Pure Gold Mining: Have We Hit Bottom?

Pure Gold Mining is down over 35% from last year's highs.

The company released a Feasibility Study in Q4, but this was met by selling pressure from the market.

The stock will need to put in a weekly close above $0.64 CAD to start a new uptrend.

In Q4 2018, while many mining stocks were beginning to try and form bottoming patterns, Pure Gold Mining (OTCPK:LRTNF) was one of the first names to turn higher and put in 52-week highs in January. Since that time, the stock has seen its relative strength deteriorate significantly against its peers, down 14% in Q1 vs. the 5% return for the Gold Juniors Index (GDXJ). While this divergence is undoubtedly frustrating for shareholders after an impressive Feasibility Study, I believe this drop was more of a sell on news effect vs. dissatisfaction with the report itself. The stock will need to put in a weekly close above $0.64 to exit its current intermediate downtrend but is now near testing support at the bottom of its multi-year base. For more speculative investors, the stock might be worth watching for signs of a turnaround.

(I have converted all figures in the article to US Dollars using a $C to $US exchange rate of 0.75).

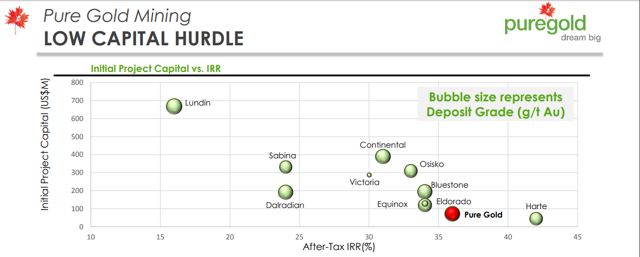

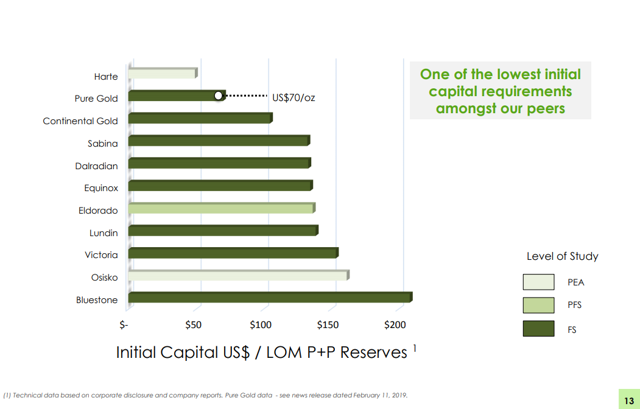

Pure Gold Mining's Madsen Project is situated in the Red Lake mining district of Ontario, Canada, and thus far, they've delineated a significant resource of 2.5 million ounces of gold. The average weighted grade of their deposit is 8.5 grams per tonne gold, and more than 75% of the resource is in the indicated category, with the other 467,000 ounces in the inferred category. The company recently released a positive feasibility study for the project, and the results are quite robust. The feasibility study envisions a 12-year mine life with 80,000 ounces of average annual production, and all-in sustaining cash costs of $787/oz. By far, the most attractive part of the project is the minimal capex to move the project into production. The study has estimated initial capital expenditures of $71 million US, and this is extremely modest compared to underground mining peers. The below table shows this in more detail:

(Source: Company Presentation)

(Source: Company Presentation)

(Source: Company Presentation)

(Source: Company Presentation)

As we can see from the above table, Pure Gold is one of the only companies with capital expenditures below $100 million other than Harte Gold (OTCPK:HRTFF) and, due to this, has one of the most attractive after-tax internal rates of returns (IRR) among their peers at 36%. This suggests a payback period of just over three years. This is significant as even though an attractive IRR is essential, a low capex is also a huge benefit, given the market that we are dealing with. It is much easier for a junior miner to raise $70 million than it is for a company to raise $300+ million US like Continental Gold (OTCQX:CGOOF) and Sabina Gold & Silver (OTCQX:SGSVF). This is not to say that the latter two companies cannot raise capital to build out their mines, but in a gold market where financiers are much less enthusiastic than they were in 2010 and 2011, it helps to be on the lower side of the capex scale if one hopes to enter production without significant dilution.

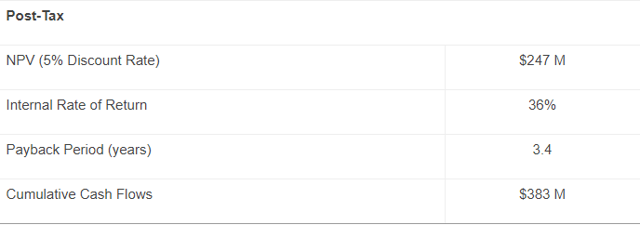

(Source: Company News Release)

(Source: Company News Release)

Digging into the project economics, the feasibility study shows an after-tax NPV of $185 million at a 5% discount rate, well above the company's current enterprise value of just over $100 million US. While this net-present value may seem modest compared to peers like Osisko Mining (OTCPK:OBNNF) and other larger projects, it's important to note that the feasibility study is based on only 40% of the company's total resources. The feasibility study was done on strictly the company's 1 million ounce probable mineral reserves at 9.0 grams per tonne gold and did not include any of the company's other 1.5 million ounce resource. This suggests that if the company can upgrade current resources to higher categories, the deposit is quite scalable.

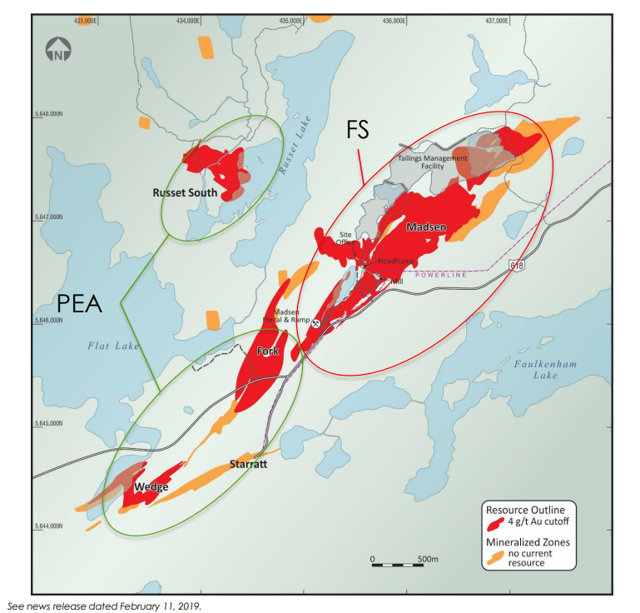

(Source: Company Presentation)

(Source: Company Presentation)

In other positive news, the company also released a preliminary economic assessment (PEA) for its Fork, Russet South, and Wedge deposits, that displays how discoveries can beef up the mine life. The PEA envisions production of an extra 210,000 ounces at an average grade of 6.4 grams per tonne gold. The projected all-in sustaining cash costs are lower than the feasibility study costs at $712/oz, given the near-surface nature of these ounces. It is still early in the exploration stage for these smaller satellite deposits, but so far, the results are encouraging. While modest, the after-tax NPV at a 5% discount is $38.2 M, with initial capex required of just under $43 million.

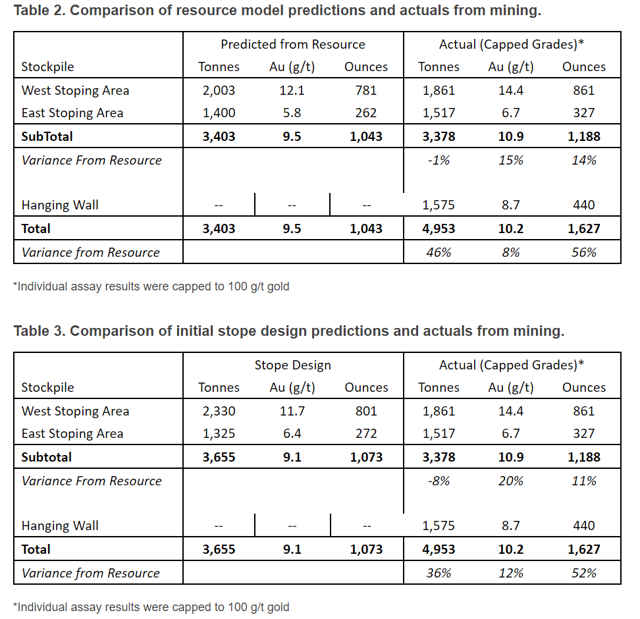

One of the risks to underground mining is that the feasibility studies can sometimes miss the mark on how execution looks, like Pretium Resources (PVG) found out in its first year of production. Despite projections for an average mined grade of over 15 grams per tonne gold for Pretium, thus far, we've seen mined gold come in at less than 12 grams per tonne gold or 20% below the average. The encouraging news for Pure Gold Mining is that test-mining in Q4 2018 came in well above expectations. As discussed in the November 28th, 2018, news release, actual grades were between 10% and 50% higher than what was predicted in the resource based on different areas mines. For example, in the east and west stoping area stockpiles, the expected resource grade was 9.5 grams per tonne gold yielding 1,043 ounces, and instead, the company managed to mine 1,188 ounces at a 15% higher grade of 10.9 grams per tonne gold. While this doesn't guarantee that the whole mine is going to look the same way and over-deliver if it goes into production, it is a positive sign for the time being that test mining exceeded initial expectations.

(Source: Company News Release)

(Source: Company News Release)

So, why is a company that just released a robust feasibility study and a new preliminary economic assessment on its satellite deposits nearly 35% off of its highs? I believe it's due to a mix of uncertainty and a sell on the news effect. It was clear that the stock ran up nearly 40% into the feasibility study and has now given up almost all of these gains as the company had baked in a lot of its current net present value at a valuation of $164 million US at its peak. Now that the company has dropped 35% from its highs, the current enterprise value of the company is just above $105 million US. The problem I see and the reason we saw such selling pressure is that the period between releasing a feasibility study and obtaining financing can be one of the trickiest for miners in their life cycle. This is because shareholders do not know if the company will dilute to raise money, or do so by use of a stream or a loan from a financier. My preference is for a modest stream or a loan, but markets hate uncertainty, so they often go to the sidelines in the meantime.

The good news for shareholders is that a good chunk of this uncertainty has now been discounted with the stock off 35% from its highs, and the stock should begin to find support if it does continue much lower as long as they can secure a good financing deal to move Madsen into production. Of course, buying ahead of this financing can be a risk on the off-chance it is less favorable than the market expected.

So, how do the technicals look?

(I have used Canadian prices for the charts as they are much cleaner than their OTC counterpart which is much less liquid).

The monthly chart below shows us that the stock is trading in a massive box with support near $0.50 CAD and resistance near $0.75. The stock briefly tried to break out of this base earlier this year, but as mentioned, it was a sell the news event. This support level at $0.50 will be a key one for the bulls to defend as below here things could get ugly if buyers don't show up. While it's unlikely that this occurs, I am open to any scenario in the market and believe it's wise to plan accordingly.

Moving over to a weekly chart of Pure Gold Mining, we can see that it's below all of its key moving averages but looks like it might be trying to find some support here just above the $0.50 level. Ideally, the bulls are going to want to see the stock reclaim the $0.64 level on a weekly close to exit this current downtrend. A weekly close above $0.64 would represent a close back above all of the key weekly moving averages.

Finally, looking at the daily chart below, we can see that the stock is locked in an intermediate downtrend but has some support just below near the $0.50 level. A breakout above this downtrend line would take some pressure off of the bulls, but more work would need to be done to transition this back to an uptrend and put the bulls back in control.

In summary, the daily and weekly charts remain under pressure for Pure Gold Mining, and the monthly chart is trading in one big base. The one silver lining is that the stock is beginning to get oversold at these levels, and critical support sits only a few percent below current prices. As long as the bulls can defend this level and buying shows up, there's a potential the lows might be in. The other good news is that the current valuation of just over $100 million US gives the company an enterprise value of less than half its total NPV, so it is indeed not overpriced at current levels and is now closer to fair valuation.

I continue to believe Pure Gold Mining is a speculative takeover target, but think that the price of gold (GLD) would aid that thesis. Most miners do not seem to have much of an appetite for junior miners in the current market environment, but a higher gold price might change that. If I was feeling aggressive, I might try to enter a position at $0.50 near support with a maximum stop of 10% if the stock broke this support and headed down to the $0.45 level, but I am choosing to sit on the sidelines for now. I would instead buy on the way up than at support, even if the stock is getting oversold. I continue to monitor the stock to see if a new uptrend develops, but for now, I believe patience to be the best course of action here.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts