Pure Gold: Insider Buying And A Few Catalysts On The Horizon

Pure Gold is developing its Madsen gold project in the Red Lake gold camp in Ontario, Canada.

In my opinion, there are a few catalysts on the horizon that could end a 2.5-year consolidation period the company's shares have been trading.

This year two insiders bought large share stakes in the company.

Pure Gold (OTCPK:LRTNF) is an exploration company developing the Madsen gold project in Ontario, Canada. Since December 2017 I have published two articles on this company, discussing the economics of the project and a few other initiatives enhancing its quality. In my opinion, Madsen is one of the most interesting mining projects in the precious metals sector. For example:

It's located in a super-safe jurisdiction The resource model is based on a reliable, large database A future mine may be developed in a few stages - as a result, initial capex is relatively smallWhat's more, it looks like the company is ahead of a few crucial events that could take its shares out of a 2.5-year consolidation period:

Source: Stockcharts.com

Introduction - the Madsen gold project

The Madsen gold project is located in the Red Lake gold camp in Ontario, one the most prolific gold districts in Canada. Since the 1930s the camp has produced approximately 30 million ounces of gold but today there's only one large and active gold operation there (the Red Lake mine owned by Goldcorp).

On the other hand, there's a number of mining companies searching for gold in the district and running gold projects at various stages of development. Of these ventures the Madsen project is, in my opinion, the most interesting one.

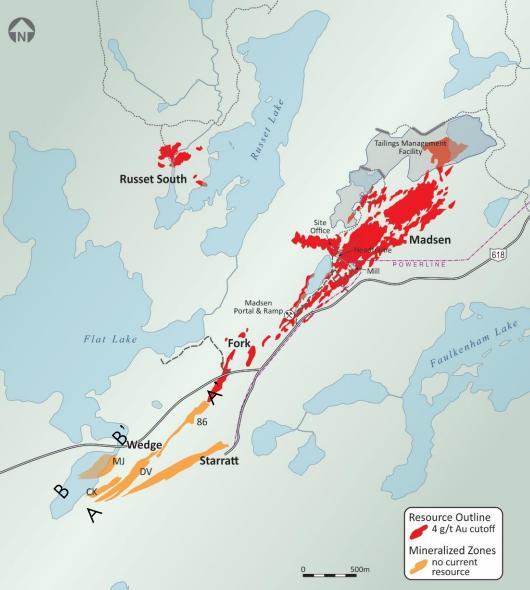

To remind my readers, in January 2018 the company released a preliminary economic assessment for Madsen. According to this report, the deposit hosts 5.8 million tons of ore grading 8.86 grams of gold per ton of ore, classified as indicated resources (totaling 1,648 thousand ounces of gold). Apart from that, there are 587 thousand tons of ore grading 9.42 g/t, classified as inferred resources (178 thousand ounces of gold). Finally, there are two satellite deposits called Fork and Russet South, holding 96 thousand ounces of gold in indicated resources and 118 thousand ounces in inferred resources.

Wedge deposit

And here's the first incoming catalyst - very soon (most probably this quarter) the company is going to expand its mineral base into the next satellite deposit called "Wedge" (look at the graph below and the yellow / pink area):

Source: Pure Gold

Currently the company is conducting a very ambitious exploration program at Wedge, having reported a few interesting drill holes so far (for example a hole grading 21.3 g / t over 10.3 meters). To remind, Pure Gold is a very conservative company - each mineral resource estimate is based on the detailed drilling campaigns delivering reliable results. I guess that a mineral estimate for Wedge will be no exception. Summarizing - it looks like very soon the current mineral resource is going to grow up significantly.

Goldcorp - an obvious candidate to purchase Madsen

By the way, in my opinion, a deposit holding 2 million ounces of gold in indicated / inferred resources is not a must-have project for a big gold mining company. Simply, it's too small. In other words, if Pure Gold wants to sell Madsen to a major gold mining company, it has to replenish its mineral base.

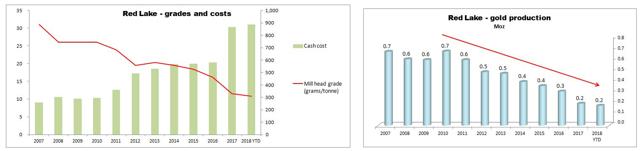

However, as mentioned in the beginning of this article, there's a big miner operating in close vicinity to Madsen. It's Goldcorp (GG), operating the Red Lake mine nearby. As the chart below shows, the Red Lake mine is an aging operation demonstrating lower production and rising costs:

Source: Simple Digressions

As a result, I think that Goldcorp could be interested in revitalizing an aging mine through adding fresh material coming from a deposit located within walking distance.

On the other hand, apart from Goldcorp (holding a stake of 5% in Pure Gold), there are additional two key shareholders that could be interested in Madsen (and Pure Gold itself):

AngloGold Ashanti (AU), holding a 14.9% stake in the company Robert McEwen (a legendary gold investor running McEwen Mining Inc (MUX) - 7.0% stakeNote:

The idea discussed in this section is very speculative in its nature. There are no reliable premises supporting my thesis, which means that an investment decision made on such an assumption is very risky. The only thing I wanted to show is the quality of the Madsen project - if I am correct, the project could be attractive for a big or medium-sized mining company.

Definitive feasibility study

Apart from an initial mineral estimate for Wedge, in 4Q 2018 the company is supposed to publish a definitive feasibility study for Madsen. I think it's an important step preceding a construction decision.

In other words, Pure Gold is in a very comfortable situation - if it's not able to sell the project to a major mining company, it can build the mine on its own. And a definitive feasibility study is an important step to reach this target. By the way, according to the previous economic study, an initial capex stands at C$50.9M so definitely the construction of the mine is within reach of Pure Gold.

Test mining at Madsen

In July 2018 the company started test mining at the McVeigh zone of the Madsen deposit. It's another initiative supporting my thesis that Pure Gold is a conservatively run company. Test mining may be compared to running a mini-mine at Madsen - if the results confirm the theoretical estimates (mainly gold grades and mining widths) the company will get strong empirical evidence that a future mine makes sense. The test should be finished this month.

Insider buying

This year two insiders purchased large stakes in Pure Gold:

Mark O'Dea (director) bought 800,000 shares on the market at an average price of C$0.62 a share Sean Tetzlaff (CFO) purchased 89,000 shares at an average price of C$0.62 a shareIt also has to be noted that the company's vice president, Phil Smerchanski, sold 25,000 shares at C$0.66 a share.

The buyers paid C$0.55 million for their shares so, definitely, they are confident the company is heading for the right direction.

Specific risk factors

Investment in Pure Gold shares carries a few specific risk factors:

As mentioned in the beginning of this article, the Madsen project hosts approximately 2 million ounces of gold classified as indicated / inferred resources. To remind my readers, mineral resources, contrary to mineral reserves, are too speculative to be considered an economically viable mineral material. Hence, investment in Pure Gold shares is more risky than investment in an exploration company with established mineral reserves. Pure Gold is an exploration company and therefore it does not generate any cash flow from operations. As a result, to build a mine the company has to find external sources of capital (public offering, loan, streaming agreement etc.). If, due to various reasons, it's not able to raise the appropriate funds, the investment in Pure Gold shares may end with big loses. Pure Gold shares are pretty illiquid. In the U.S. they are listed on the over-the-counter market and the average daily trading volume has been around 60.5 thousand shares or $25.8 thousand this year up-to-date. Hence, investors interested in Pure Gold shares should take this risk into account.Summary

Pure Gold is ahead of a few crucial events (initial mineral estimate for Wedge, definitive feasibility study for Madsen and test mining). In my opinion, these events may have a positive impact on the company's share prices, trading in a narrow range since middle 2016. This thesis is indirectly confirmed by a few insiders having purchased large stakes in Pure Gold this year.

Final Note

Did you like this article? If your answer is yes, please visit my Unorthodox Mining Investing Marketplace service where I manage a portfolio of up to 10 mining picks, discuss new investment ideas, and provide subscribers with a medium-term outlook on a few financial markets (particularly the base/precious metals market).

Disclosure: I am/we are long CEF, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Follow Simple Digressions and get email alerts