PTJ Warns Inflation is the Single Biggest Threat to Society

During an otherwise quiet pre-market session, billionaire investor Paul Tudor Jones sat down for an interview with the CNBC "Squawk Box" crew. But anybody who expected this to be a quiet, softball-filled interview about PTJ's philanthropic work (ahead of a major gala by his Robin Hood Foundation being held Wednesday night) was quickly disabused of that notion when PTJ opened with a polemical attack on the Federal Reserve and its entire monetary policy framework, claiming that surging inflation is now "the single biggest threat to certain financial markets and probably I think to society in general."

Inflation could be "much worse" than feared, billionaire hedge fund manager Paul Tudor Jones says. "It's probably the single biggest threat to certainly financial markets and probably I think to society just in general." https://t.co/OoMbhdnsm0 pic.twitter.com/yCP11BVELO

- CNBC (@CNBC) October 20, 2021Even as the regional Fed banks publish report after report pushing Fed Chairman Jerome Powell's line that rising inflationary pressures are expected to be "transitory," PTJ warned viewers that the Powell-led Fed has unleashed an inflationary plague on society that will likely result in a repeat of 1970s stagflation - a mess that will eventually need to be handled by some later cast of bureaucrats who - hopefully - will have the strength to take drastic actions like former Fed Chairman Paul Volcker, when he hiked rates to break the back of inflation 40 years ago.

"To me the number one issue facing main street investors is inflation. Inflation is not transitory its here to stay and its probably the single biggest threat to certain financial markets and probably I think to society in general."

With this, PTJ has added his name to the growing list of Fed critics - like Stanley Druckenmiller - who have warned that surging inflation is a danger to society and that the inevitable collapse of the massive asset bubble blown by the Fed's policies will hurt working- and middle-class Americans the hardest.

Why does PTJ feel this way? Well, fortunately for viewers, the fund manager and philanthropist managed to carefully and coherently explain his thesis. Right now, "there's a combination of structural and cyclical forces that, right now, are all running in the same direction to say that inflation can be much worse than what we fear."

He added that October's 5.4% YOY CPI number, which matched readings from June and July, was perhaps the most glaring warning yet. And, like a growing number of analysts and forecasters outside of the Eccles Building and its national satellites, PTJ warned that it's likely only going to get worse.

"This 5.4% CPI...it was the highest CPI we had in 30 years and of course it's going to go higher in the next few months as energy feeds through it. So for an investor, in particular most of this audience, it's an absolute death throe for a 60/40 long stock long bond portfolio. So the question is: how do you defend yourself against it, how persistent will this be and what does the outlook hold?"

PTJ neatly summed up his reasoning behind his views on inflation, dividing it up into two factors: cyclical, and structural. On the cyclical side, there's all the money printed by the Fed that's still sitting on the sidelines.

"Let's start with the cyclical forces first. We have the demand side...M2 has grown $5.4 trillion since the pandemic began that's $3.5 trillion greater than it would be...that's $3.5 trillion just sitting in liquid deposits that could go into stocks or real estate or crypto...that's just a huge amount of dry powder thats sitting there just waiting to be usitlized at some point. That's why inflation's not going to be transitory."

Additionally, "we just raised benefits for social security retirees and military...that's just more fuel for the inflationary fire."

The other cyclical factor driving inflation is rising wages, which PTJ expects will also continue. Just look at job offers relative to the unemployed: there are 10.4MM job openings right now, and 7.7MM unemployed.

Which leads PTJ to the "structural" piece of his argument: clearly, there's a growing mismatch between the jobs that are opening, and the workers who are eager/willing/qualified to fill them. Whatever the issue is, it's not going to be fixed by continuing QE, and leaving interest rates at rock-bottom levels.

"It's clear we have a structural issue in our labor force that's not going to be resolved by zero interest rates and quantitative easing."

The second major structural issue is that, as PTJ put it, "we have a Federal Reserve board that are inflation creators, not inflation fighters."

This prompted interviewer Andrew Sorkin to take a step back and ask PTJ who exactly he's speaking to here: CNBC viewers, or Chairman Powell himself. PTJ replied with a wry grin, before clarifying that "first and foremost, I'm concerned about the future of this country....clearly, I think we have maybe the most inappropriate monetary policy that we've seen. We are adding stimulus, we are still quantitative easing when we should be doing the exact opposite, and we're taking for granted treating inflation very very lightly."

But to clearly explain what bothers him the most about the people currently running the Fed, PTJ had to offer examples from the 60s and 70s.

"What most bothers me about this particular set of central bankers...is that they're ignoring the lessons of history." There once was a time when central bankers confronted a joint session of Congress with a warning about the imminent threat posed by inflation. But those days are long past. And clearly, the financial lever-pullers at today's Fed have much more confidence in their ability to continuously impose its will on markets by pushing stocks higher and higher.

All this vitriolic talk led Sorkin to ask the inevitable follow-up: does PTJ think Jay Powell will be renominated? Or is he as "dangerous" as Sen. Elizabeth Warren says?

"I think he probably will be," PTJ replied, although he added that he doesn't think Powell is "necessarily the right person to be dealing with the situation in front of us" and that, more than likely, "the people that solve the problem won't be the ones who created the situation for it to exist."

Why is Powell not right? Well..

"The goal was to get inflation above 2%...well guess what, they wont that game in a blowout. But when you're running the Fed, you don't want a blow out because it creates an expectation that this will continue."

"And the best person who addressed that was Paul Volcker in 2015 when he said if we follow mathematical models, and we ignore the fact that human emotions are often impactful on the way people will continue to believe"...central bankers run the risk of undermining the entire dollar-based global financial system.

But whoever ends up in charge of the Fed, the problem now is that the "inflation genie is out of the bottle...and if we don't shift to attack it...we run the risk of going back to the 1970s, where it was the most important issue for multiple presidents and multiple Fed presidents..."

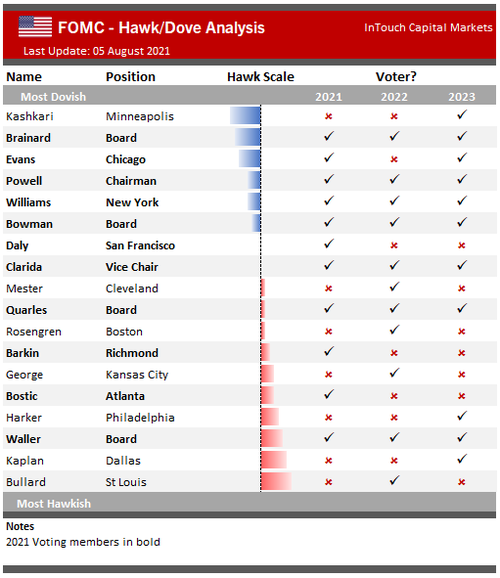

In response to this, Sorkin's co-anchor, Becky Quick, stepped in with another Fed-related question: if Powell isn't renominated, it's more than likely that "somebody even more dovish than Powell being appointed to lead the Fed.

PTJ replied that an even more dovish Fed President (Lael Brainard, perhaps?) would be "an absolute disaster."

At any rate, looking ahead, PTJ believes the FOMC meeting that will conclude with Powell's Nov. 3 press conference could be "the most crucial meeting for this Fed" because "now they're facing, for the first time, the other side of the dual mandate" - ie, prices have now overshot the central bank's 2% inflation target, and show no signs of the acceleration slowing.

"...forward guidance assumes a linear wall...it assumes the wall is a train as opposed to a rollercoaster. Which is you have inflation and you don't see any end of it in sight so at this meeting, what's the reaction going to be?"

It will be an interesting meeting for a couple of other reasons, including: "For first time Comcast/YouGov Poll released a poll showing Americans see inflation as the biggest issue over unemployment."

But if Powell continues to insist that the shift from accommodative policy will be "slow and gradual", well, PTJ believes that would be a woefully misguided policy response. If this happens, PTJ believes investors should "double down on the inflation trade, double down on long commodities, long TIPS, breakevens...and you don't want to own fixed income...you don't want to own that at all."

The Fed is essentially telling the world that it will be "slow and late" to fight inflation, which means that, someday, somebody down the road will have to come in and "put the hammer down like Paul Volcker did."

Given all the talk about failing Fed policy and the risks of inflation, CNBC's Sorkin couldn't help but ask PTJ about a comment the billionaire investor made back in May, which is that he views crypto as a hedge against central bank money printing.

"Clearly there's a place for crypto, and clearly its winning the race against gold at the moment. Yes, I also think that would be a good inflation hedge, it would be my preferred one at the moment."

As for whether investors should gain exposure through direct buys or the ETF, PTJ has preferred direct ownership. Although he thinks the Bitcoin ETF will be "fine" and the SEC's blessing is reassuring...he's not an expert in the ETF.

But circling back to the question of whether the Fed's policy response is misguided, PTJ offered viewers one last warning about asset prices. If inflation keeps accelerating, and the Fed is forced to hike short-term interest rates, then P/E ratios across the market will likely plunge as higher rates make debt financing more expensive, and fixed income more attractive as an investment (in the aftermath).

If the Fed hikes short-term rates to 4% or 5% (from the zero-bound), for stocks, "you're talking about a P/E of 17 or 18...and the market's down 35%."

In effect, it would be a much more drawn out rerun of the COVID panic that forced the Fed to amp up its accommodative policy last year. But the long-term outlook for equities would be much, much worse.