Quebec puts Azimut back in play as SOQUEM leaves more money on the table for exploration

In his February 26th Discovery Watch broadcast, John Kaiser from Kaiser Research Online cheers some major changes in the strategic alliance between Azimut Exploration (AZM) and SOQUEM, a subsidiary of Ressources Qu?(C)bec. The arrangement appears to be a major rethink by the Quebec government on how to promote mining exploration in the province.

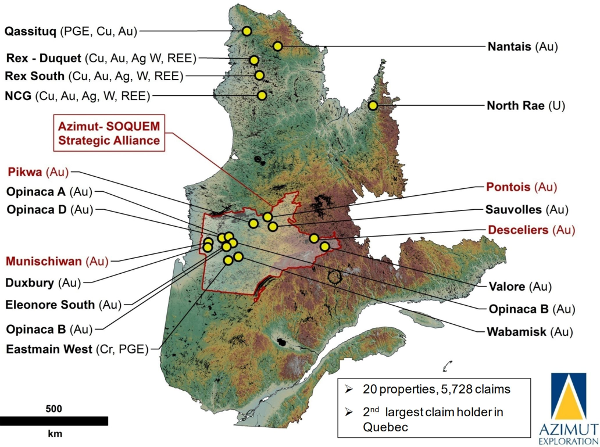

In the February 14th Discovery Watch episode, Kaiser highlighted that Midland Exploration (MD)'s Mythril project in the James Bay area of Quebec was getting attention after the company identified a 2,400-metre moly, copper, gold, and silver trend. According to Kaiser, a similar type of discovery may also exist at Azimut's nearby Pikwa project. However, there was a problem. Under the original agreement that covered Pikwa, SOQUEM had the ability to get to 100% ownership potentially leaving AZM with only a royalty.

A February 25th news release changed all that. As Kaiser describes it:

The news release was actually a blockbuster of groups rethinking their purpose. SOQUEM's job is really to stimulate exploration and mining Quebec...so they rethought this deal and said okay, we are close to vesting for 100% after spending just over $3 million, why don't we do a deal where on four projects (Munischiwan, Pikwa, Pontois and Desceliers), Azimut can earn back 50% by spending $3.3 million over the next 3 years.

The new agreement didn't stop there with SOQUEM agreeing to be a 50/50 partner in the Galin?(C)e and Dalmas properties where Azimut will remain operator on these projects. SOQUEM will also relinquish its exclusive rights to acquire an interest in other properties wholly owned by Azimut (Duxbury, Kukamas East, Corvet and Synclinal).'

In essence, SOQUEM backed down from having the overwhelming advantage and basically being responsible for finding something on all these prospects that Jean-Marc Lulin's team at Azimut had generated, to saying: okay, we are going to make sure the shareholders of the junior get to benefit.

Kaiser notes that this means that junior shareholders will have to put up more money, something which he is not too concerned about given the company's existing institutional shareholding base and share structure with about 57 million shares outstanding fully diluted.

In addition, SOQUEM and Azimut carved out a new strategic alliance on Nunavik which Kaiser is also cheering:

Even more stunning, was the other deal that SOQUEM agreed to which was on the Nunavik projects in the most remote part of Quebec.

Kaiser explains that SOQUEM has agreed to earn 50% in the Rex-Duquet, Rex South and Nantais properties by spending $16 million, of which $8 million is firm in the first two years. Once they vest for 50%, they can earn an additional 10% in any one of those projects by spending more money and delivering a PEA.

Which is huge for a little junior like Azimut...SOQUEM has gone back to its purpose. It is putting up taxpayer money in a region where a junior will end up with 40% of anything good that they find, but putting that risk capital in there also opens the potential for future dividends that, yes there is something up there, we will develop this area in the Northwestern corner of Quebec.

All in all, Kaiser characterizes it as a tremendous announcement, particularly given the potential for Midland's Mythril to become a hot play this summer.

Earlier in the broadcast, Kaiser gives us his take on a recent brief news release from Klondike Silver (KS) which he views as being very important and the latest news from Nevada Exploration (NGE) which disappointed the market.

This post also appeared on INKResearch.com