Profit Target Hit On XAU. What Now For Gold?

I advised investors to buy Gold when it was trading at 1,217 in October, with a take profit target of 1,300. Last week, Gold hit highs of around 1,298.

Macro developments should continue to be supportive of Gold prices, as well as a more accommodative Federal Reserve policy.

Wait for a retracement in XAU/USD to 1,240-1,250 to enter Gold. The VIX Index remains at elevated levels, which means the market is already pricing in high levels of volatility.

I opined in my previous article "Gold Awakens From Slumber" written in October that XAU/USD (GLD) was poised to make an assault on the 1,300 level. Then, I advised investors to buy XAU/USD at spot (1,217 at that time), with a take profit target at 1,300 and a stop loss at 1,165.

Chart: XAU/USD

Since then, XAU/USD made a high of 1,198.65 in the first week of January 2019, with prices urged on higher by equity market volatility, as shown in the chart of the VIX Index below.

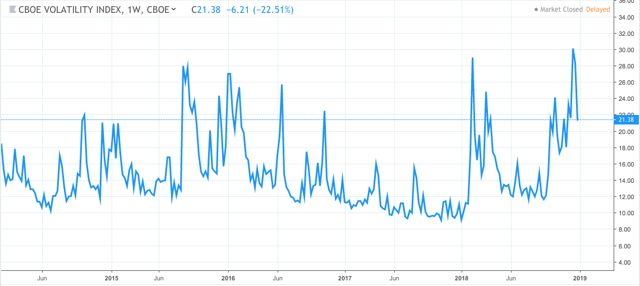

Chart: VIX Index

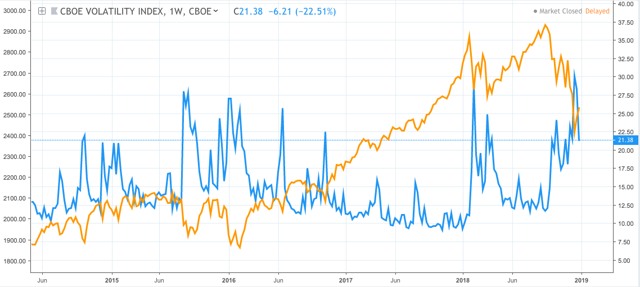

The value on the VIX reflects the implied volatility of at-the-money options on the S&P 500 Index. When volatility remains mild below 14 on the index, equity markets tend to perform well. Going into 2019, the VIX Index surged to highs of close to 30, which corresponds to the S&P 500 crashing close to 18% between September to December 2018. The below chart plots the S&P 500 against the VIX Index.

Chart: VIX Index and S&P 500

Needless to say, with Gold being a good hedge against volatility and equity market weakness, XAU/USD rose close to 8% between September to December 2018, which was my rationale of advising investors to add Gold to their portfolios.

What now for Gold?

2019 will likely remain volatile, with pertinent issues of the US-China trade war and an unresolved Brexit vote still looming ominously in the horizon, which should be positive for XAU.

On top of that, the US Federal Reserve appears to be adopting a more dovish tone going into the new year, with Fed Chair Powell saying the central bank will be more flexible with its monetary policy just last week. Keep in mind that the Fed raised interest rates 4 times in 2018, and a higher interest rate environment reduces the appeal of a zero-carry instrument like Gold. As such, a less aggressive Fed policy is likely positive for XAU in 2019.

The macro picture continues to look supportive for XAU/USD, but the key question is about timing. When do we buy into Gold, given that it has rallied close to 8% in the last 3-4 months already?

My advice is to wait for a retracement in XAU/USD. Sentiment surrounding global equity markets is arguably at extremely bearish levels, with the S&P 500 shedding close to 18% in the last 3-4 months alone. With such panic selling already taking place, any positive news that surprises on the upside is likely to give the markets a boost.

One example is when Fed Chair Powell delivered his dovish message on Friday, which led to the S&P 500 closing more than 3% higher on the day, which feels slightly out-sized and fueled by relief. Clean positioning also helped the rally, as many investors might have already sold their positions in panic during the last 3-4 months. If most have sold their positions already, who is left to sell?

Look at the VIX Index to time your entry into XAU/USD. The VIX Index currently sits at 21, which implies that the market is still pricing in a lot of volatility into the horizon. Should the VIX Index trickle back down to 10-14 levels, that would be a more attractive entry timing into XAU/USD.

Chart: XAU/USD

Looking at the technical chart, last week's price action saw XAU/USD hit highs of around 1,298 before pulling back quite significantly to close near 1,285. This implies that the market might be offloading or taking profit on their long positions in XAU/USD. At the moment, 1,300 appears to be a relatively strong resistance level. 1,240-1,250 would be an attractive entry level. This level was a pivot low recently in December 2017, and prices could find some support there.

In conclusion, Gold looks highly attractive still as a hedge against volatility and equity market weakness. Investors should continue to add Gold into their portfolios as a hedge against their equity positions. Just as people do not look to make out-sized capital gains on their insurance, the role of an insurance policy is to reduce losses during thunderstorms, which is absolutely crucial. Storm clouds look to be gathering in the horizon, but near-term relief rain could open up a more attractive entry level into XAU/USD.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Max Loh and get email alerts