Private capital won't touch mining

Last year was a horrible year for commodities and the resources sector, but it appears contrarian investing in the sector is alive and well.

According to a new report by private capital tracker Preqin, fundraising for natural resources investment reached record levels in 2015, with 62 funds raising a total of $63bn. That was up 14% compared to 2014 and edged past 2013's banner year when more than 111 funds were active in the market.

Investors, perhaps anticipating that valuations are close to bottoming, threw money at closed-end fund managers and limited partners who were able to rake in 113% of what was targeted for the year. 2015 was the third consecutive year target sizes were exceeded.

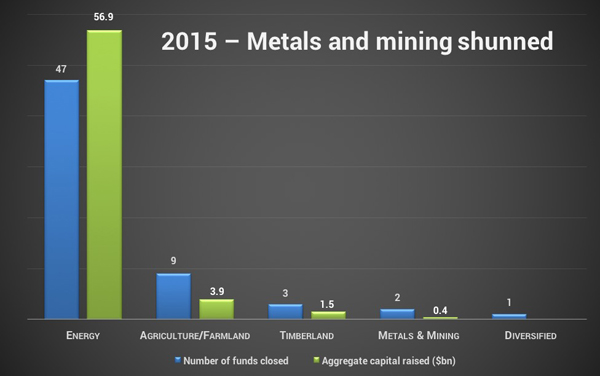

Despite plummeting crude oil and natural gas prices, according to Preqin energy-focused funds were once again the main driver of growth in 2015, accounting for more than $9 out of every $10 raised during the year. The bulk of the cash will be invested in North America.

Mining and metals made up a paltry 0.6% of funds raised (more money were raised for timberland) with just two funds closing on $400 million in 2015. Nearly ten times the amount of money went into investment in agriculture and farmland in 2015.

Source: Preqin

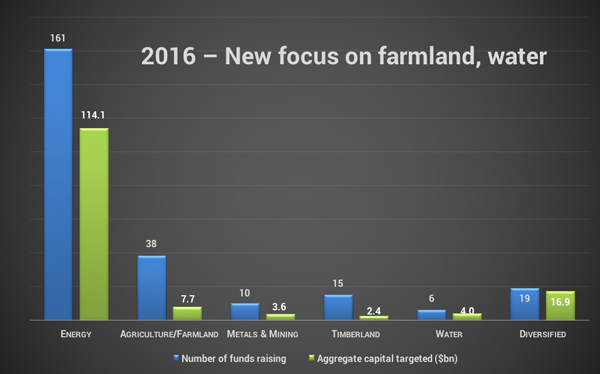

This year 10 metals and mining focused private closed-end funds are hoping to raise $3.6bn, compared to 38 funds in the market targeting $7.7bn for agriculture and farmland investment, mostly outside North America.

Water has now become enough of a focus for private capital that Preqin, which has tracked the industry since 2003, is breaking out the numbers, identifying six funds in the market which want to attract at least $4bn.

The vast majority of funds are once again raising money for energy investments in 2016, but with oil prices reaching fresh 11-year lows in January it will be interesting to see how close the funds active in the sector come to the more than $114bn targeted.

It's also telling that one of the largest energy-focused funds in the market this year is the Green Investment Bank which is targeting over $1.5bn to build offshore wind farms. In October, the UK-based bank announced it's more than 80% there with $1.2bn already in the kitty.

Source: Preqin

Private capital encompasses a range of investment vehicles and strategies including traditional private equity such as buyout, venture capital and turnaround funds, private debt including distressed debt and direct lending, and private real estate, infrastructure and natural resources funds. A total of $550bn were raised by 1,061 funds across all strategies and sectors in 2015 according to Preqin data.