly ten times the amount of money were raised for investment in agriculture and farmland in 2015.

In contrast to mining and metals around 90% of farmland and water investors are seeking bigger opportunities to invest in this year.

Even in the energy sector investors are showing an increased willingness to inject money while water has become enough of a focus for private capital that Preqin, which has tracked the industry since 2003, is breaking out the numbers separately.

The vast majority of funds are once again raising money for energy investments in 2016 - in 2015 nearly $9 out of every $10 raised were destined to be poured into the sector.

The growth in food-focused fundraising is set to continue this year says Preqin - 41 funds are targeting $9.3bn for agriculture and farmland investment, mostly outside North America. July last year saw the biggest ever farmland fund, TIAA-CREF Global Agriculture II, close at $3 billion.

Source: Preqin

Private capital encompasses a range of investment vehicles and strategies including traditional private equity such as buyout, venture capital and turnaround funds, private debt including distressed debt and direct lending, and private real estate, infrastructure and natural resources funds.

A total of $550bn were raised by 1,061 funds across all strategies and sectors in 2015 according to Preqin data. Private capital also have an all-time high $7.4 trillion to invest.